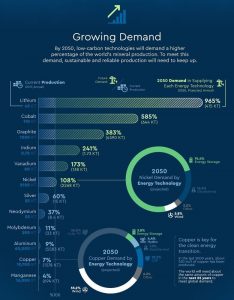

As the nickel industry faces unprecedent demand due to the increasing popularity of electric vehicles, Altilium have created a process that generates high levels of nickel with minimal environmental impact.

The world needs more nickel; however, it is not necessarily the nickel produced by pyrometallurgical (pyromet) processes that is needed, but the type of nickel delivered through the chemical process of hydrometallurgy (hydromet). Due to nickel’s essential role in the production of batteries used in electric vehicles (EVs), the demand for this type of Class 1 nickel is expected to grow significantly each year as the production of electric vehicles also increases. The problem which must be solved, therefore, is where that nickel will come from.

Metallurgical processes

Smelters, the plants which operate pyrometallurgical processes, are plentiful and are ideal for the production of nickel for the stainless-steel industry and some companies have even announced their intention to convert a product generated by smelters into a battery metal product. However, the environmental cost, at least in terms of CO2 generation, negates what is sought to be achieved by the electric vehicle revolution.

Hydrometallurgical plants, on the other hand, use acid to dissolve the metals contained in the ore and generally produce a compound, known as MHP – mixed hydroxide precipitate – which can be chemically converted into the sulphates needed by electric vehicle battery manufacturers. When it comes to hydromet, as it is often called, some processes are more efficient than others and some are simpler to operate than others. This is where serendipity comes into play.

With global pressure to make the move to electric vehicles, automakers and metallurgists around the world are struggling to identify sources of nickel that meet their ESG (Environmental, Social & Corporate Governance) standards and which can be obtained at a price low enough to allow the much-needed mass adoption of electric vehicles. As noted in an article by McKinsey last September: ‘In general, three main aspects will be considered important by electric vehicle OEMs: the ability to provide nickel that is clean, Class 1, and easily accessible.’1

Electric vehicles: Solve one problem, create another

In our haste to fuel a green revolution, we risk harming the very environment we are seeking to protect. When it comes to mining and processing it really is a question of the greater good or the lesser evil. Both are necessary: the greater good dictates that trees may be cut down, people may be relocated, holes will be dug, and residue will be created; because the adoption of electric vehicles will significantly reduce our carbon emissions and contribute to the arresting of anthropogenic global warming. The challenge which faces us all is how we obtain the materials we need to advance humanity whilst minimising the impact on human health and our environment. The International Council on Mining and Metals’ guidelines for responsibly mining ore, which include guidance such as how to support local communities and how to reduce environmental impact, are readily available and understood. It just takes the commitment needed to implement them.

When it comes to the extraction of the contained metals in that ore, however, more nuances come into play. Pyromet technologies produce copious amounts of inert slag, which is generally shaped and contoured to form hillsides. In the hydromet world, things are a little more complex. There is one well-known technology called high pressure acid leaching (HPAL) which is presently the most common hydromet process. Although it is quite effective at extracting nickel and cobalt, mainly from limonitic ore, it does produce acid-rich tailings which require neutralisation with limestone and then further containment, or disposal of those tailings is required. For each tonne of ore processed, the tailings constitute around one and a half tonnes because of the addition of limestone. What is more, the process uses sulphuric acid, operates within an autoclave which creates the high-pressure environment, and operates at high temperatures. It works – but it cannot process all of the laterite ore, it cannot extract all of the available metals, and the tailings it produces create an environmental threat which must be addressed.

It is possible to manage those tailings in a more environmentally friendly way, but to do so means building a special facility – adding another $1bn plus to the price-tag of an HPAL plant on top of the billions spent building the plant in the first place. Unfortunately, HPAL tailings are problematic and, as noted in the aforementioned McKinsey article, ‘…can contain heavy metals and iron hydroxides.’ A better process needs to be developed.

A brief geology lesson

Nickel laterites make up around 70% of the world’s nickel resources, with sulphide ores making up the remainder.

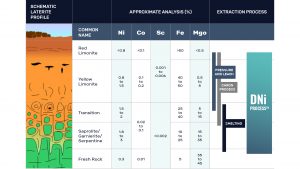

Laterite ore is comprised of limonite in the upper portion and saprolite in the lower. There may also be a transition zone between the two which has different mineralogy. The limonite has low magnesia and high iron but contains the lower grades of nickel and most of the cobalt. This ore feeds the HPAL process plants. The saprolite contains the higher nickel and some of the cobalt but also has magnesium which is a ‘poison’ to the HPAL process because it sucks up acid.

The apparently illogical way the nickel industry has developed over decades is that pyromet processes largely use the more valuable saprolite but only for the iron and nickel, whereas HPAL largely uses the lower value limonite but only for the nickel, cobalt and, in some cases, scandium.

The industry needs a process which will extract all the metals from all the ore in one plant; a process that will utilise the complementary nature of limonite and saprolite, where the magnesium acts as the bearer for the acid, enabling it to be recovered once its work is done, thereby making the process more sustainable and environmentally friendly.

The most sustainable solution may be the most profitable

A hydromet process which treats the entire laterite ore body, extracts all of the metals contained within that ore, and which does not produce a residue requiring permanent containment sounds perfect but is it realistic? Why are we wasting the iron, magnesium, aluminium, scandium, and rare earth elements which are contained in nickel laterites by using just pyromet or hydromet processes? As we strive to make better use of the Earth’s limited resources whilst minimising our impact on the planet, we need an efficient, elegant chemical process that does all of this without leaving a legacy which threatens human health and the environment.

The solution to the problem is found in Altilium’s DNi Process™. It is the most sustainable method of delivering nickel and cobalt, in the form of MHP, to the electric vehicle battery industry. In fact, it is the only sustainable method and here is why:

- Firstly, the DNi Process is effective in processing the whole of the lateritic profile and it makes a lower mine cut-off grade possible, consequently increasing the resources available;

- Secondly, it uses nitric acid at atmospheric pressure, and not the stronger, more reactive sulphuric acid which demands high temperature and pressure to work;

- Thirdly, up to 98% of the nitric acid is recycled; and

- Finally, the process efficiently extracts all the available metals and produces co-products of hematite and magnesium oxide, amongst others.

This all means that not only does the DNi Process recover extremely high amounts of nickel and cobalt into MHP, but it is also possible to extract:

- Aluminium as an hydroxide;

- Scandium into solution;

- Rare earth elements (REEs) into solution;

- Iron in hematite; and

- Magnesium oxide.

Crucially, the DNi Process leaves a dry and inert residue which requires minimal neutralisation, using the magnesia already in the system. This amounts to about 20% of the volume of the original ore feed in stark contrast to the HPAL plants, which produce more residue volumetrically than the ore they started with. Furthermore, DNi Process residue contains trace amounts of magnesium nitrate, which is a fertiliser so it can be safely dry-stacked and used to revegetate the mine site. All of which makes the DNi Process a significantly more sustainable solution.

By generating multiple revenue streams, the DNi Process fundamentally changes the economic evaluation of a resource and the profitability of the processing plant. We must also mention that because the process is much simpler, due to operating at atmospheric pressure and using nitric acid, materials of plant construction are, by-and-large, just 304 grade stainless steel. This results in significantly lower capital and operating costs and fast, efficient plant design and construction.

Serendipity: the right technology at the right time

Stephen Grocott from Queensland Pacific Metals explains: “The reason you are only hearing about the DNi Process now is because there was only really one market for nickel back then – stainless steel. In the 2000s, China developed something called ‘nickel pig iron’ (NPI) which remains the cheap way to get nickel into stainless steel. When Altilium were trying to commercialise their process, the only market was effectively stainless steel, and they were competing with low cost NPI. But timing is everything. Battery sector demand is now emerging, and to go from NPI to battery nickel is not economical.”

Invented in the US, developed in Australia, and now owned by a British company, the DNi Process has already been proven by Altilium working with the Australian government’s CSIRO at their demonstration plant in Waterford, Western Australia.

More recently, Queensland Pacific Metals Ltd is, under licence, developing the first commercial DNi Process plant in Queensland, Australia. In February 2021, they doubled the planned output from their ‘TECH’ project because of strong offtake interest from the likes of LG Chem and Samsung. In June, LG and POSCO signed deals to invest and secure off-take of their MHP. QPM is currently progressing with a Definitive Feasibility Study (DFS) prior to a final investment decision and ahead of first production in 2023.

The future is bright… and it is green. Funnily enough, the same colour as our MHP. Altilium is currently in advanced talks with several parties regarding the development of plants in laterite-rich countries. Altilium’s technology is the next step forward and will be a landmark within the industry.

Supporting the idea that the DNi Process is the future of nickel, QPM’s Stephen Grocott concluded: “After this is [commercially] proven, I cannot see anyone building another HPAL project!”

References

- How clean can the nickel industry become?’ by Marcello Azevedo, Nicholas Goffaux and Ken Hoffman, McKinsey & Company, September 2000

Please note, this article will also appear in the seventh edition of our quarterly publication.