Discover the challenges and opportunities facing Australia’s lithium production sector and how they can supply the ever-increasing demand.

Achieving net zero greenhouse gas emissions by 2050 requires an unprecedented acceleration to the current global roll-out of renewable energy infrastructure, which includes solar and wind turbine ‘farms,’ electrification of transport systems, and extensive and widespread clean energy storage capacity. The latter is largely reliant on lithium-ion batteries and is fuelling a boom in lithium production and mining.

Lithium is used in a wide range of applications, from pharmaceuticals to glass and ceramics manufacturing, but by far, its biggest use currently is in battery technologies which have increased from 22% of global lithium end use in 2013 to 74% in 2022.

The list price for lithium carbonate has increased by a factor of ten in the last two years and shows little sign of backtracking in the near future. Global demand for lithium by 2040 is expected to be between 40 and 60 times higher than the 2020 production rates. However, forecast modelling by the International Energy Agency and S & P Global predicts a significant global shortfall of lithium within the next several years. The implications of this should not be underestimated: it represents a critical threat to reaching net zero targets.

Australia is currently the world’s largest lithium producer, has an established lithium production sector, and has immense geological potential for further discoveries of ore deposits that can feed the world’s lithium hunger. However, there remain significant challenges to realising this potential, which we outline below. Beforehand, it is worthwhile reflecting on the broader supply chain risks of lithium and other so-called critical minerals.

Critical minerals are not one and the same

It seems ‘critical minerals’ are the new buzzwords across many sectors of society, from academic, government, the minerals industry, and mainstream media. And – as is so often the case – the term tends to be used loosely, often with little regard to a precise definition or meaning. Nonetheless, there are two universal factors that define a critical mineral:

1) The mineral (or metal or commodity) is crucially needed by society, which increasingly relates to enabling the clean energy transition; and

2) There is a substantial risk to the ongoing supply of the mineral.

These risk factors may relate to social, environmental, and geological factors but are dominantly geopolitical. An insufficient supply of any critical mineral would have significant economic, security, and quality-of-life impacts on societies.

Critical minerals are mainly assessed based on current production, but it is worthwhile examining the situation in terms of mineral reserves (i.e. recognised in-ground resources that are feasible to mine) if we are to consider the longer-term goals to 2050.

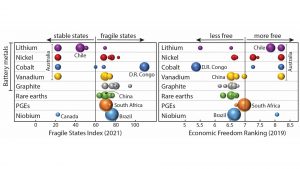

In Fig. 1 below, we have plotted mineral reserve data for various countries for key critical minerals (taken from the US Geological Survey mineral commodity summaries for 2022) against measures of countries’ stability and freedom, represented by the Fragile States Index, and the Economic Freedom Ranking.

These are rankings of countries based on their records and performance in economic and social freedom, prosperity, human rights, political stability, corruption, and environmental stewardship, among others. The bubble size represents the percentage of the world’s reserves held by that country, and the measures of a fragile state and economic freedom are indicators of fragility to the ongoing supply of these metals.

As can be seen, the bulk of reserves for most of the critical minerals in Fig. 1 are within countries considered to be more fragile and less free (e.g., South Africa, China, Brazil, and the DRC), which corresponds to a significant supply risk, and hence a high criticality index for these minerals.

The case of lithium is quite different. Most lithium reserves are within Australia and Chile, both of which are stable and economically free countries with well-developed mineral resource sectors. Therefore, the definition of lithium as a critical mineral is not due to the risk of supply of known reserves, rather it is the emerging huge disparity between supply and demand. The solution is clearly to fast-track more supply, but this is easier said than done.

Also noteworthy is that Australia is rather unique that it hosts significant reserves of a range of battery metals; this should be seen as a crucial factor in support of developing on-shore sovereign capacity for battery manufacturing, especially given China’s dominance in the refining of battery ready material with more than 50% of the world’s yearly refined lithium, cobalt, and nickel. Like many other commodities, Australia exports large shares of its extracted ores, with nearly all lithium ore shipped to China for processing.

The Australian Government has been investing significant capital, particularly through the Modern Manufacturing Initiative programme, to support the development of sovereign lithium refinement capabilities, with the first lithium hydroxide produced in Australia in 2021, and additional capacity scheduled to come online in 2023.

Sources of lithium

Almost all of the world’s lithium is mined from two principal ore types:

- So-called ‘hard rock’ lithium-caesium-tantalum (LCT) pegmatites, of which Australia is the major producer. Pegmatites are igneous bodies characterised by very large crystals (up to several metres) that form from volatile-rich (water, halogens, etc.) silicate magma that is highly enriched in elements, such as lithium, that are not easily incorporated in common igneous minerals. The main ore mineral in these deposits is the lithium silicate spodumene.

- Saline brines or salars, which are high-salinity enclosed groundwater reservoirs within sedimentary rocks that have high dissolved lithium contents. Major resources of this type are currently recognised in Chile, Bolivia, Argentina, and China, although sedimentary basins of central Australia are also considered to be prospective. The commercial viability of metal extraction from these resources is limited by current technology that relies on complex, energy-intensive evaporation procedures. However, processes for direct lithium extraction using minimal energy are expected to be commercially viable in the next few years, at which time the industry will pivot rapidly to saline brine sources for lithium.

Despite this general picture of lithium ore geology, we lack knowledge of how and where lithium ores form in the crust, and hence how to effectively explore for deposits. This, to a large extent, is due to the recent rise of lithium as an important commodity for society, and there has been very little previous research focused on understanding the geology of lithium ore formation.

This does not bode well for the future, as time is not on our side. Timeframes from lithium ore discovery to production are typically between around five and 15 years, meaning there is an acute urgency for new ore discoveries to be made as soon as possible.

We can, however, draw optimism from the advanced state of knowledge we have on ore geology of other metals (e.g., copper, gold), which we can adapt to lithium and other critical metals, and recent advances in data acquisition capabilities that can rapidly deliver the large geological and geochemical datasets we need.

The Australian Critical Minerals Research Centre, part of the Institute for Sustainability, Energy and Resources at the University of Adelaide, is rising to this research challenge, combining globally recognised expertise in critical minerals from academia, industry, and government, with novel new developments in mineral characterisation to fast-track geological understanding of lithium ore systems, and development of effective exploration strategies.

Australia’s opportunities and challenges in the lithium industry

Australia’s lithium sector is ramping up. Australia produced 48% of the world’s lithium in 2022, and the output of lithium concentrates is projected to grow by 20% per year over the next few years as new mines and processing plants come into production.

Western Australia is dominating the scene, with most lithium production coming from the Greenbushes (Talison Lithium), Pilgangoora (Pilbara Minerals), Mount Marion (Mineral Resources and Jiangxi Ganfeng Lithium), and Mount Cattlin (Allkem), pegmatite deposits. Northern Territory is not missing out, with mine production from Core Lithium’s Finniss deposit, south of Darwin, beginning in 2022. Australia’s lithium processing and refining capacity is expanding, with new facilities expected to accommodate 20% of global lithium refining by 2027.

Across the continent, lithium exploration is also booming. Mineral explorers are discovering new resources, particularly in the ancient geological terrains of central Australia, and in doing so, defying the challenges of exploring for minerals in such a vast continent with disparate infrastructure and an extensive blanket of younger sediments that cover the older basement rocks. Our research on understanding lithium ore systems and their ‘fingerprints’ in the geological records will further assist explorers in targeting prospective areas for new discoveries to feed the pipeline of lithium supply into the future.

There are many other challenges we face in ensuring critical metal supply for the clean energy transition. Economic risks associated with volatile critical mineral markets, including lithium, will continue. Industry is calling for simplification and fast-tracking of regulatory processes, which would not only reduce the lead time from discovery to lithium production but also reduce financial risks and encourage investment. Revision of the regulatory framework would need to be intertwined with continual improvement to Australia’s high ESG (environmental-social-governance) credentials.

Perhaps the biggest risk to Australia’s lithium sector (and minerals sector as a whole) is a chronic shortage of skilled workers. Quite simply, we are not producing enough engineering and science graduates to support industry. The situation is exacerbated by the burgeoning hydrogen and clean energy sectors, which serve to divvy up this limited human resource further. The closure or scaling down of university geoscience departments across the country (ANU, Curtin, Macquarie, and Newcastle in the last two years alone), does not bode well for rectifying this situation.

With critical minerals industries developing in countries across the world, it will be increasingly difficult to attract talent from overseas to Australia. There is a deep urgency to address this issue now, given the unavoidable lag time of education and training of the skilled professionals we need. A starting point is incentivising migration of skilled workers and tertiary education students to Australia, but more comprehensive measures need to be implemented to attract and retain students in engineering and Earth science fields.

Carl Spandler

Associate Professor

Dr Jarred Lloyd

The Australian Critical Minerals Research Centre

Institute of Sustainability, Energy and Resources

The University of Adelaide

https://www.adelaide.edu.au/australian-critical-minerals-research-centre/

https://twitter.com/uniofadelaide

https://www.linkedin.com/school/uniofadelaide/

https://www.facebook.com/uniofadelaide

Please note, this article will also appear in the thirteenth edition of our quarterly publication.