Green Lithium has made significant progress towards centralising the European lithium supply chain with its UK refinery.

The car manufacturing industry in Europe and the UK is currently undergoing an unprecedented revolution due to the anticipated demand for electric vehicles, driven by EU-wide and national targets set under the Paris Agreement along with other green energy initiatives. The Paris Agreement brings together United Nations Member States in the common cause to strengthen the global response to the threat of climate change. Decarbonisation and the commitment to drastically reduce the burning of fossil fuels is a key focus of the agreement.

As the EU attempts to reduce its consumption of fossil fuels and the trend in car production moves towards electric energy, the lithium-ion battery will be at the heart of such cars. Europe is one of the largest consumers of lithium, but its supply chain is currently entirely dependent on imports from China. Not only does this have serious environmental concerns, the lithium supply chain is also at the mercy of commercial and geopolitical issues.

The current strategic risk and high cost to the environment

The battery pack (including the battery management system) is the most significant cost associated with the production of modern electric cars, accounting for about 40% of the overall vehicle cost; as many of the raw materials needed are imported from Australia and China. Not only does this expose the lithium supply chain to risks regarding the transport of raw materials, but the environmental cost is also high due to the cost of shipping, giving electric cars an inherently high carbon footprint before they are even manufactured.

The European approach

In October 2017 the European Commission launched The European Battery Alliance (EBA). The immediate objective was to create a competitive manufacturing value chain in Europe, with sustainable battery cells at its core.

European Commissioner Elżbieta Bieńkowska said: “Europe is investing in a competitive and sustainable battery manufacturing sector. We want to provide a framework that includes secure access to raw materials, support for technological innovation and consistent rules on battery production. We envisage a strong battery industry that contributes to the circular economy and clean mobility.”

In line with the rising trend for electric vehicles and the increase in European lithium battery factories, calls for a domestic raw material supply chain with a low carbon footprint are also mounting. The UK car industry has announced plans to invest £1bn (€1.16bn) to build electric cars in Britain – an objective that is directly supported by the UK government. This commitment has been echoed by European auto manufacturers, but these ambitions are restricted by the need to import the raw materials from China.

The current lithium supply chain

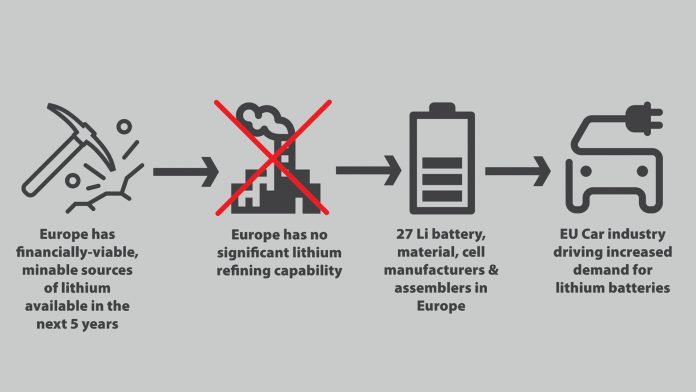

While there are more and more lithium mines being developed in Europe, there is currently no refinery in the European battery supply chain which can convert raw lithium ore concentrate into battery grade lithium hydroxide or carbonate. This means that despite the increase in domestic lithium mining manufacturers still need to outsource the refining of the lithium to China, significantly reducing the environmental benefits of locally mined lithium, and maintaining the high costs associated with the refining process.

Instead, European battery manufacturers need a solution which shortens and secures the supply chain; and domestic refinery capabilities are the missing link. While other regions are attempting to compete with China’s refining capabilities (for example Neometals and Manikaran Power are making significant strides in India), currently only one UK company is seeking to fill this gap in the European value chain – Green Lithium.

EU centralised lithium refinery in the UK

Green Lithium has made significant progress towards building a European lithium refinery based in the UK, which will shake up the European lithium market and all but extinguish the need to outsource to China. The refinery will act as a centralised hub to process unrefined lithium concentrate from sources across the UK and Europe and provide battery-grade lithium hydroxide and carbonate to Europe’s battery factories. By doing so, Green Lithium will provide the missing link to securing and shortening the supply chain for the UK and European auto industry.

A market leading refining approach

Working with strategic partners from around the world, and improving upon existing industry practices, Green Lithium has developed a ‘market leading’ refining approach the company calls ‘Pit2Plant’.

Pit2Plant harnesses beneficiation and hydrometallurgy techniques, which will be the technical foundation of their centralised refinery. This is a unique end-to-end approach for lithium mineral processing using innovative technologies which are not currently widely used within the industry, making Green Lithium a trailblazer in this area. This technology will be instrumental in providing an environmentally friendly solution to tightening the European lithium supply chain.

Drawing on experience from some of the largest lithium operations in the world (with a focus on large scale Australian mining operations), Green Lithium’s approach has three main benefits when compared with traditional refining techniques: reduced cost, fewer risks and shorter project delivery times.

The processing and refining of lithium is often overlooked but is a vital component of any strategic regional supply chain, and one which the UK and Europe green economy cannot do without.

Green Lithium

107-111 Fleet St

London EC4A 2AB

+44 (0)20 8191 7644