Power Nickel focuses on the acquisition and exploration of mineral properties that offer the potential for mining high-grade nickel.

The price per tonne of nickel has increased by almost 100% year on year. The commodity bull market is here, and, thanks to the electric vehicle (EV) revolution, it is here to stay for many critical metals.

One company making a name as a key player within this secular trend is Power Nickel (TSX-V: PNPN, OTCBB: CMETF, Frankfurt IVVI). Previously known as Chilean Metals, Power Nickel is a mining company headquartered in Toronto, Canada. The company focuses on the acquisition and exploration of mineral properties in Canada that offer the potential for mining high-grade nickel deposits. Power Nickel’s main objective is to supply the market with all the high-grade battery-critical metals that are powering the shift to cleaner energy.

Nickel is the new gold

The transition to EVs is one of the most obvious societal trends today. What may not be so obvious to investors is the critical role that nickel plays in powering it.

The world produces approximately 2.7 million tonnes of nickel every year and 8% of that is consumed by lithium-ion (Li-ion) batteries. Li-ion batteries are used to power EVs, of course, but they are also used in medical devices, cordless power tools, energy storage, and many more applications.

By 2025, it is expected that 58% of Li-ion batteries will contain nickel, as the metal provides several significant advantages. The benefits include that it takes up less space, enables a longer life, provides efficient energy storage, and is lighter. In short, batteries with nickel-containing cathodes are simply more efficient. This is leading companies and governments to make major investments in the R&D and production of such batteries, which are aligned with clean energy goals.

It is clear that, in future, EV batteries will contain much more nickel. However, not all nickel is created equal and only 42% of global production is suitable for the battery supply chain. This is where Power Nickel comes into play with its latest gamechanging acquisition.

NISK

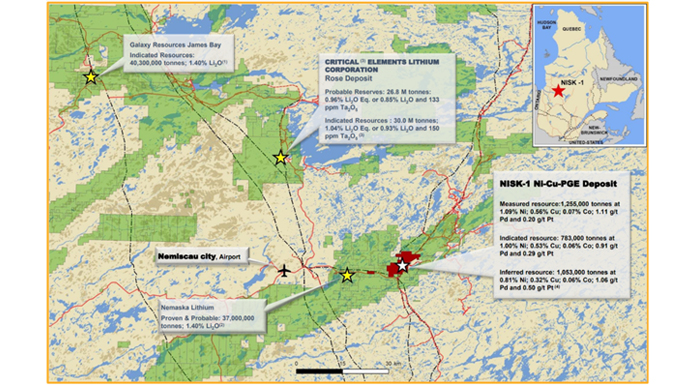

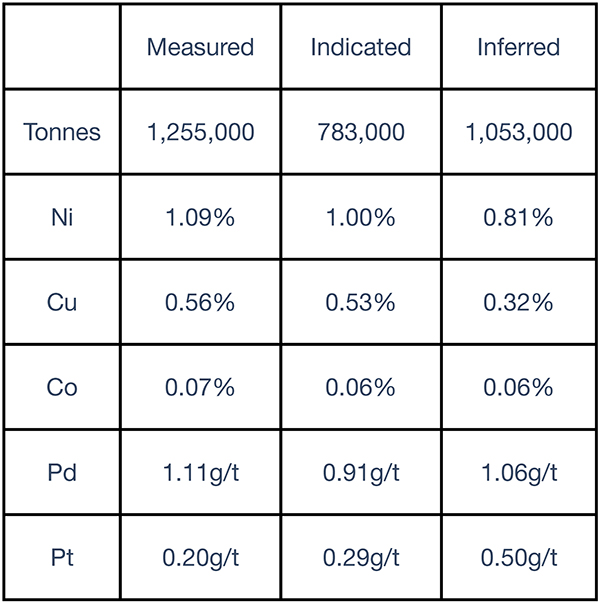

NISK is Power Nickel’s flagship project, which is ideally located in an active mining region of Quebec. The market is strong for multiple battery metals and NISK has got them all, with mineralisations in nickel, copper, cobalt, palladium, and platinum.

NISK’s historic resources also have great potential for expansion.

The information regarding the NISK-1 deposit was derived from the technical report titled ‘Resource Estimate for the NISK-1 Deposit, Lac Levac Property, Nemiscau, Québec’, dated December 2009. The key assumptions, parameters and methods used to prepare the mineral resource estimates described above are set out in the technical report. The existing resource estimates at the Nisk project are of historic nature and the company’s geology team has not completed sufficient work to confirm a NI 43-101 compliant mineral resource. Therefore, caution is appropriate since these historic estimates cannot, and should not, be relied on. This is for informational purposes only.

The NISK deposit is open at depth and along strike. Power Nickel has completed Q4 2021 – a 2500m drill programme targeting high-grade nickel and copper mineralisation for EVs.

Encouraging results from the new exploration holes confirm the presence of high-grade nickel mineralisation and suggest extended mineralisation in what the company believes will be the first of many nickel charged pods in a string-of-pearls configuration.

Terry Lynch, CEO of Power Nickel, said: “The historical estimates are for about three million tonnes of nickel at NISK. We believe we can more than triple that number in the next 12 months.”

The NISK property sits on 4,589 hectares and covers a total of 90 mineral claims, which uniquely positions Power Nickel to meet the growing demand for high-grade metals in the battery industry.

The new 43-101 resource estimate will be released in the second quarter, before the project enters its second phase of drilling at the end of the quarter.

Further prospects

The potential at NISK alone is enough for Power Nickel to merit an allocation in any portfolio, but it is bolstered by a collection of significant assets that provide further value (and future cashflow) for investors.

The company owns 100% of Consolidation Gold and Silver and plans to use a palm of arrangements to dividend that asset out and create a new company; 20% of which will be owned by Power Nickel shareholders, with 80% owned by Power Nickel.

Consolidation Gold and Copper focuses on the acquisition and exploration of copper and gold in Chile and British Columbia’s famous Golden Triangle, where more than 130 million ounces of gold, 800 million ounces of silver, and 40 billion pounds of copper have been discovered to date.

At the heart of the Golden Triangle lies the Golden Ivan Project, which hosts two known mineral showings described to be polymetallic veins that contain quantities of silver, lead, zinc, +/- gold, and +/- copper.

Consolidation Gold and Copper also owns 100% interest in three projects in Chile covering nearly 20,000 hectares.

That group is highlighted by the Tierra De Oro project, which occupies 5,667 hectares of the country’s prolific iron oxide-copper-gold belt. Phase 1 of drilling at the promising site has already returned 716g/t silver and 0.453% copper over two metres.

The company also holds a 3% royalty for Copaquire, a copper moly deposit it discovered, which is held by Teck Resources. The mine is expected to be brought into production in the future and will provide recurring cashflow for investors.

Positioned to meet the increasing demand

The recent surge in commodities and metals like nickel is not just a one-off – it is a foreshadowing of a future that will be powered by technologies that demand more and more high-grade metals.

Power Nickel is well-positioned to meet this demand and its potential for expansion (particularly at NISK) represents a historic opportunity in the midst of this commodities boom.

At a current market cap of C$12m, this company is trading at a deep discount to its peers. Pound for pound, Power Nickel offers a great value deal for nickel exploration.

Please note, this article will also appear in the tenth edition of our quarterly publication.