Paul Gorman, CEO and Director of Reflex Advanced Materials Corp (CSE:RFLX) (OTCQB:RFLXF), highlights graphite’s role in North America’s transition to electric vehicles and the new green economy.

A global graphite shortage is a matter of when, not if, without new sources of supply. For the US, which is 100% dependent on foreign imports of the material, it is a ticking time bomb that could derail the nation’s vehicle electrification and decarbonisation ambitions.

This emphasises the importance of establishing a reliable, secure and sustainable ‘mine to battery’ electric vehicle (EV) supply chain, beginning with a domestic graphite source and integrating it with processing, manufacturing, and recycling to create a full and secure supply chain.

Graphite is known for its metallic properties, including thermal and electrical conductivity, and non-metallic properties, including inertia, high thermal resistance, and lubricity. These properties are put to use in industrial applications such as high-temperature lubricants, brushes for electrical motors, and friction materials. Perhaps its most important application is the lithium-ion battery, where graphite ranks above even lithium as the key ingredient. There is actually 10-30 times more graphite than lithium in a lithium-ion battery.

Any product with a battery containing a graphite anode – electric cars, hybrid cars, laptops, smartphones – contributes to graphite demand. High-technology applications for graphite, and thus the demand for the material, are likely to grow. According to the U.S. Geological Survey, technological advances to improve graphite purity are opening up a range of uses in carbon-graphite composites, electronics, foils, friction materials, and special lubricants. Flexible graphite products, such as graphoil (a thin graphite sheet), will likely be the fastest-growing markets. Large-scale fuel-cell applications in development could consume as much of the metal as all other uses combined.

Graphite is also the source of graphene oxide – a much-hyped, manmade, two-dimensional material – consisting of a single layer of carbon atoms. Graphene is touted as an extraordinarily strong, thin, and electrically and thermally conductive ‘super material’ destined for applications that include but are not limited to electronics, heat transfer, bio-sensing, membrane technology, battery technology, and advanced composites. Although still in the early stages, graphene technologies are developing rapidly, and new applications are still emerging.

Meeting rapid graphite demand

So where is all this graphite going to come from? Since synthetic graphite costs twice as much as natural graphite, natural will likely be the source for most applications. Currently, most of the world’s graphite is mined in China. Much like rare earth metals, China has dominated the graphite market for economic and environmental reasons. But as China continues to close its mines due to pollution concerns and ore depletion, many North American junior mining companies are preparing to ramp up operations to fill the supply gap and take advantage of future opportunities.

Graphite is included on a list of 35 critical minerals the U.S. Geological Survey has deemed critical to the national economy and national security.

A White House report on critical supply chains showed that graphite demand for clean energy applications will require 25 times more graphite by 2040 than was produced in 2020. However, the concentration of mined and synthetic graphite production in one producing country casts doubt on the ability of the mining industry to supply the needed battery raw material.

A White House official said recently: “Over the last decades, China has cornered the supply chain for batteries from critical mineral mining and processing to cathode anode belt manufacturing for critical minerals. For the critical minerals lithium, cobalt, graphite, nickel and manganese that are crucial to advanced batteries, China controls nearly all global processing capacity.”

This, however, is beginning to change, as funding from the US government is being offered to companies with the technology and know-how to build battery plants that can compete with Asian battery and electric vehicle manufacturers. The formation of a ‘mine-to-battery’ domestic supply chain is well underway.

Battery growth

Estimates are that battery demand could consume well over 1.6 million tonnes of flake graphite per year (in 2021, total usage of graphite equated to one million tonnes). Remember, the mining industry still needs to supply other graphite end users. Currently, the automotive and steel industries are the largest consumers of this metal, with demand across both rising at 5% per annum.

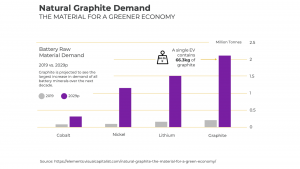

Benchmark Mineral Intelligence, the world’s top critical mineral analyst, shows demand for natural graphite from the battery segment amounted to 400,000 tonnes in 2021, with that number expected to scale up to 3 megatonnes by 2030. Demand for synthetic graphite came to about 300,000 tonnes in 2021 and is expected to increase to 1.5 megatonnes by 2030.

Where are the EV makers going to find the graphite? According to Fastmarkets, a UK-based commodity price reporting agency, the current rate of EV production indicates demand for battery-grade graphite could rise by a jaw-dropping 36% in 2023.

By estimates, at least 125 million EVs are expected to be mobile by 2030. That is more than eight million tonnes of additional battery-ready graphite needed this decade; remember, the mining industry is currently only able to supply one million tonnes.

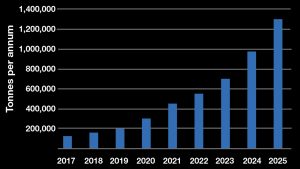

According to Benchmark Mineral Intelligence, the flake graphite feedstock required to satisfy the world’s lithium-ion anode market is projected to reach 1.25 million tonnes per annum by 2025. At this rate, demand could easily outstrip supply in a few years.

Requirements in the electric world

Just to meet demand for battery anode materials by 2035, an estimated 97 natural flake mines will need to be built assuming each mine can produce 56,000 tonnes per annum. Currently, there are 70 mines globally with the majority of the mines located in China, India, and Africa.

Almost all lithium-ion battery manufacturing currently takes place in China because of the ready availability of graphite, weak environmental, social, and governance (ESG) standards, and low costs.

There are no graphite-producing mines in North America. The fact is, for the United States to develop a ‘mine to battery’ supply chain at home, it currently has no choice but to import its raw materials from foreign countries. For battery-grade graphite, that means China, which is growing increasingly adversarial, economically, politically, and militarily.

The United States is 100% import reliant according to the US Geological Survey. In 2021, the US imported 53,000 tons of natural graphite, of which 57% was high-purity flake, 42% was amorphous and 1% was lump and chip. 33% came from China, Mexico 21%, Canada 17%, India 9%, and other 20%.

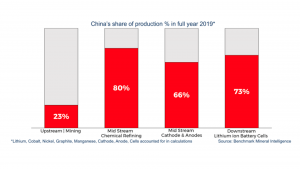

A 2020 article by BMI aptly demonstrates China’s battery metals strength. BMI’s chart below shows China’s share of global battery production, broken down by each stage of the battery supply chain — upstream (mining), midstream (refining, cathode/anode production), and downstream (lithium-ion battery cells).

The proposed US Inflation Reduction Act promises $369bn for climate and clean energy policies but also sets an ambitious target to extract and process key battery minerals locally.

President Joe Biden had earlier invoked the Defense Production Act (DPA) to step up US production of minerals for electric vehicle and storage batteries and lower the nation’s reliance on foreign supply.

Separately, the U.S. Department of Energy (DOE) dedicated $3.16bn of funding as part of the Bipartisan Infrastructure Law to develop the country’s battery supply chain. The funding will be allocated across the supply chain, with the bulk of it being made available to mid-stream processing to cathode, anode, and battery cell production.

Benchmark data shows that China currently has 81% of the world’s cathode manufacturing capacity, 91% of the world’s anode capacity and 79% of the world’s lithium-ion battery capacity.

Fortunately, the US government has begun taking a stand on US critical minerals vulnerability, including graphite.

On 24 February 2021, President Joe Biden signed an executive order aimed at strengthening critical US supply chains. Graphite was identified as one of four minerals considered essential to the nation’s “national security, foreign policy, and economy.”

To bolster domestic production of these minerals, US miners can now gain access to $750m under the act’s Title III fund, which can be used for current operations, productivity and safety upgrades, and feasibility studies. The support can also cover the recycling of these materials, according to Bloomberg sources.

The Biden administration has also allocated $6bn as part of the $1tr infrastructure bill — towards developing a reliable battery supply chain and weaning the automotive industry off its reliance on China, the biggest EV market and leading producer of lithium-ion cells.

Economic benefits of graphite

Trading at a fraction of the price of nickel, cobalt and even manganese, graphite is a critical part of the EV supply chain.

Source: Benchmark Mineral Intelligence

During a presentation at BenchmarkWeek2022 in Los Angeles, BMI’s COO, Andy Miller, said that batteries became more than 50% of the cobalt market in 2016 and the same thing happened to lithium in 2018. Next year, the company sees lithium-ion batteries overtaking the steel industry and becoming the top demand source for graphite.

Source: https://elements.visualcapitalist.com/natural-graphite-the-material-for-a-green-economy/

According to Benchmark’s Natural Flake Graphite Forecast, refractories and foundries this year still dominate demand, but, by 2025, the battery industry is set to consume two-thirds of the world’s flake graphite, increasing to 79% in 2030.

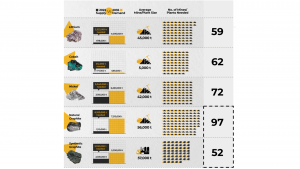

To meet 2035 graphite demand, the industry needs 97 new mines, at an average production rate of 56,000 tonnes per day, and 52 new synthetic plants, averaging 57,000 tpa. Compare this to the 59 new lithium mines, 62 cobalt mines, and 72 nickel mines needed.

The electrification of the global transportation system is one of the most important, and enduring, themes to emerge following the turn of the millennium.

Source: BenchmarkWeek2022

Governments are spending billions of dollars to encourage consumers and businesses to switch their driving and car-buying habits from fossil-fuelled to electric models. Automakers are also investing heavily in electrification, with just about every major carmaker offering new electric models. 2021 automakers announced $36bn of investments to build facilities dedicated to manufacturing EVs and batteries. In the first five months of 2022, automakers announced $24bn in EV-related investments.

Graphite is essential to electrification, as it is needed in the anode part of the battery and there are currently no substitutes.

To meet the 2035 graphite demand, the industry needs 97 new mines, at an average production rate of 56,000 tonnes per year.

The most interesting deposit in the US is the Ruby Graphite Deposit in southwest Montana, being developed by Reflex Advanced Materials Corp (CSE:RFLX) (OTCQB:RFLXF).

Please note, this article will also appear in the thirteenth edition of our quarterly publication.