World Nuclear Association presents its latest Performance Report, providing insights into recent global trends, examining the new countries joining the nuclear energy industry, and exploring advancements towards carbon neutrality through the adoption of small modular reactors.

World Nuclear Association (WNA) is promoting the sustainable and responsible use of nuclear energy worldwide, advocating for nuclear power as an essential component in achieving global energy security and addressing climate change.

As part of this effort, the WNA releases an annual Performance Report, shedding light on the current state of nuclear energy generation and offering valuable insights and data on global trends and advancements in the nuclear energy industry. In anticipation of the 2025 Performance Report, The Innovation Platform spoke with the WNA to gain an understanding of the nuclear outlook for this year, and the challenges and opportunities that lie ahead.

Can you provide an overview of global nuclear energy generation? What are the key statistics, and what does the Performance Report indicate about the status of nuclear construction worldwide?

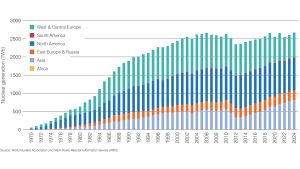

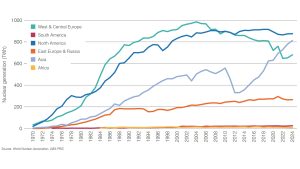

Nuclear reactors worldwide generated 2667 TWh of electricity in 2024. This is the largest amount of electricity produced in one year from nuclear energy, beating the previous best of 2660 TWh in 2006.

Nuclear reactors meet around 9% of the world’s electricity needs. This is down from around a 16% share in the mid-1990s, even though nuclear generation has increased. The decline in share has occurred because global demand for electricity has increased much faster, largely met by additional fossil fuel generation.

For construction, seven reactors were completed in 2024 and were connected to the grid. Three of these were located in China, with the remaining four in the United Arab Emirates, France, India and the United States. There are currently 70 reactors under construction worldwide, with construction on nine reactors starting in 2024, six in China and one each in Pakistan, Egypt and Russia.

Can you elaborate on any significant trends and shifts in the global nuclear market and landscape in 2025 highlighted in the report?

The increase in global nuclear generation seen over recent years is primarily due to a rapid increase in nuclear electricity generation in Asia, with 56 of the 68 reactors that have started up over the last ten years being built in that region. This looks set to continue, with 59 of the 70 reactors currently under construction being built in countries in Asia.

While most reactors under construction and planned are large reactors, we will soon see SMRs (small modular reactors) playing an emerging role. The 125 MWe Changjiang ACP100 is due to start up in China next year, and construction on two 53 MWe RITM-200S units will begin soon in Russia. SMR construction is also expected to move forward in countries such as Canada and the USA soon. These smaller reactors will broaden the range of applications to which nuclear technologies can be applied, and in the longer term, with factory-based modular production and more rapid construction, should help bring down costs.

The report offers a country-by-country overview of nuclear capabilities. Which countries have demonstrated notable advancements or faced challenges in their nuclear energy sectors?

China is continuing its programme of nuclear building. It has just overtaken France as the country with the second largest number of nuclear reactors (58), and looks set to overtake the United States, with more than 100 reactors operating within the next decade.

Also notable are the number of new countries that have either recently started their first reactors (United Arab Emirates and Belarus) or have their first reactors currently under construction (Bangladesh, Egypt and Turkey). With countries such as Kazakhstan, Poland and Uzbekistan looking to begin construction of their first reactors in the next few years, the number of countries choosing to use nuclear as part of their energy mix is growing.

What does the report reveal about global progress towards carbon neutrality, and what role does nuclear energy play in this transition? How is the nuclear energy industry positioning itself to contribute to climate goals in the coming years?

Global progress to carbon neutrality is happening far too slowly. Even when the rapid growth of renewable generation is added to nuclear energy, global use of fossil fuels for electricity production has continued to rise, driven by the overall increase in electricity demand. That increase in demand is set to continue, according to the International Energy Agency, electricity consumption is predicted to more than double over the next 25 years, driven by increased electricity use in emerging economies and increasing demand from new sectors, such as supplying the huge increase in demand coming from AI and data centres.

Governments have recognised that a rapid expansion in the contribution from nuclear energy is needed. At COP28 in 2023, in the Global Stocktake document approved by all nations, nuclear was included as one of the mitigation technologies needed to reduce emissions. Additionally, 25 governments signed a declaration supporting a goal to triple global nuclear capacity by 2050, with six more countries joining the declaration at COP29 in Baku in 2024.

That tripling goal has been supported by a pledge from more than 130 companies in the nuclear energy industry to work with government and others to achieve that goal, and in 2024 fourteen large energy users, including Amazon, Meta, Google and Dow, declared their support for the tripling nuclear goal, recognising nuclear’s role in enhancing energy security, resiliency and providing continuous clean energy.

What specific areas does the report identify as having a particular need for innovation and investment moving forward? How can these be addressed to enhance the industry’s growth and sustainability?

From a technical perspective, nuclear’s potential to decarbonise hard-to-abate sectors beyond electricity production will require innovation to fully realise. Many of these potential applications involve the supply of process heat at higher temperatures than that generated from conventional large, water-cooled reactors. Instead, gases, molten salts or liquid metals will be used as coolants, allowing process heat supply at up to 750°C, instead of the 300°C typical for water-cooled reactors. These alternative coolant technologies have already been demonstrated; what is required is continued development and deployment of commercial reactors based on these technologies.

Innovations in finance will also be required, particularly for construction in liberalised electricity markets. There is a huge potential market for new nuclear, with nearly 500 reactors currently under construction, planned or proposed, requiring a prospective investment of $1.8 trillion, according to our World Nuclear Supply Chain Report.

The finance sector is addressing this issue. At New York Climate Week 2024, fourteen financial organisations discussed ways in which their sector supports the global goal to triple nuclear capacity.

Based on the findings in the 2025 report, what is World Nuclear Association’s outlook for the industry in 2026? What trends do you foresee that could significantly impact nuclear energy development in the next few years?

Over the short term, as the reactors currently under construction are grid-connected over the next five to six years, we should see global nuclear capacity and total nuclear generation continuing to rise.

There may be some closures of older plants, but our analysis has shown that for the current reactor fleet, including those reactors that have operated for at least 50 years, there is no decline in reactor performance related to age, with the older reactors achieving high capacity factors at least equal to newer reactors. Indeed, in the US, we are seeing some reactors that recently shut being reopened.

Longer term, we are likely to see two drivers that should prompt an acceleration in the pace of new nuclear build. The first is the continued commitment to decarbonise global electricity supplies. But the second, and perhaps more significant, driver is growing electricity demand. Given this, additional demand would also need to be met by clean energy sources, a minimum of a tripling of nuclear capacity will be needed to help meet these goals.

Further reading

Please note, this article will also appear in the 23rd edition of our quarterly publication.