Krish Dharma, Strategic Advisor for the SEMI Supply Chain Management (SCM) Initiative, explains how the semiconductor industry is moving from fragmented insight to coordinated resilience – by building a capability-led blueprint that allows companies to anticipate disruption, improve capital efficiency, and respond faster without compromising competitive advantage.

The global semiconductor supply chain has entered a new phase. Disruption is no longer an occasional shock, but a structural condition shaped by geopolitical realignment, AI-driven demand growth, climate risk, and unprecedented capital intensity.

While individual companies have invested heavily in digital tools and internal resilience, the broader ecosystem still struggles to respond coherently to systemic risk. Data remains fragmented across tiers, trust is limited, and decisions are often made in isolation. Coordination typically begins only once a disruption is already unfolding, leading to amplified volatility, misaligned capacity investments, slow response times, and inefficient use of capital.

The challenge is not a lack of capability at the company level. It is the absence of a neutral, global industry-level operating model that enables companies to anticipate disruption and act with shared awareness – without compromising confidentiality or competitive advantage.

The need for an industry operating model

Bettina Weiss, Chief of Staff & Corporate Strategy at SEMI, said: “Systemic risks require systemic responses.

“No single company, regardless of scale or sophistication, can independently manage geopolitical exposure, critical material dependencies, or demand shocks that propagate across the entire value chain.”

What the industry needs is a shared framework that defines how coordination works: how signals are exchanged and received safely, how insight is developed, and how readiness is built over time, across the value chain. This is the role of OSCAR – Open Supply Chain for Agility & Resilience.

OSCAR is a long-term, industry-led capability framework that is being developed as part of the global SEMI Supply Chain Management initiative and is designed to provide the foundation for ecosystem-level coordination. It establishes a common operating model that allows companies to remain autonomous while benefiting from collective visibility, foresight, and preparedness.

Why OSCAR?

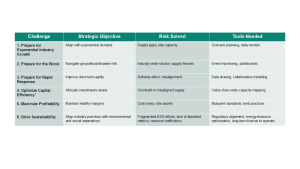

The industry is at an inflection point. There are six primary reasons that justify the need for an industry-wide SCM blueprint.

Making coordination executable

For coordination to be robust, it must be designed as a system rather than a collection of ad-hoc initiatives. OSCAR therefore rests on a clear execution logic that links intent to action.

It begins with strategy: a shared articulation of the problems being solved and the outcomes that matter to the industry. These include readiness for growth, preparedness for disruption, the ability to respond to rapid change, improved capital efficiency, and sustained profitability. This strategic framing is time-horizon aware, distinguishing near-term actions from longer-term structural shifts. Strategy is translated into capabilities – the essential functions the ecosystem must develop to operate effectively under uncertainty. These include sensing risk in near real time, harmonising forecasts across tiers, modelling scenarios before disruptions occur, and developing multi-tier visibility with context rather than raw transparency. These capabilities are intentionally prescriptive enough to be benchmarked and standardised, while flexible enough to be adopted in different ways by stakeholders along the entire value chain.

Capabilities only become real when supported by defined processes and protocols. This layer establishes how collaboration happens: how data is shared safely, common data models and ontologies, how signals are interpreted, and how escalation occurs during disruptions. Without this discipline, even the best analytics remain disconnected from action.

Technology then enables scale by turning shared capabilities into something the ecosystem can use. A foundational requirement is visibility – bringing together macroeconomic indicators, market trends, demand signals, and supply constraints into a coherent, industry-level view. These signals are aggregated through Conductor™ – the first platform designed to operationalise OSCAR. Conductor, developed by SEMI and strategic partner Beebolt, provides a neutral, governed environment for secure signal exchange, shared visibility, and scenario exploration. It is not a standalone product or a centralised system; rather, it functions as an execution layer that translates OSCAR’s operating model into practical workflows, while allowing multiple tools and platforms to coexist within a common framework.

Finally, governance ensures continuity and trust. Clear decision rights, working structures, funding models, and roadmaps allow coordination to persist beyond individual leaders or business cycles. Governance is what transforms collaboration from goodwill into a durable system.

From signals to insight – without centralising decisions

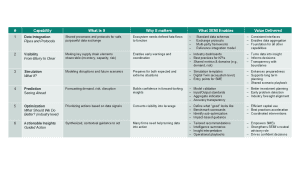

Within this operating model, the industry is aligning around a set of core capabilities that move coordination from awareness to readiness. These capabilities span integration of signals, visibility across demand, supply, materials, and logistics, simulation of future scenarios, prediction of demand and risk shifts, and optimisation of response options.

OSCAR provides the capability framework that allows the ecosystem to consistently generate insight across strategic, tactical, and operational horizons.

Strategic insight supports long-term investment and capacity decisions. Tactical insight improves medium-term supply-demand balancing. Operational insight enables faster, more coordinated responses to near-term disruptions. Decisions remain with individual companies; OSCAR strengthens all those decisions by improving the quality, timeliness, and alignment of the information behind them.

Adoption is the critical test

The success of this model will not be determined by conceptual elegance, but by broad, global industry adoption. We’ve seen time and again that coordination efforts fail when they are framed too narrowly as supply chain initiatives or technology programmes, not as a holistic and inclusive approach.

For OSCAR to succeed, it must be communicated in the language of business leaders. CEOs need to see how collective readiness protects long-term growth and geopolitical resilience. CFOs need to understand how better foresight reduces stranded assets and improves capital efficiency. Operators need clarity on how the model supports execution under volatility.

Momentum is built through visible progress rather than abstract vision. Early, pragmatic milestones – enabled through platforms like Conductor™ – demonstrate feasibility and value, while preserving the long-term ambition of the framework.

A call to action

The semiconductor industry has reached a point where resilience can no longer be treated as a competitive differentiator. It is a collective requirement.

OSCAR offers a path forward – not through mandates or centralisation, but through shared capabilities, trusted governance, and practical execution. The next phase depends on active participation: companies large and small need to engage in capability definition, pilot collaborative processes, and contribute to the industry standards that will shape how the ecosystem operates under prolonged uncertainty. Join the OSCAR working group or sign up for early access to Conductor.

The question is no longer whether systemic coordination is needed, but whether the industry will build it deliberately – before the next disruption forces it to improvise yet again.

About the author

Krish Dharma has a four-decade track record driving innovation and change in the electronics industry, focusing on supply chain operations, information technology, eccosystem collaboration, and enterprise business transformation to drive profitable revenue growth. He has held several senior level management positions in supply chain and operations and has worked across a broad spectrum of electronics companies including semiconductors, contract manufacturers, and consumer electronics.

Please note, this article will also appear in the 25th edition of our quarterly publication.