To meet the challenge of limiting global warming to 1.5°C, the oil and gas sector must evolve from reactive observer to proactive participant in the energy transition.

The ambition to limit global warming to 1.5 °C is slipping out of reach. Even remaining below 2 °C will require annual global emissions to fall by another 15 – 20 Gt CO₂e by 2050. One option that deserves serious consideration is the integration of oil and gas assets with Pressurised Oxy-Fuel (POF) power generation to create economically viable, low-emission energy systems.

TriGen Energy proposes a two-step roadmap to decarbonise mature oil and gas assets while maintaining energy security and commercial returns.

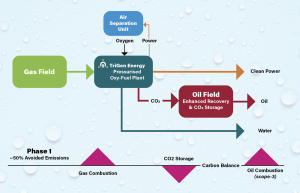

Phase 1: Profitable decarbonisation of mature assets (2025–2040)

TriGen’s near-term strategy focuses on using POF technology to build integrated carbon capture, utilisation and storage (CCUS) value chains. This involves redeveloping low-quality gas fields to fuel POF plants that produce clean, dispatchable power. The CO₂ emitted from these plants is used for enhanced oil recovery (EOR), with the residual gas permanently stored in depleted reservoirs.

This integrated approach delivers:

- Up to 50% carbon avoidance at the value chain level

- Up to 20% increased oil production and reserves

- Commercially attractive projects across diverse asset types and geographies

CO₂-EOR is an established method, particularly in the United States, where it accounts for roughly 180,000 barrels per day. CO₂ storage requires only modest modifications to field operations and presents minimal technical risk. The main barrier, the cost-effective capture of CO2, can be addressed with POF.

POF combusts hydrocarbons in pure oxygen, producing only steam and CO₂, which are easily separated without complex chemical processes. The system can process contaminated, low-quality gases while also generating marketable by-products such as nitrogen, high-purity water, and argon. Integrating these outputs with oilfield operations improves both project viability and efficiency.

The clean power generated is flexible and dispatchable – critical in grids with high shares of intermittent renewables – and typically commands premium pricing. Operators benefit from reduced scope 1 emissions and lower operating costs. Where clean power use is not prioritised, stored CO₂ can be monetised through carbon credits or the sale of “blue barrels”: oil whose lifecycle emissions have been pre-captured, contributing to scope 3 emission reductions.

TriGen has conducted more than 20 feasibility studies worldwide. Results indicate that typical projects, designed to avoid approximately 0.8 million tonnes of CO₂ annually and deliver 150 MW of clean power, are financially competitive, often outperforming renewables in terms of the cost per tonne of CO₂ avoided ($30-$60/tonne). Perhaps more importantly, these projects utilise existing infrastructure and organisational capabilities, laying the groundwork for further decarbonisation.

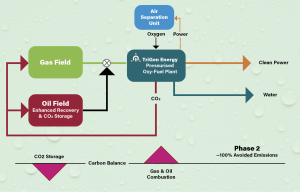

Phase 2: Full conversion to clean power (2040–2050)

The second phase envisions a shift from producing oil and gas for combustion to using hydrocarbons solely as feedstock for POF-based clean electricity generation. In this model, CO₂ is reinjected into the same reservoirs from which hydrocarbons were extracted, completing a closed-loop, circular system.

This dual-phase approach offers the oil and gas industry a realistic pathway toward long-term decarbonisation. It retains the sector’s core competencies while opening new opportunities for value creation aligned with net-zero goals.

If deployed at scale, this model could avoid up to 5 Gt of CO₂ per year by 2050, roughly one-quarter of projected mid-century global emissions. Realising this vision would require the construction of 4,000 to 5,000 integrated POF-CCUS facilities, supported by annual investments of approximately $250 billion. While ambitious, this investment is comparable in scale to the global aviation industry and is technically feasible.

Towards a new operation licence for oil and gas producers

Momentum behind CCUS is building. Regulatory trends such as mandatory scope 3 tracking and the emergence of ‘Carbon Take-Back Obligations’ reflect increasing expectations for oil and gas producers to address emissions across the full value chain. Public and investor acceptance of carbon management solutions is also growing.

TriGen’s model presents a practical, near-term strategy for reducing emissions while maintaining economic viability. It leverages existing assets, infrastructure, and expertise to help operators meet both environmental and shareholder expectations.

This is no longer a theoretical exercise. TriGen is currently working with several (national) oil companies to develop and implement first-generation POF projects. The required technology is proven. The business case is sound. The timing is urgent.

The challenge now is to reframe oil and gas as a platform for clean energy delivery, part of a wider system that balances environmental responsibility with energy security and affordability. Done right, this can secure the sector’s licence to operate in a decarbonising world.

For further information or to explore collaboration opportunities, please contact TriGen Energy.