John Wightman, Managing Director of The Goldfields Group of Companies, discusses a high-grade molybdenum discovery in New Brunswick and its strategic significance for industry and critical minerals.

Molybdenum is one of the world’s most versatile and strategically important industrial metals, yet it often flies under the radar compared to more familiar commodities like copper, gold, or lithium.

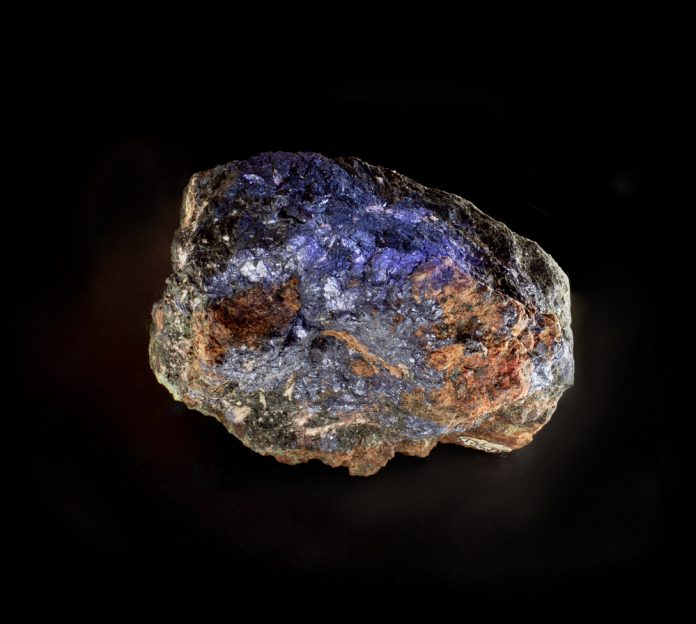

A silvery-grey metal with remarkable strength and resistance to heat and corrosion, molybdenum is primarily used to enhance steel, making it stronger, harder, and more durable. It is a critical component in construction, automotive, aerospace, and energy industries, where high-performance materials are essential.

Beyond steel, molybdenum plays a key role in modern technologies, including electronics, batteries, and catalysts used in chemical production. Its high melting point and stability under extreme conditions make it indispensable in demanding industrial processes. With global infrastructure, renewable energy, and defence sectors all increasingly dependent on high-performance materials, molybdenum has grown in strategic importance.

The demand for molybdenum has also been shaped by its classification as a critical mineral in several countries, including Canada, the United States, and members of the European Union. This designation reflects its economic and national security importance, as well as the need to secure reliable supply chains amid rising geopolitical and environmental pressures.

Despite its widespread industrial use, primary molybdenum deposits are relatively rare, particularly outside the western regions of North America. Discoveries in new locations can therefore represent significant economic and strategic opportunities. In this context, exploration projects targeting high-grade molybdenum deposits are closely watched by investors, industry experts, and governments alike.

This interview explores one such discovery, shedding light on its potential and the broader significance of molybdenum in today’s industrial and strategic landscape.

We’re here to talk about the Wildcat project, a high-grade molybdenum discovery in New Brunswick. Can you explain why this discovery is important?

This is a porphyry system, which is not common in Eastern North America. Porphyries are usually found in Western Canada and the US, as well as in the Yukon and Alaska. On the Eastern Seaboard, there are no other molybdenum discoveries as a primary mineral. There is another tungsten property nearby, about an hour’s drive away, that contains a minor amount of molybdenum, but it’s primarily a tungsten deposit.

This discovery is significant because it’s within an hour’s drive of the American border in Southwestern New Brunswick and within 9 km of a very large tungsten and tin deposit at Mount Pleasant. Most molybdenum deposits are associated with geological systems known as porphyries. Porphyries are normally found in active geological terrains, like the Rocky Mountains. Mineralising fluids from deep underground push up under great pressure, accessing faults and cracks in the rock – this is what we call an intrusion. Porphyry intrusions tend to be very large – hundreds of millions of tonnes when fully explored – though not necessarily high-grade. This area near Wildcat Brook is one of those porphyry intrusions.

Wildcat Brook is about 40 kilometres north of St. George, New Brunswick. The grade here is unusually high, averaging around 0.4% molybdenum. By comparison, most molybdenum mines worldwide are economic at 0.1% to 0.2%. Molybdenum is a strategic metal used to strengthen steel. Given the current focus on critical minerals by countries like the UK, the EU, the US, Canada, and Australia, Wildcat is a strategically important discovery, located close to the American market.

Typically, porphyry deposits contain a combination of copper and gold, or gold and molybdenum, or copper and molybdenum or tungsten and molybdenum. But the Wildcat deposit is primarily molybdenum. It’s formed in what we call a dyke, a narrow vein or zone about 20m thick, within the intrusion as it intrudes into the surrounding rock.

You can think of it like a tree: the main trunk is the central intrusion, and it branches out both vertically and horizontally. Many similar deposits in Western Canada are several hundred million tonnes, and the Wildcat deposit represents one of these branches with very high molybdenum content. We are keen to explore the main intrusion at depth, where larger volumes of minerals, including tungsten, may be present.

The importance lies not only in the high grade but also in the recovery potential. We sent samples to SGS Canada, a leading laboratory in this field, to test how much molybdenum could be recovered. Recoveries for molybdenum can vary from 60% to 80%, rarely above 90%. Our tests confirmed a 98% recovery, which is exceptional.

Is there evidence of other minerals associated with the deposit?

In the zones we’ve drilled, it’s primarily molybdenum. However, some deeper drilling intersected a zone of zinc and lead. At the surface, we’ve trench-sampled mineralised zones, finding samples as high as 22% zinc, which is exceptional.

Additionally, intruded into the porphyry felsic dyke is a later pulse of mineralisation: a sheeted quartz system carrying very high-grade tungsten, of up to 13% over half a metre in places. While this tungsten alone wouldn’t be economic, if we mine the dyke for molybdenum, it’s an added credit. More importantly, this indicates that deeper mineralisation from below is tungsten-rich.

Geophysical surveys suggest a larger porphyry intrusion exists beneath the molybdenum zone, potentially around 800 meters down. Further drilling will be needed to explore this trunk of the tree.

We are currently looking for a partner to develop this opportunity. It’s in the same area as the Mount Pleasant mine, a very large tin tungsten deposit, and we hope to find a similar type of porphyry intrusion at Wildcat Brook.

Does the location of the deposit face any environmental or human conflicts?

Canada has a large landmass, much of it away from cities, consisting of Crown land, which is government-owned. The Wildcat deposit is about 10 km from the nearest human habitation, with no rivers flowing through the mineralized zone. This increases the potential for ease of permitting.

The deposit was discovered by prospectors and geologists who noticed mineralisation along a forest access road. Over the years, we’ve followed up to define the surface expression of the porphyry. The area has good access via an all-weather gravel road, connecting to a major highway about 9 km west. We anticipate that environmental permitting should be straightforward.

How does molybdenum’s designation as a critical mineral by the Canadian Government impact development?

Developing a deposit from a prospector’s discovery requires significant investment, including drilling, sampling, and environmental studies. Canada has strict environmental regulations, but once a deposit reaches a certain level of knowledge, permitting may take two to three years.

This deposit’s proximity to skilled labour is a major advantage. Workers can commute daily, avoiding the costs of remote bush camps, which include housing, flying in materials, and infrastructure. This significantly reduces operational costs.

You mentioned seeking partners. What are the next steps toward production?

To date, a few individuals have funded the project with around $2m. Over the next three years, we’ll likely need $10–20m to reach the point of a bankable feasibility study, which is required to raise $200–300m for production. The staged spending would likely be: $2m in the first year, $4m in the second, $4m in the third, and about $20m in the fourth year.

The Canadian Government offers significant tax benefits to qualified investors of 80% for investment in the exploration and development expenditures for molybdenum deposits, such as Wildcat.

This funding covers diamond drilling, assaying, environmental studies, and third-party mining engineering work for the feasibility study. A production decision would likely take around four years, starting with a partner through a joint venture arrangement: we provide the property, they provide the funding.