The Innovation Platform spoke with World Nuclear Association (WNA) about its World Nuclear Outlook Report, delving into its key findings and the insights we can gain from them.

World Nuclear Association has published its first-ever World Nuclear Outlook Report, providing a comprehensive analysis of international nuclear energy goals and strategies. Many countries have committed to tripling the global nuclear energy capacity by 2050, as detailed in the Declaration to Triple Nuclear Energy, an ambitious plan that seeks to meet increasing energy demands while significantly reducing carbon emissions worldwide.

However, despite the high ambition from governments, there is an urgent necessity for cooperation among various stakeholders, including governments, industry leaders, investors, and civil society, to turn these goals into practical, actionable strategies.

The Innovation Platform Editor Maddie Hall spoke to WNA’s Jonathan Cobb to to delve into the report’s key findings and insights, and explore how, with the right strategies and frameworks in place, nuclear energy can significantly contribute to a cleaner, more secure, and sustainable energy future for all.

Can you provide an overview of the key facts and figures outlined in the report?

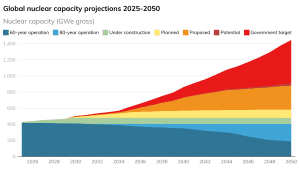

More than 30 countries have signed the Declaration to Triple Nuclear Energy, which establishes a goal to increase global nuclear capacity to around 1200 GWe by 2050.

The World Nuclear Outlook Report sets out to collate the national policies, goals, and targets individual governments have set for nuclear energy and assess whether they would be sufficient to meet the tripling goal.

The report findings are that the collective ambition of governments significantly exceeds that tripling target, with a combined total of 1446 GWe of nuclear generation capacity targeted by governments for 2050.

The report also assesses how governments could reach their 2050 nuclear energy targets, such as maximising the contribution of reactors already in operation and those currently under construction, and delivering on existing plans and proposals for new nuclear build. In total, this could deliver around 900 GWe of operable nuclear capacity by 2050. For each country, the report establishes any gap between these actions and the goals each country has set for nuclear energy capacity. Overall, it would then require around 300 GWe additional nuclear capacity to reach the global tripling goal and a further 250 GWe of nuclear capacity to meet the targets set by governments.

The report examines the developments and capabilities of the nuclear sector across various countries. Which nations are targeting the most growth? Are there significant discrepancies in the nuclear outlook between countries, and what factors contribute to these differences?

Five countries, China, France, India, Russia, and the United States, are collectively targeting nearly 1000 GWe of nuclear capacity by 2050. The US has the largest target, with 400 GWe, China 335 GWe, India 100 GWe, France 89 GWe, and Russia 56 GWe. However, there are significant differences in how those targets may be achieved, with China and the US representing two distinct cases.

The US has the largest fleet of nuclear reactors in operation, with a total capacity of around 100 GWe. Many of these reactors were built in the 1970s and 1980s, so to maximise the contribution of these reactors in 2050 would require extending their operations. The U.S. Nuclear Regulatory Commission (NRC) is reviewing and approving applications to extend operating licenses from 60 to 80 years. Nearly 50 reactors (about half) are in the pipeline to extend operations to 80 years to meet clean energy goals and electricity demand.

There has been little new construction in recent years, and defined plans for new reactors are limited. So, to achieve its capacity goal will require a very significant programme of new nuclear build to be established, which will include establishing the supply chain required to deliver this.

China’s centralised planning, strong state support, and established supply chains are enabling its nuclear energy expansion. China has 58 GWe of operable reactors and 41 GWe under construction. This commitment to continued new construction, based around repeated series build of reactors, is resulting in faster and more predictable construction, with construction times of 5-6 years for each reactor regularly achieved.

China also has a clearer roadmap for future nuclear construction, with existing reactors, reactors under construction, and planned and proposed reactors meeting almost the entirety of its 335 GWe target.

What factors are taken into account to assess and predict the future demand for nuclear power in different regions?

While the report does not model future electricity demand directly, it assesses government targets and examines the underlying drivers that will influence nuclear demand, including population growth, electrification of transport, heating, and industry, decarbonisation targets, and rising electricity demand from new technologies such as data centres and digital infrastructure.

What trends does the report identify in the development of new nuclear technologies?

The report identifies a trend toward greater technological diversity. While large pressurised water reactors (PWRs) remain dominant, there is growing development of small modular reactors (SMRs), microreactors, and advanced reactor designs using gas, molten salt, or liquid metal coolants. These technologies are intended to support non-electric applications, including district heating, industrial process heat, hydrogen production, desalination, and energy storage, as well as more flexible deployment models.

How do geopolitical factors affect the projections made in the report? Is there a strategy for planning around these factors?

The report highlights nuclear energy’s resilience to fuel supply shocks due to high energy density and diversified uranium supply chains. While it does not outline a formal geopolitical risk-planning framework, it emphasises diversification of supply chains, lifetime extensions, and domestic capacity development as practical strategies to manage geopolitical uncertainty.

Did you encounter any challenges or unexpected findings while researching and assembling the report?

Individual governments have different time horizons for their energy policy strategies. Not all have defined objectives for specific forms of electricity generation for 2050, including nuclear. As a result, the report doesn’t include some countries that are currently evaluating nuclear energy, but have yet to set a target.

Similarly, countries already making use of nuclear energy may have stated some plans for future capacity, but not necessarily as far ahead as 2050. Because of this, the 1446 GWe capacity figure is probably an underestimation of the intentions governments have for nuclear capacity in 2050.

What initiatives or policies does the report find to be most important for supporting the expansion of nuclear energy?

For governments, the report recommends that they integrate nuclear energy into long-term decarbonisation and energy security planning, alongside renewables and other low-carbon technologies. They should set durable, actionable nuclear policies and industrial strategies to enable long-term investment and to maintain industrial capabilities, workforce, and supply chains. They should also support operating lifetime extension programmes to 60-80 years where technically feasible, avoiding premature closures. In many countries, there is a need to reform electricity markets to ensure equitable treatment of nuclear energy alongside other low-carbon sources and to support the acceleration of licensing, siting, and financing mechanisms to facilitate an increase in construction rates.

For financial institutions, the report recommends that they implement technology-neutral lending and ESG policies to ensure nuclear and other low-carbon sources are evaluated using equivalent criteria. They should also support nuclear deployment in emerging economies through financing frameworks, guarantees, and multilateral partnerships.

The report also recommends actions for the nuclear industry itself, emphasising the need to expand manufacturing and supply chain capacity, including fuel cycle infrastructure, and optimise series build to reduce costs and shorten build times. The nuclear industry also needs to be ready to meet the goals that governments have set by developing large-scale deployment strategies to meet post-2035 demand, including for non-grid applications utilising novel reactor technologies.

What are the next steps and future areas of research for the nuclear industry identified in the report?

Future focus areas identified include scaling construction rates, extending reactor operating lifetimes to 60–80 years, deploying advanced and small reactor technologies, and expanding non-electric applications of nuclear energy. The report also points to the need for further analysis of fuel cycle services, supply chain capacity, and financing mechanisms, particularly for post-2035 deployment.

To conclude, can you summarise WNA’s recommendations for the sector as a whole?

World Nuclear Association recommends that governments recognise nuclear energy as a central pillar of decarbonisation and energy security, integrate it into long-term planning, and establish durable, actionable policies. Key recommendations include supporting lifetime extensions, reforming electricity markets to ensure fair treatment of nuclear, accelerating licensing and financing, and expanding industrial and supply chain capacity. If these measures are implemented, the report concludes that nuclear power can play a critical role in delivering secure, affordable, and net-zero-compatible energy by 2050.

Please note, this article will also appear in the 25th edition of our quarterly publication.