Amidst escalating regulatory demands, customer pressures, and evolving environmental standards, there is an urgent need for manufacturers to improve their visibility and understanding of the dangerous PFAS chemicals in products.

PFAS has moved from a niche chemical issue to a strategic test of how the global manufacturing system manages risk, redesigns products, and protects public health.

Across automotive, aerospace, batteries and gigafactories, food and beverage, life sciences, pharmaceuticals, electronics, industrial equipment, energy systems, apparel, and chemicals, PFAS has been woven into coatings, membranes, surfactants, lubricants, and critical performance materials for decades.

At the same time, regulators and courts in North America, Europe, and Asia-Pacific are rapidly tightening expectations. TSCA PFAS reporting in the US, CERCLA hazardous substance designations, state-level product bans, the emerging EU REACH ‘universal restriction,’ and stricter water and waste standards all share a common assumption:

Manufacturers should know where PFAS chemicals are in their products and supply chains – and be able to prove it.

For most companies, that assumption is still far from reality. The core problem is not a lack of effort. It is a lack of visibility.

Why PFAS is now a boardroom and policy priority

PFAS is unusual because multiple forces are converging at once:

- Regulatory escalation. New and proposed requirements span TSCA reporting, CERCLA liability, state product bans, and ‘currently unavoidable use’ regimes, EU REACH restrictions, and sector-specific rules. Each regime defines PFAS slightly differently and moves on its own timeline.

- Litigation and liability. Companies across sectors are being drawn into remediation, cost recovery, and product liability actions. Legal arguments increasingly hinge on what companies ‘knew or should have known’ about PFAS use and releases.

- Customer and value-chain pressure. OEMs and global brands are asking suppliers to certify PFAS-free or PFAS-managed products and are beginning to factor PFAS into sourcing decisions and long-term partnerships.

- ESG and capital markets. PFAS exposure is showing up in ESG assessments, lender due diligence, and investor questions. Companies that cannot quantify or explain their PFAS footprint are seen as higher risk.

For boards, PFAS chemicals are no longer just an EHS or regulatory topic. It touches strategy, capital allocation, product roadmaps, and reputation.

The visibility gap in complex manufacturing supply chains

The central issue is PFAS visibility. Most manufacturers, even highly sophisticated ones, are working with partial, inconsistent, or outdated information. Five structural challenges appear across almost every sector:

- PFAS is buried in product complexity

Modern products can contain thousands of parts and materials sourced from multi-tier global supply chains. PFAS may be present in a surface treatment, a polymer additive, a membrane, or a speciality lubricant that sits several tiers away from the OEM. - Documentation is incomplete by design

Safety Data Sheets and specifications often omit PFAS used at low concentrations, as impurities, or where suppliers assert trade secrets. Those omissions can be legally compliant yet leave downstream manufacturers blind. - Data is fragmented and unstructured

Relevant information sits in ERP and PLM systems, purchasing records, supplier portals, SDS libraries, email attachments, and lab reports. Formats may also vary by supplier, country, and year. - Definitions and lists keep evolving PFAS may be defined structurally, by lists, or by function, and the scope changes as science and policy advance. A chemical that is ‘out of scope’ one year can become ‘in scope’ the next.

- Processes are manual and one-off

Supplier questionnaires, spreadsheet inventories, and ad hoc SDS checks are manageable for dozens or hundreds of materials – not tens of thousands – and they quickly become obsolete as portfolios and regulations change.

The result is a PFAS blind spot: companies are asked to sign PFAS declarations, file regulatory reports, and make ‘PFAS-free’ claims based on a data foundation that everyone recognises as incomplete.

Why the traditional toolkit can’t carry you through 2026

Most organisations are using some combination of four tools: supplier surveys, SDS reviews, selective lab testing, and static inventories. Each has a role, but none can carry the full weight of 2026 PFAS expectations:

- Supplier surveys depend on upstream knowledge and goodwill, and often produce inconsistent answers.

- SDS reviews are slow and limited by what is declared.

- Lab testing is powerful, but it is too expensive and narrow to map PFAS chemicals across entire product portfolios.

- Static inventories and one-off PFAS ‘projects’ age quickly as products, suppliers, and regulations evolve.

As regulations expanded into annual reporting, PFAS restrictions and bans, PFAS cannot be managed as a one-time reporting exercise. It must be treated as an ongoing data and decision problem.

It requires a different kind of infrastructure – one that can continuously transform scattered, messy information into a living, defensible PFAS inventory.

What PFAS AI (A specialised AI-first platform) really does

‘AI’ is a broad label. For PFAS, the critical question is not whether AI is used, but whether it is specialised for PFAS chemistry, product, regulation, and supply-chain data.

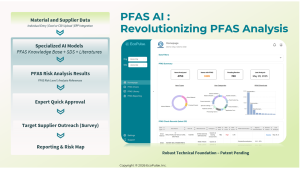

EcoPulse represents the PFAS AI platform (patent pending), the next generation of PFAS detection and supply chain intelligence. Designed specifically for PFAS analysis, it uses specialised large language models, a curated knowledge base, and workflow automation to deliver fast, reliable insight.

1. Unmatched depth of analysis

PFAS AI goes far beyond simple yes/no answers. It delivers:

- Chemistry-level insights

- Regulatory-aligned classifications

- Evidence-backed determinations

- Quantitative estimates where possible

This level of detail creates confidence internally, with regulators, and with customers.

2. Scale and efficiency

PFAS AI can analyse thousands of materials in a timely manner, enabling companies to build near-complete PFAS inventories quickly. This eliminates the bottlenecks of manual review and reduces reliance on slow supplier questionnaires. The recent enterprise pilot and deployment validated the obvious comparison:

- Manual review (for equivalent level of results):

1 hour / ten materials - PFAS AI review: 30 secs / ten materials

Assuming $100 / hour is the cost of labour, the savings for analysing 10,000 materials is ~ $100,000, which is a very compelling amount, especially for a company with hundreds of thousands of materials to review.

3. Audit-ready documentation

Every result comes with traceable logic, references, and structured evidence, creating documentation suitable for:

• TSCA (U.S. EPA) and similar reporting in other

countries

• State-by-state PFAS submissions

• Customer inquiries

• Internal audits

• Litigation defense

4. Integrated workflow for compliance teams

PFAS AI doesn’t replace your experts; it accelerates their work. With built-in review and QA workflows, teams can confidently validate analyses, track decisions, and maintain a complete history for future audits.

5. A pathway to broader compliance

While PFAS is urgent today, PFAS AI’s approach can extend to additional substance regimes. Companies adopting an AI knowledge-base model now are building the infrastructure for continuous compliance in the future.

Five questions company executives should ask about PFAS data

- Do we really know where PFAS is in our products and supply chain – or are we relying on assumptions?

As a company executive, you should insist on seeing a product- and material-level view of PFAS exposure, plus a clear explanation of how that view was constructed. If the answer is ‘we think’ rather than ‘here is our documented inventory,’ there is work to do.

- Can we defend our PFAS disclosures and decisions to a regulator, a customer, or a court?

Regulators, investors, and litigators will increasingly ask not only what your PFAS position is, but how you arrived at it. You should be able to see, for a sample of products, the underlying documents, logic, and expert sign-offs that support PFAS determinations.

- How quickly can we update our PFAS view when regulations, suppliers, or product designs change?

PFAS regimes are evolving. New lists, thresholds, and bans will continue to emerge. How long would it take today to refresh the PFAS view of your portfolio after a major change – for example, a new EU restriction, a key supplier exit, or a platform redesign? If the answer is measured in quarters or years, the risk would be high. A modern PFAS data approach should be able to re-run analyses in days or weeks, not rebuild them from scratch.

- Where does PFAS risk intersect with our growth strategy and capital allocation?

PFAS is not only a compliance cost; it is a strategic variable. It can affect the viability of future product lines, the economics of certain sites, and the attractiveness of acquisitions. Ask for a PFAS risk overlay on your strategy:

- Which growth products are most PFAS-exposed?

- Which sites face the highest regulatory or remediation risk?

- Where might PFAS constraints create competitive disadvantage – or advantage?

- Are we using technology that is purpose-built for PFAS – or trying to solve a 2026 problem with 1990s tools?

Spreadsheets, email surveys, and static inventories can no longer keep up with regulatory expectations or portfolio complexity. Your teams will benefit largely by using PFAS-specialised AI and data infrastructure that can:

- Ingest and harmonise PFAS-relevant data at scale

- Interpret PFAS chemistry and regulation, not just keywords

- Produce transparent, audit-ready inventories

What ‘good’ looks like in 2026

In 2026, the PFAS conversation will be less about awareness and more about performance.

Both sides need the same foundation: a shared, defensible understanding of PFAS chemicals in real products and real supply chains.

PFAS AI by EcoPulse is not a substitute for policy, science, or leadership. But it is a practical and efficient way to close the PFAS blind spot – turning scattered documents into decision-grade insight, and helping industry, regulators, and investors move from crisis response to long-term, evidence-based PFAS strategies.

Book a Demo to review PFAS AI and try it out using your own material/parts. You can also email contact@ecopulsenow.com for any question or feedback. EcoPulse website