Dr Harry J. Barraza, Co-founder and COO of PFxBiotech, discusses how Europe’s strategies are scaling precision fermentation to deliver sustainable, human-relevant proteins like lactoferrin, transforming food, health, and bioeconomy systems.

Europe’s food and health systems are entering a decisive decade. Precision fermentation (PF) and engineered biology are rapidly moving from promising lab concepts to scalable, market-ready solutions that deliver functional nutrition, resilience, and sustainability.

This article explores how Europe’s new Bioeconomy Strategy (COM(2025) 960) and the Life Sciences Strategy (COM(2025) 525) are reshaping regulatory pathways, unlocking finance, and building lead markets – and why these shifts matter for companies scaling human-identical, health-promoting proteins such as lactoferrin.

By weaving systems thinking with policy action, Europe can convert scientific excellence into competitive industry, future-proof jobs, and better nutrition for all.1,2

A systems moment for European nutrition: Fermented proteins in the global food system and why they matter

Fermented proteins are moving from niche to necessity. They enable high-precision ingredients with consistent quality, strengthen supply resilience, and decouple nutrition from land- and animal-intensive inputs – helping food systems meet health and sustainability goals.

Precision fermentation is the engine of this shift: it produces specific proteins, enzymes, and bioactives with high purity and traceability, supporting sensitive applications in food and health.

Momentum is accelerating: market analyses cited in the November draft project PF to scale rapidly this decade, while lifecycle assessments show substantial resource savings –

74–99% less water, 77–91% less land, and up to 87% lower greenhouse-gas emissions versus conventional livestock systems.

Lactoferrin – market snapshot and use cases

Lactoferrin (LF) is an iron-binding glycoprotein central to immune modulation, antimicrobial defence, and iron homeostasis.

Human lactoferrin (hLF) shows higher compatibility with human receptors than bovine LF, which underpins interest in PF-derived hLF for health-sensitive nutrition.

- Market size & growth: The fermented protein market is projected to reach $2.49bn by 2035, growing at a CAGR of 7.3%, while the lactoferrin market is expected to expand from $724.6m in 2025 to $985.7m by 2030 at a CAGR of 6.4% (Mordor Intelligence).

- Regional note: Asia–Pacific leads by revenue (≈30.7% share, 2024); infant formula dominates applications; iron absorption is the largest function segment.

- Why demand is rising: Immunity and gut-health positioning across infant, clinical, and healthy-ageing nutrition; clean, reliable supply; and batch-to-batch consistency.

- Human vs. bovine: Structural and glycosylation differences matter – hLF exhibits stronger receptor affinity and cytokine signalling, supporting human-relevant bioactivity.

- Applications: Infant formulas (adjunct to HMOs), medical & elderly nutrition, and functional foods targeting microbiome and iron metabolism.

How precision fermentation can disrupt future nutrition

- Designed bioactivity: Move beyond protein quantity to targeted functions (immunity, iron metabolism, microbiome support).

- Assured quality: Pharmaceutical-like control over purity, safety, and traceability for health-linked products.

- Sustainability at scale: Materially lower land, water, and emissions footprints versus conventional animal systems; compatibility with renewable feedstocks.

- Decentralised, resilient supply: Regional biomanufacturing hubs improve food security and shorten supply chains.

- Digital & AI-enabled scale-up: Strain engineering, process digital twins, and data-driven QC accelerate development and reduce costs.

- Path to personalisation: Precise molecules and combinations tuned for population segments and life stages.

Across Europe, climate pressures, resource constraints, and rising diet-related disease have exposed the limits of linear, incremental approaches to food innovation. A systems perspective – one that connects nutrition outcomes, environmental performance, supply resilience, consumer trust, and regulatory agility – is now essential.

Alternative proteins, once framed primarily as substitutes for animal-derived ingredients, have matured into a design paradigm for functional foods, enabling targeted bioactivity, consistent quality, and transparent supply chains. At the centre of this paradigm sits precision fermentation, which programmes microorganisms to produce highly specific proteins and bioactives with the purity and consistency required for health-sensitive applications.3

The stakes are economic as well as social. Europe’s bioeconomy was worth up to €2.7 trillion in 2023 and supported 17.1 million jobs directly across biomass-producing and converting activities, with broader bioeconomy-relevant sectors contributing between 11–16% of EU GDP. Life sciences more broadly generated €1.5 trillion in value added and employed around 29 million people in 2022 – underscoring that biology-enabled industries are not niche, but a strategic pillar of competitiveness. 1,2

From substitutes to bioactive functionality: Precision fermentation’s edge

Precision fermentation goes beyond protein mass to deliver specific, human-relevant bioactivities. Human lactoferrin (hLF), an iron-binding glycoprotein abundant in human milk and mucosal secretions, offers immune modulation, antimicrobial defence, and iron homeostasis benefits.

While bovine lactoferrin is widely used, structural and glycosylation differences make hLF more compatible with human receptors and cytokine signalling, potentially translating to stronger health outcomes across infant, clinical, and senior nutrition. Environmental performance is also compelling: fermentation-based manufacturing can cut land, water, and emissions footprints compared to conventional livestock systems, while improving traceability and batch-to-batch consistency.

Crucially, precision fermentation fits the EU’s broader industrial strategy. The Bioeconomy Strategy identifies advanced fermentation as a lead technology enabling high-value compounds from renewable feedstocks, while the Life Sciences Strategy positions biotechnologies and AI-driven biodesign as engines for industrial renewal and health innovation.1,2

Case study: PFx Biotech’s scale-up of human-identical lactoferrin

PFx Biotech, founded in 2022 and incubated at UPTEC (University of Porto), demonstrates how open innovation and systems design can bring human-identical milk proteins to market without animal farming. Motivated by a real clinical need – cow’s milk protein allergy – PFx engineered production strains, optimised upstream fermentation, and deployed downstream purification to produce hLF at pilot scale. Early runs at 150 L have now matured into a scale-up plan spanning 1,500 L to 75,000 L fermenters, supported by a Lisbon applications lab for regulatory dossiers and product development.

This trajectory exemplifies the ‘two valleys of death’ that European innovators face: proving technical-economic viability post-demonstration, then securing growth capital and offtake to achieve industrial production. EU instruments announced for 2026–2030 are designed to bridge exactly these gaps – through coordinated standards, regulatory sandboxes, blended finance, and demand-creation mechanisms.1,2

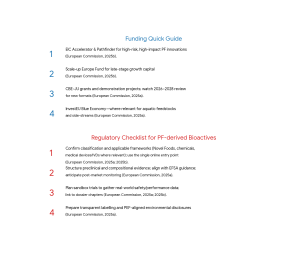

Regulatory innovation and challenges ahead: The decisive shift

Under EU Regulation 2015/2283, PF-derived proteins require Novel Foods approval. Timelines can exceed three years, especially for first-in-class molecules that sit between categories. Europe’s 2025 policy frameworks directly address these frictions. The Biotech Acts will introduce sectoral and horizontal enablers, notably regulatory sandboxes and fast-track authorisations for microbial solutions used in industrial bioeconomy processes, alongside streamlined permitting for biomanufacturing projects.

In parallel, a European Bioeconomy Regulators & Innovators’ Forum will coordinate risk-assessment practices across EFSA, ECHA, and EMA—facilitating early dialogue and consistent classification, while a single online entry point and clearer guidance on novel bio-based product categories reduce duplication and uncertainty.1

The Life Sciences Strategy complements these measures with an EU Biotech Act, regulatory sandboxes in health domains, and an AI-powered interactive tool that helps researchers and companies navigate cross-sector regulations from the design stage – embedding compliance early and cutting rework. Together, these instruments create a more predictable path from lab to market, precisely where PFx’s hLF case needs acceleration.2

From a systems lens, regulatory agility should be matched by public trust. The strategies call for transparent standards and metrology across bioeconomy products, making performance comparable across materials, from bio-based polymers to construction products, and improving single-market circulation. This, combined with One Health and evidence frameworks, helps ensure bioactives enter markets with robust safety and efficacy narratives.1,2

Finance and funding: Bridging Europe’s two valleys of death

Biotechnology and industrial biomanufacturing are capital-intensive. Beyond lab success, scale-up requires demonstration assets, quality systems, large fermenters, and downstream processing – plus validation batches for regulatory dossiers and customer qualification. The Bioeconomy Strategy proposes blended finance instruments that link EU and national tools, creating a pipeline of bankable projects and crowding in private capital at first-of-a-kind stages.1

Specifically, the next Multiannual Financial Framework (2028–2034) will mobilise the European Competitiveness Fund and Horizon Europe policy windows in health, biotech, agriculture, and bioeconomy to de-risk industrial deployment. Nearer term, the Scale-up Europe Fund and EIC instruments, coordinated with the EIB Group and national promotional banks, aim to close late-stage venture gaps. The Commission will also review the CBE-JU partnership format (2026–2028) and convene a Bioeconomy Investment Deployment Group to align research, demonstration, and scale-up financing—prioritising advanced fermentation facilities and biorefineries.1

Demand certainty is another lever. The strategies activate public procurement for life-science innovations (~€300m via Horizon Europe/EU4Health) and create a Life Sciences Investors & Corporates Interface to match startups with offtakers. By pairing procurement pull with voluntary alliances, like the Bio-based Europe Alliance, which seeks €10bn in collective purchases by 2030, Europe can transform promising PF pipelines into reliable supply chains.1,2

Lead markets and smarter biomass use: Building predictable demand

Identifying and strengthening lead markets unlocks scale advantages where bio-based solutions are near deployment or already mature. The Bioeconomy Strategy highlights bio-based plastics and polymers, textiles from bio-based fibres (including artificial cellulosic fibres), construction materials (wood, hemp, mycelium, composites), and biofertilisers/biopesticides, with pathways being streamlined.1 For PF companies, these adjacent markets matter: enzymatic aids, scaffolds, biopolymers, and functional additives often share unit operations, standards, and customer networks, which can diversify revenue and reduce risk.

Efficient biomass use prioritises food and nutrition security while directing feedstocks to higher-value products that store carbon longer and substitute fossil inputs, with residuals used for energy where alternatives are limited. The Commission will improve transparency of biomass flows, support cascaded use through the Knowledge Centre for Bioeconomy, and advance lifecycle assessment methods, including biogenic carbon accounting and microplastics indicators under the Product Environmental Footprint review. Industrial symbiosis valleys and regional hubs will coordinate feedstocks, infrastructure, and investment – stabilising inputs for fermentation and lowering costs through shared utilities and co-product valorisation.1

Data, AI, and One Health: Faster design, stronger evidence

Breakthroughs in engineered biology increasingly depend on access to high-quality datasets and the ability to model complex biological systems. The Life Sciences Strategy introduces AI Factories, AI Gigafactories, and an Apply AI plan to accelerate uneven AI uptake, with dedicated ecosystems for drug discovery and genomics, while the European Health Data Space (EHDS) creates structured access to electronic health data for research and innovation.2

Beyond human health, One Health approaches integrate environmental and animal domains – opening opportunities in microbiomes, biosecurity, and sustainable agriculture. By promoting targeted R&I agendas (e.g., health & climate) and supporting biodata infrastructures, Europe aims to strengthen translational pipelines and evidence frameworks that underpin responsible claims for bioactive nutrition. 2For PFx’s hLF case, model-based dossier design and evidence synthesis can shorten cycles, improve consistency, and enhance trust.

Why engineered biology is central to the EU bioeconomy

Engineered biology offers Europe a route to strategic autonomy in materials, chemicals, and health-related ingredients while meeting climate and biodiversity goals. By synthesising high-value compounds from renewable feedstocks with lower process emissions and resource use, advanced fermentation pathways can decouple growth from fossil inputs, reduce import dependency, and improve resilience to global shocks. This is not only about new molecules; it is about building integrated biomanufacturing capacity, skilled jobs, and regional ecosystems that valorise by-products and drive circularity.1,2

Europe’s strengths – world-class science, single market scale, and a track record in standards and safety – align with the governance tools now being deployed. With consistent regulation, harmonised standards, and demand-side instruments, engineered biology can become a mainstream productivity engine across value chains from food to construction, with spillovers into healthcare and advanced materials.1,2

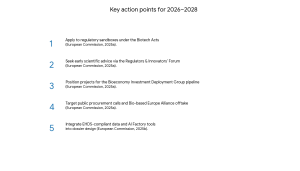

Actionable playbook: How PF companies can navigate Europe’s new landscape

- Design for compliance early: Use the forthcoming AI-powered regulatory navigation tool to map the correct legal frameworks (Novel Foods, chemicals, medical devices/IVDs, where relevant) and shape dossier structure from day zero. Engage EFSA/ECHA/EMA via the Regulators & Innovators’ Forum for early scientific advice.

- Leverage sandboxes and test environments: Apply to regulatory sandboxes under the Biotech Acts to pilot PF-derived ingredients and manufacturing controls in real-world settings, collecting targeted safety and performance data to support authorisation and market claims.

- Align with lead markets and procurement: Identify adjacent lead markets (bio-based polymers, construction, fibres) for co-products or platform molecules, and respond to public procurement calls that prioritise low-carbon, circular materials – building offtake certainty and customer references.

- Assemble blended finance: Combine EIC instruments, the Scale-up Europe Fund, national promotional bank loans, and equity with grants from CBE-JU or regional programmes. Position projects for the Bioeconomy Investment Deployment Group pipeline to access de-risking and crowd-in private capital.

- Build symbiosis: Join or form Industrial Symbiosis Valleys to secure consistent feedstocks (including secondary biomass), shared utilities, and downstream valorisation of side-streams; integrate lifecycle and biogenic carbon accounting into reporting to increase procurement competitiveness.

- Strengthen evidence and trust: Use EHDS-compliant data, model-based analyses, and One Health perspectives to articulate benefits and safety, especially for bioactive ingredients targeting immunity, iron, or microbiome outcomes. Plan for transparent labelling and consumer communication aligned with PEF method updates.

Future outlook (2026–2030): Milestones, metrics, and risks

- Milestones 2026–2028: Establishment of the Regulators & Innovators’ Forum; activation of the Bioeconomy Investment Deployment Group; revision and potential refit of CBE-JU; standardisation requests under the Construction Products Regulation; launch of the Competitiveness Coordination Tool and Bio-based Europe Alliance; expanded access to demonstration infrastructure for fermentation SMEs. 2026–2027: public procurement calls for life-science innovation; ATMP Centres of Excellence network; AI Factories ecosystems; EHDS operationalisation; strategic biodata support.1,2

- Metrics: Track (i) time-to-authorisation for PF-derived ingredients; (ii) share of projects entering sandboxes; (iii) volumes under offtake agreements; (iv) leverage ratios on blended finance; (v) carbon/water/land intensity per kg product; (vi) consumer trust indicators and claim substantiation quality.

- Risks & mitigations: Biomass competition, permitting delays, and standards fragmentation can slow deployment. Mitigate via cascading use strategies, early permitting engagement, and participation in standard-setting pilots. Data access and ethics must be managed under EHDS and the AI Act – use the Life Sciences Data Assembly and best-practice repositories to harmonise approaches.2

“The future of protein is fermented—precisely.” — PFx Biotech, Head of R&D

References

- European Commission. (2025a). A Strategic Framework for a Competitive and Sustainable EU Bioeconomy. COM(2025) 960 final.

- European Commission. (2025b). Choose Europe for life sciences: A strategy to position the EU as the world’s most attractive place for life sciences by 2030. COM(2025) 525 final.

- PFx Biotech Article. (2025). PFX Biotech Advances…’. Innovation News Newtwork, December 2025