Tim Rynott, CEO of Four Corners Helium LLC, discusses the journey of interest and investment in US helium, from a surge to a waiting game.

For some US helium investors, their confidence has cooled. Will that shift – or persist? For too many investors, the business has gone from mouthwatering to eyebrow‑raising. An expensive learning curve, with one common thread: waiting.

- Waiting for a permit.

- Waiting for a rig.

- Waiting for a test.

- Waiting for revenue!

Early investors who rode stock multipliers on AIM, TSX, and ASX exchanges are seeking encouraging news – anchored in transparency. Instead, the US helium industry has begun to resemble deepwater oil and gas, where Return on Investment (ROI) rules the day while robust Rate of Return (ROR) remains elusive.

The early buzz

- Four major shortages in just 19 years.

- Average helium price quintupled in under a decade.

- U.S. Federal Helium Reserve, supplier of ~30% of the domestic supply, is now ~90% depleted.

- Semiconductor growth forecasts, boosted by the Inflation Reduction Act, could see 6-10% demand growth per year.

The fundamentals remain: helium is irreplaceable in critical technologies, environmentally friendly, and yes – will infatuate toddlers for years to come.

ROR realities

As an example, private capital-centric North American Helium sacrificed early earnings by initially frontloading capital into its midstream. Call this a ‘trust’ arrangement between capital providers and management. Eleven years later, NAH produces ~170 million cubic feet/year – nearly 5% of North America’s supply. But this model is special and unique. Public traders rarely share such patience.

For most explorers:

- Midstream isn’t fast or cheap.

- Pipeline proximity to helium plants is ideal, but rare.

- Mobile facilities mean thin margins if leased, and a direct purchase clobbers the ROR.

- Shallow reservoirs (800-1200 ft) struggle with low pressures → low rates.

- Subsalt high‑pressure plays yield higher flow (50–250 MCFD), but drilling and completion CAPEX can run $6m–$15m/well.

- Enticing high‑nitrogen plays in Montana/Saskatchewan/Alberta are more affordable to process, but type curves suggest relatively steep declines after the first two years of production.

ROI: Seal the deal

All consequential helium accumulations fundamentally occur when the rate of expulsion from source exceeds the rate of seal leakage, since helium can diffuse through virtually all subsurface materials over geologic time – even unfractured granite.

It has been determined worldwide that low-permeability evaporitic formations (salt, anhydrite, and gypsum) create the best seals, not only for oil and gas, but also for helium. It has also been numerically established that breached seals remain the top exploration risk for oil, gas, and helium. Breached, or ‘blown seals’, often relating to tectonics, micro‑fracturing, or offset faulting, can also be difficult to de-risk with available exploration tools. Considering it can take hundreds of millions of years to fill a helium reservoir (radioactive decay is drip, drip, drip), one episodic event can wreck the economic party. i.e. – wreck the ROI.

Going forward, test tools/practices to assist in de‑risking blown seals are:

- Pore pressure plots

- Palinspastic mapping

- Borehole image logs

- Isochrons and isopachs

Secondary exploration risks – source, rock mechanics (porosity/permeability), migration effectiveness, and trap/timing – are relatively quantifiable with a proximal analog and sufficient seismic.

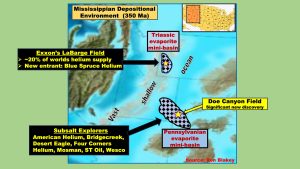

A prime modern analog, Doe Canyon Field in SW Colorado, is situated on the eastern flank of a massive ancient shallow ocean (Fig. 1). Doe’s Mississippian porous dolomites – draped by a 12,500 square mile Pennsylvanian evaporitic canopy – has produced almost 3 billion cubic feet of helium since 2016, with another 4–6 billion cubic feet possible. With flow rates exceeding 20 million cubic per day at .4–.5% helium (reaching almost 3% near 4Corners), and laterally extensive shallow uranium/thorium enriched basement rocks, the 4Corners area has become opportune for favorable ROIs.

Maximising ROR

Four Corners Helium, LLC anticipates utilising pore pressure plots and high-resolution isochrons at the pinch-outs of large evaporite bodies. The ultimate objective is to test reservoirs with an evaporite seal thick enough to trap minuscule helium element (not to be confused with molecules), while thin enough to avoid 7-inch intermediate casing – a prerequisite for wellbore stability drilling through thick evaporites. Requiring a 7-inch intermediate casing at today’s steel prices almost doubles the drill/completion capex for subsalt locations, hammering the rate of returns.

Secondly, stacked plays matter too: seismic inversion can de‑risk shallower oil zones above helium deposits. Oil cash flow offsets helium’s notoriously slow hook‑ups.

Supply/demand meets ROI

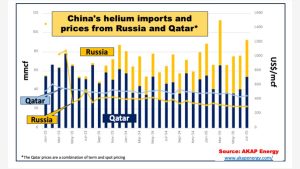

Present helium veterans – often oil and gas refugees who’ve survived (or not) through cyclical over-supply scenarios – know how commodity price fluctuations can brutalise the ROR/ROI. Case in point: Russia’s infiltration of China’s market share in Sept 2023, cut Qatar’s China foothold by over 40% and dropped Qatar’s spot prices ~20% within 19 months (Fig.2). United States red flags are being hoisted!

Gazprom’s Amur Trains 1, 2, and 4 are online, with 3, 5, and 6 potentially coming online later this year. Once fully ramped up, Amur could potentially supply 3-3.5X more than required for non‑sanctioned Asian/Middle East markets (including China, India, UAE, Saudi Arabia, Vietnam, Malaysia).

If Gazprom can accommodate these countries, increase domestic allocations, and build strategic inventories for either intra-cushions or future pricing optimisation – and still have remaining capacity, what’s next for this helium bounty?

First, the sanctions could eventually be lifted, expanding market options.

Second, and paraphrasing Phil Kornbluth Kornbluth and Associates: “…the Russian helium sanctions are dividing a previously global helium business into two entities: those companies who can buy discounted Russian helium, and those companies who are prohibited from buying discounted Russian helium.” With that in mind, how does this relate to the other high-consuming, legally approachable countries?

- Japan and South Korea represent a hefty ~36% of Asia’s demand but ride a slippery slope. Neither of these countries has specific sanctions forbidding Russian helium, although they are firmly aligned with the G7/US-EU camp. In other words, South Korea needs to express loyalty to allies while quietly keeping industrial lifelines open where sanctions don’t bite.

- A sanction-free United States, the largest helium consumer on the globe, undoubtedly would be in Russia’s crosshairs. Although there are obstacles:

- Costly shipping.

- Civil unrest from many plebeians.

- The primary US distributors (Air Products, Linde, Messer, Matheson, etc.) may hesitate due to reputational risk.

- Complex Tariffs. In this case, Column 2 exclusions mean Russian helium ’could’ face high tariffs – effectively pricing it out of US competition.

- The US is barred from using Gardner Russian filled helium containers. US-based Gardner supplies the vast majority of global 11K gallon ISO’s, but Chinese firms are moving fast to fill Gazprom’s needs.

- Competitive RORs/ROI’s – an area where American explorers can control their own destiny. i.e., Can capitalism-driven scientific ingenuity, sweat, and determination move the US field-level economics beyond what Gazprom can undercut?

Geology rules

Mother Nature rules the day, again. Of 195 countries on the planet, the geological conditions for economic helium have occurred primarily in only five countries to date.

In 2021, the United States Geological Society (USGS) estimated 306 billion cubic feet of recoverable helium are contained within its known reservoirs. If less than 25% of this amount is deemed economic, this produced volume could supply the United States’ needs for a generation.

Top US helium explorers – namely Avanti Helium, Blue Spruce, Desert Eagle, Exxon, Four Corners Helium, Helix Resources, Mosman Oil and Gas, US Energy, and Wesco – bring a high level of expertise and a scientific arsenal of exploration tools, including 3D seismic attributes such as AVO (amplitude versus offset), RMS (root mean square), spectral decomposition, inversion, coherency, seismic petrophysics, plus high-definition open hole logging, NMR and bore-hole image logs and advanced geochemistry. There is a reason that many countries around the globe seek the expertise and tools of US explorationists.

It’s been written that modern Homo Sapiens have roamed the Earth for approximately 300,000 years, yet helium was only discovered 157 years ago! So, investors, keep your britches buckled up – this new industry will have growing pains, and a waiting game!

Please note, this article will also appear in the 24th edition of our quarterly publication.