Sokoman Minerals Corp. is an industry-leading Canadian gold exploration company boasting an impressive portfolio of projects across Newfoundland and Labrador, Canada.

Founded 15 years ago, Sokoman is a Canadian gold exploration company with a lithium/critical minerals project it stumbled across in 2021. The company’s ethos is to advance its projects across Canada’s premier destination for gold discovery to capitalise on the region’s growing gold mining district.

The current primary focus of the company is Sokoman’s flagship Moosehead project, which is situated across the Central Newfoundland Gold Belt. The Moosehead project comprises 98 claims over an area of 2,450 hectares.

Sokoman is currently performing a Phase 6 diamond drilling programme consisting of over 100,000 metres of drilling – with 85,000 metres already completed. The programme has added four new significant mineralised zones to the project, taking the defined zones to five.

The company has recently obtained the thickest high-grade results to date from Moosehead’s lower Eastern Trend section of the property.

Sokoman is also targeting Dalradian-type orogenic gold mineralisation at the company’s 100% owned Fleur de Lys project in northwestern Newfoundland. The project represents a readily accessible, underexplored, district-scale gold target that has yielded promising results.

More recently, Sokoman has strengthened its project portfolio by forging a strategic partnership with Benton Resources Inc. The Alliance will see the companies collaborate on large-scale joint venture properties, including Grey River, Golden Hope and Kepenkeck in Newfoundland.

Beyond being a leader in the Newfoundland gold rush, Sokoman is actively exploring lithium after discovering the critical mineral at one of the company’s gold projects with joint venture partner Benton Resources Inc.

Jointly, the two companies are actively drilling the lithium property with a planned 5,000m program underway. The world is currently seeking reserves of lithium and other critical minerals to fuel the need for vehicle batteries, this could prove lucrative for Sokoman and Benton.

In this eBook, Tim Froude, the CEO of Sokoman Minerals, delves into the company’s stellar range of mineral assets and its future plans for project development.

Exploring the Moosehead gold exploration project’s exceptional potential

The Moosehead Gold exploration project is Sokoman’s 100%-owned flagship property on the Central Newfoundland Gold Trend. The initial discovery of high-grade boulders (>400 g/t Au) was made by local prospector Calvin Keats in the late 1980s.

Consisting of 98 claims totalling 2,450 hectares adjacent to the Trans-Canada Highway, the property has excellent access with abundant internal logging and drill roads.

The project’s structure, geology, and mineralisation are comparable to the Fosterville-type gold deposit hosted in antimony-rich quartz veins in folded Paleozoic turbidite sequence adjacent to a major crustal-scale break.

Since 2018, drilling by Sokoman has defined four new zones of mineralisation – all of which remain open.

In the next section of the eBook, Tim Froude explores the project further and provides updates on the current work the company is undertaking at Moosehead.

How many drills are currently operating at Moosehead?

Currently, we are on Spring break up, so there is nothing turning right now at Moosehead. However, we expect that in two or three weeks, we will bring the drill crews in again once things dry up and the roads are passable.

At this point, we are not sure if the barge will be part of our project this year. We have encountered some very interesting structures in our more recent drilling programmes and we are still trying to flesh those things out.

These are complicated systems. Vein systems, by their very nature, are harrowing things to explore. With high nugget effect grades, amongst others, it adds another dimension to it. We expect to be very active with at least a couple of drills, and a third drill if it’s warranted, but it depends on the targets too.

During this quiet period, we are conducting a review of all of our older drilling because our more recent drillings have indicated that the plumbing system may not be as originally thought.

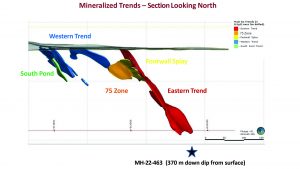

The Eastern Trend is the dominant structure here, with splays off of it to the 75 Zone. The footwall splay and the South Pond zone are also likely splays off of the main Eastern Trend.

However, it now appears that the gold may be present in structures that are completely perpendicular to it. This means that with a standard drilling pattern, a lot of our current and older holes may not have been drilled to optimally test this new possibility.

We are now busy reconstructing the drilling model, which is usually done every few months as things have been missed in the past. Mines that were assumed dead, such as Red Lake and Fosterville, have been re-explored because people did not realise what was inside them until they were able to explore further.

At this stage of an exploration programme, it is healthy to have second thoughts and be flexible. Thankfully, we have got the metre reach to allow us to build on those ideas and prove them.

How many metres remain in the phase six programme and what happens beyond 100,000 metres?

There are around 15,000 metres left, but there is no stop sign at the end of the road for that. Sokoman will continue to drill as long as it has got open-ended zones and structural models that are evolving.

Currently, even though we may have been that far at an angle, we have not drilled down to 400 metres vertically. The real gem at Fosterville was that they were able to drill 1,200 metres down. Moosehead may not necessarily go as far as 1,200 metres, but we know that the structure can do that.

The structure that Moosehead sits on, or splays off of, is the major structure, and it goes right through Newfoundland, down through the five million-ounce Valentine Lake Deposit, and all the way down to the Matador Minings’ deposit on the Cape Ray structure.

Therefore, we know the structure has the possibility of generating large-scale deposits, but these types of vein systems are notorious. They need to be drilled tightly, and the building of the mineralised zones needs to be constructed outwards. Drilling 100-metre step-outs does not work in this programme because a lot could be missed.

What is the current financial situation for continued gold exploration? Will financing be required for next year?

Sokoman is funded for the remainder of this programme, as well as its ongoing JV project with Benton, where drilling started mid-May.

However, we will still need to finance at some point this year, but summer is not usually the best time for it. We will likely look at the markets in the third quarter, but things are comfortable for now.

Have you determined a mineralisation model that brings together the multiple zones?

This is one of the painstaking things that we are currently going through. As previously mentioned, you have to be flexible and willing to change your way of thinking, which was started by the drilling process at hole 463.

There were signs of what we now know about 463 – the possibility of a completely different plumbing system was there right from the first phase to the fifth phase. Occasionally, we were getting intersections out in the footwall that was completely out of place because we were not drilling in the right way.

We were drilling it the right way to test the Eastern Trend; however, we were not drilling it to test that other plumbing system. The whole footwall environment is now open for testing in the nonconventional way of drilling down the structure because these geological processes are extremely complex and can change over time.

As you explained, the mineralisation model is continuously evolving and changing. Is the Fosterville comparison still valid?

Unquestionably, yes. That has not changed, given the style of drilling. Unlocking the uniqueness of every deposit will take time because no two deposits are exactly alike.

We had 12 items that we wanted to complete to be at Fosterville, and we have successfully completed eight or nine of them, which is a really good average. We are still comfortable with the Fosterville model.

Is the 463 Zone the future for the gold exploration project?

The 463 Zone is certainly a potential game-changer. The review of our entire database highlights outliers that did not fit anywhere before, and they are starting to line up.

It will take more drilling to determine this; however, that is a standard part of any process.

Is the assay laboratory service providing a satisfactory turnaround on samples? How about the lithium analyses?

The timing of gold assays has certainly improved dramatically. Eastern Analytical Ltd, in nearby Springdale, is our go-to lab, which many other companies, including Marathon Gold, also use. Turnaround levels have continually gotten better over time. They are almost back to pre-rush levels of 2019 and 2020. There were record amounts of exploration samples, but times are almost normal again.

What slows our process down is that with nuggety gold, our policy is to reassay via metallics, which is a much more involved process. Any sample that returns an initial value of greater than one gram per tonne has to be pulled and reassayed by the other technique. Therefore, instead of just doing a regular assay, it turns into a much more involved metallics process that involves pulverising and sieving the whole sample. Even though it doubles or triples our lag time, whenever we get a sample greater than a gram, it’s results are brilliant.

With lithium, last year was a disaster in terms of the service we were promised and the service we ended up getting. We were advised that the service would require a three- to four-week turnaround, but it turned into eight or nine weeks. Earlier this year, I was in Vancouver with the hope of having our 2022 results back in time for an important conference, but that didn’t happen.

We are certainly hoping that this will change in 2023.

Are QA/QC criteria working out well given the high grade of mineralisation?

Yes, we have found that it works with the gold that is nuggety. It is impossible to reproduce the same value with a high-grade gold target because we would never know how many grains of gold are in half of the core that you cut, which will always be an issue.

However, we are very happy on the gold exploration side. We have got tens of thousands of assays for gold, so it’s easy to see that.

With respect to lithium, we likely still do not have enough. We sometimes see a scattered outlier, but that is quite normal. Overall, the quality of the results we are getting is okay. As mentioned, the turnaround with lithium is extremely slow, so it is hard to tell.

What is the schedule for a mineral resource estimate at the Moosehead gold exploration project?

Currently, there isn’t one planned because, as explained, we are still trying to figure things out. If eight or ten drill holes can increase the volume of mineralised veins within an area that is already drilled, we are short-changing ourselves if we don’t include those.

It is pointless to do a resource as long as the model is evolving and ongoing, and the zones are still open. To do a resource now would be like buying yesterday’s newspaper, as constant evolution means an analysis would already be out of date.

Until we can deliver the most up-to-date model that most accurately represents what we have and its evolution, it would not be in the shareholders’ best interest to do a resource estimate within the next phase and beyond.