Plastic waste is a vast and increasingly urgent issue. The Alliance to End Plastic Waste discusses the urgency of the issue and what must be done to tackle it.

Just over a century since the first fully synthetic plastic was patented, the material is now ubiquitous in daily life. Plastic serves many purposes in essential industries, whether it be to prolong the shelf life of perishable food, enable safe and effective medical care, reduce the weight of and improve performance in automotives, and more.

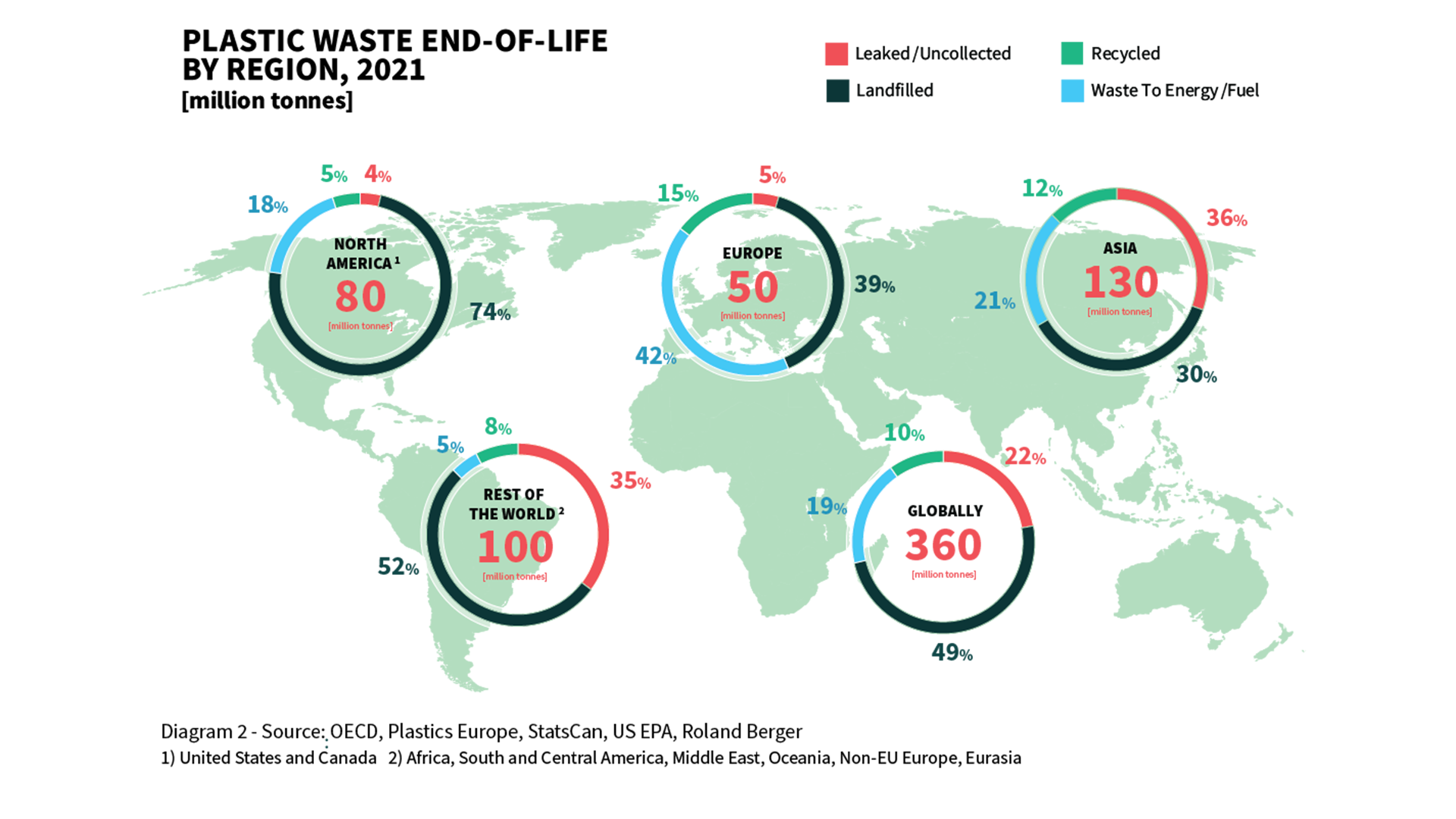

However, plastic consumption has become intrinsically correlated with economic growth and, coupled with the lack of waste management for 2.7 billion people, the ensuing waste has become a serious challenge. Today, plastic production is 460 million tonnes per year, up from two million tonnes in 1950. Of this, 360 million tonnes of plastic waste are generated annually, with 70% remaining uncollected, either leaking into the environment, dumped in landfills, or, even worse, openly burned.

One solution to eliminate plastic pollution is to establish collection and then disposal into properly managed landfills or use as waste-to-energy in the incineration of organic waste. A more visionary approach, however, is to create a circular economy for plastics.

Conceptualised by the Ellen MacArthur Foundation, a circular economy involves a shift from the current linear model of take-make-dispose to one that encourages reduce-reuse-recycle. In a circular economy model, materials and products are kept in use and circulation for as long as possible, ensuring that plastic waste is not simply disposed of but valorised. The economic case is clear: according to the UN Environment Programme’s (UNEP) Global Waste Management Outlook 2024, a circular economy approach will see a projected annual net gain of $108.1bn. Perhaps more importantly, a circular economy will enable a significantly lower carbon footprint and hence contribution to mitigate climate change.

Recycling is the engine that drives circularity

The first levers in transitioning to a circular economy are to reduce plastic usage where there is a low benefit to society (for example, over-packaging) and to establish multiple rather than single-use where possible.

These will mitigate but will not eliminate the challenge of post-use waste. Recycling will also be a strong component of the circular economy for plastics, helping to extend the economic value of existing items. Keeping existing materials in the loop reduces the need for new raw materials, cuts down overall greenhouse gas emissions, and reduces plastic production. Ultimately, renewable sources of energy and feedstock will be utilised, creating an increasingly bio-based, green economy.

However, current plastic recycling rates in most countries are far lower than needed to achieve full circularity, with over 60% of countries recycling less than 10% of all plastic waste generated. This can be attributed to underdeveloped or inadequate waste management capacity, exacerbated by factors driving growth in plastic consumption – individual wealth, urbanisation, population growth, and the lightweight, versatility, performance, and low cost of plastics versus other materials.

Without robust waste management systems in place, much plastic waste remains uncollected, resulting in environmental leakage. The collection of clean and sortable waste is also a key to enabling recycling at scale. Often, plastic waste is not cleaned and segregated at the source, which leads to contamination and the need for downstream sorting, impacting the efficiency and quality of the resulting recycled plastic, as well as the economics of recycling.

No silver bullet solution for countries tackling plastic waste

Addressing this management challenge must be approached with the understanding that there is no one-size-fits-all solution to plastic waste. Effective solutions build on each country’s strengths and focus on interventions with the most significant potential for positive impact.

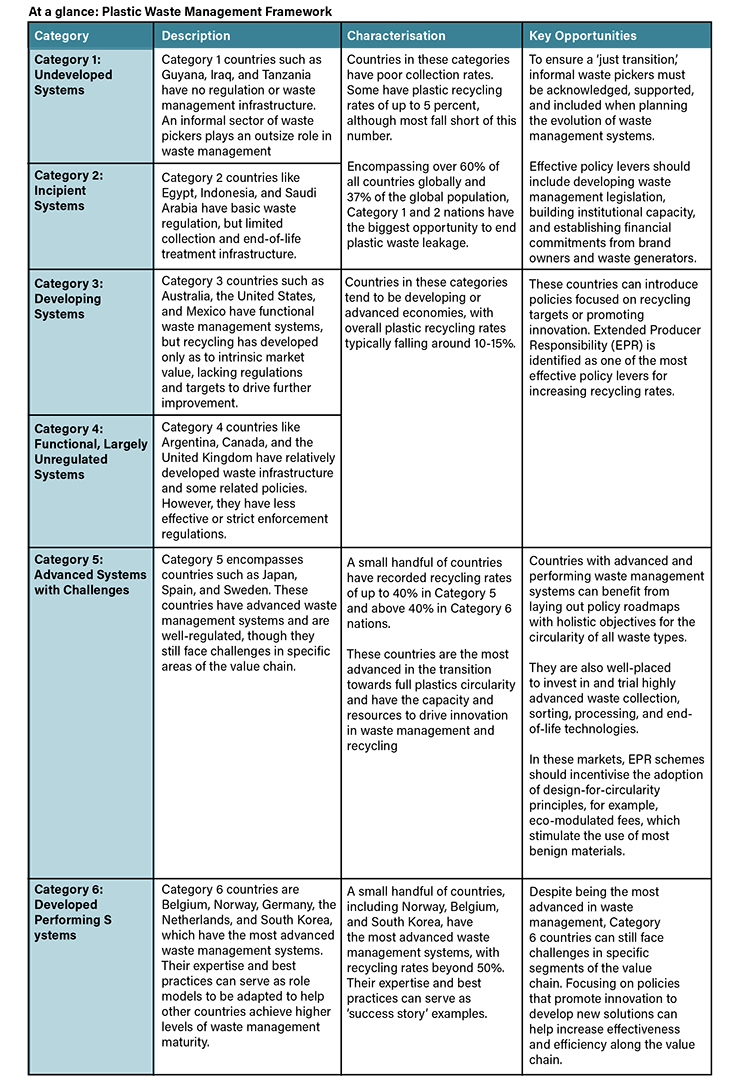

To support these efforts, the Plastic Waste Management Framework outlines 27 actions and policies that can reduce plastic waste leakage and increase recycling rates. Developed by the Alliance to End Plastic Waste with the support of Roland Berger, the study, based on a meta-analysis of 192 countries, identified six categories of waste management and recycling maturities globally.

The efficacy of Extended Producer Responsibility

Opportunities for improvement exist at every stage of maturity, but in particular, Category 3 and 4 countries such as the UK, the US, and Canada can significantly increase plastic recycling rates through thoughtfully developed and well-implemented EPR schemes.

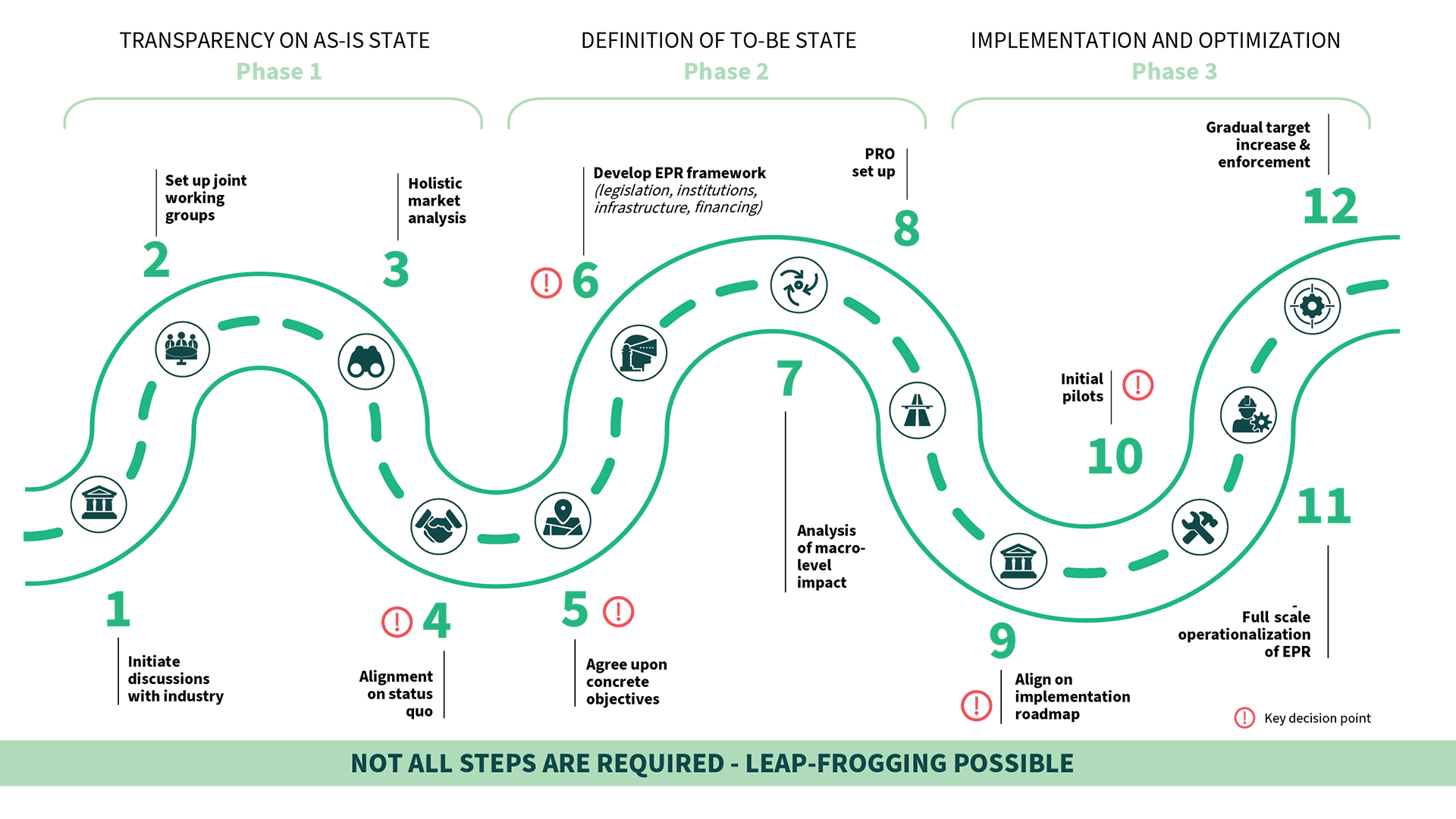

Defined as an environmental policy approach in which a producer’s responsibility for a product is extended to the post-consumer stage of its life cycle, EPR has proven to be one of the most effective policy instruments for increasing recycling rates and transitioning into a circular economy. EPR helps enforce shared responsibility across the plastic value chain, including brands and retailers and promotes sustainable design, the financing of waste management infrastructure, and effective collection and recycling. There have been instances where recycling rates for packaging and items such as Waste from Electrical and Electronic Equipment (WEEE), tyres, and batteries saw increases of up to 15-25% over a 10-15-year period.

Public-private collaboration is crucial in operationalising an EPR system that is efficient, financially sustainable, and technically feasible. EPR schemes work best when co-designed, driving alignment across the entire spectrum of the value chain, including brand owners, waste collectors, recyclers, municipalities, and regulators.

Whilst the scheme is likely to be industry-led, governments should provide reliable oversight to ensure transparency and accountability and establish a level playing field across all participants and alternative materials to encourage the adoption of the best environmental approach. The maintenance of EPR systems across the value chain often faces resourcing constraints. Authorities must ensure that collected fees are ring-fenced and funnelled back solely into resource management, including improving waste management and recycling solutions.

For early-stage countries that are less well-equipped to ensure legitimate use of funds and manage complex and comprehensive legislations, EPR schemes may have to be voluntary. Alternatives such as plastic credits or green bonds could be deployed. With greater maturity, schemes should also become mandatory to ensure equal applicability to all players and to level the playing field. Most advanced schemes should adopt eco-modulated fees in which the cost of EPR to a brand or retailer varies according to the cost of post-use management of the packaging and products they put onto the market.

An effective way to fulfil the obligation to manage packaging and products after use is a Deposit Return System (DRS), which requires consumers to pay a deposit when purchasing a single-use or reusable/refillable container and receive a refund once the container is returned. Schemes are also emerging in which there is no deposit, but a fee is levied if the article is not returned within a specified period.

In the US, states with DRS systems for PET beverage bottles account for 27% of the US population but provide 61% of all PET bottle recycling in the country. The approach has been successfully implemented in Europe, North America, and Australia and can be voluntary or mandated. To date its most common use is limited to beverage bottles such as polyethylene terephthalate (PET) bottles, as well as non-plastic packaging, including aluminium cans and glass bottles, but extension to other materials is increasingly common, and include supporting reuse/refill as well as recycling.

With the latest draft of European Union legislation on packaging and packaging waste mandating the introduction of DRS in all EU countries by 2029 (unless they reach a 90% collection rate for beverage packaging), DRS is increasingly in focus for many countries within the European Union. Countries like Romania, Ireland, Hungary, Austria, Greece, and Poland have recently passed DRS legislation, with the UK also set to implement its own DRS system. To enable effective implementation, it is important to determine the appropriate deposit amount as it strongly influences the return rates, in particular at the start of a scheme where it is important to create consumer habits.

Closing the loop with innovative technologies

Category 6 countries, which include Germany, Norway, Belgium, the Netherlands, and South Korea, are the most advanced in the transition towards full plastic circularity. However, this journey cannot end here. These nations possess the capacity and resources required to drive innovation and pioneer new technology and capital-intensive solutions to address every aspect and different application of post-use plastic. Recycling rates are entirely dependent on the ability to efficiently provide streams of feedstock of suitable quality, in particular for mechanical recycling. Where collection of segregated feedstock through take-back schemes, including DRS, is not feasible, sorting becomes critical, for example, for the recycling streams collected from household waste. Primary sorting of plastics using optical and spectroscopy for detection and pneumatic sorting at municipal materials recycling facilities (MRFs) are already well established. However, the demand for high-quality recyclates will only be met by more granular sorting, which requires secondary sorting facilities to be established, taking feedstock from a network of primary MRFs and utilising increasingly sophisticated detection and sorting technologies, enabled by digitalisation and deployment of AI.

Some companies are already trialling advancements in sorting technologies, such as the use of digital watermarks and artificial intelligence-enabled object recognition to digitalise supply chains, further enhancing existing waste management systems.

One such instance of this is the HolyGrail 2.0 project. Driven by AIM – European Brands Association, and powered by the Alliance to End Plastic Waste, HolyGrail utilises digital watermarks – postage stamp-sized codes that carry information about the packaging material, printed on plastic packaging, and imperceptible to the naked eye.

Recent trials indicate a 99% detection rate and a 93-95% purity of sorted materials. When adopted at scale, these digital watermarks can potentially differentiate each different type of plastic article and packaging that enters the market. This enables highly specific sorting and identification of material attributes such as the types of polymer, additives, and adhesives used, plus conformance with standards such as food-contact regulations, recyclability norms, etc.

Access to such sophisticated sorting and information will enable step-changes in the quality of recycled products, although it will take time to establish the infrastructure and logistics to fully materialise the benefits.

Thinking even more strategically, such digital identification at every point in the value chain, from retailer to consumer to collector to recycler, provides a sort of digital passport. In addition to being used by retailers and consumers, this would provide accurate information on actual recycling rates at the level of specific products and brands, which would inform businesses and governments on the effectiveness of their systems, focus the efforts of Producer Responsibility Organisations (PROs), and enable the determination of eco-modulated EPR fees based on real recycling rate data.

Catalysing the impact needed to advance circularity

One organisation cannot solve the plastic waste problem alone. Only a collaborative, co-ordinated, and sustained effort by governments, industry, and civil society can prevent or mitigate plastic waste at scale. By convening stakeholders across the plastic value chain, the Alliance to End Plastic Waste supports and collaborates with partners across geographies with varying levels of waste management capabilities to implement workable solutions that can bring about systems change.

Gathering the technological, economic, and social lessons from our projects in countries spanning the categories of waste management capabilities derived from the Framework, the Alliance has developed a series of Solution Model playbooks that serve as blueprints for systems change. These playbooks draw on real-world learnings to document what is possible and what is needed to increase plastic recycling rates.

From policy levers to ecosystem conditions, business models, and innovation, Solution Model playbooks identify the enabling conditions for success to encourage other organisations to adapt and replicate the best practices outlined. The intent is to inform, inspire, and collaborate with a wider network of partners to further develop, strengthen, and scale these Solution Models, catalysing the impact of reducing unmanaged waste and capturing value from this waste to create social benefit and mitigate climate impact.

UNEP has affirmed its intent to finalise the draft of the International Legally Binding Instrument on Plastic Pollution by the end of the Fifth Intergovernmental Negotiating Committee (INC-5) which concludes in December this year. As we move to tackle the pervasive issue of plastic waste and transition towards full plastic circularity, a nuanced approach tailored to each country’s circumstances is the key to unlocking the plastic waste problem.

What we do today matters, and there is no better time to act than now. Through collaborative efforts, innovative solutions, and effective regulation, nations worldwide can forge a path towards a more circular future.

Please note, this article will also appear in the 18th edition of our quarterly publication.