An alternative technology offers the opportunity to overcome some of the biggest challenges that have faced EV (electric vehicles) battery manufacturers. Dr Hadi Moztarzadeh, Head of Technology Trends, the Advanced Propulsion Centre UK (APC), reflects on whether sodium-ion batteries have the potential to dislodge lithium in popularity.

The electric vehicle (EV) industry is continually driving towards a cleaner, more sustainable future, and at the heart of this transformation lies the choice of energy storage technology. Lithium-ion batteries (Li-ion), primarily nickel manganese cobalt (NMC), have been the leading choice for many years when it comes to powering EVs, but the emergence of sodium-ion (Na-ion) technologies introduces an intriguing alternative chemistry.

Proponents of sodium have touted the technology as being cheaper, more environmentally friendly, and easier to source, with fewer supply chain challenges than lithium-ion.

However, the truth is not as simple as that. Our recent report titled ‘Automotive Battery Value Chains,’ delved into some of these advantages of sodium-ion to ascertain just how useful the technology might be to UK manufacturers, both in the present and over the long-term.

Reduction of supply chain risks

While sodium-ion batteries leverage the abundance of sodium, the overall cost-effectiveness of the technology remains an open question. The materials and manufacturing processes associated with sodium-ion batteries may require optimisation to achieve cost parity with lithium-ion batteries.

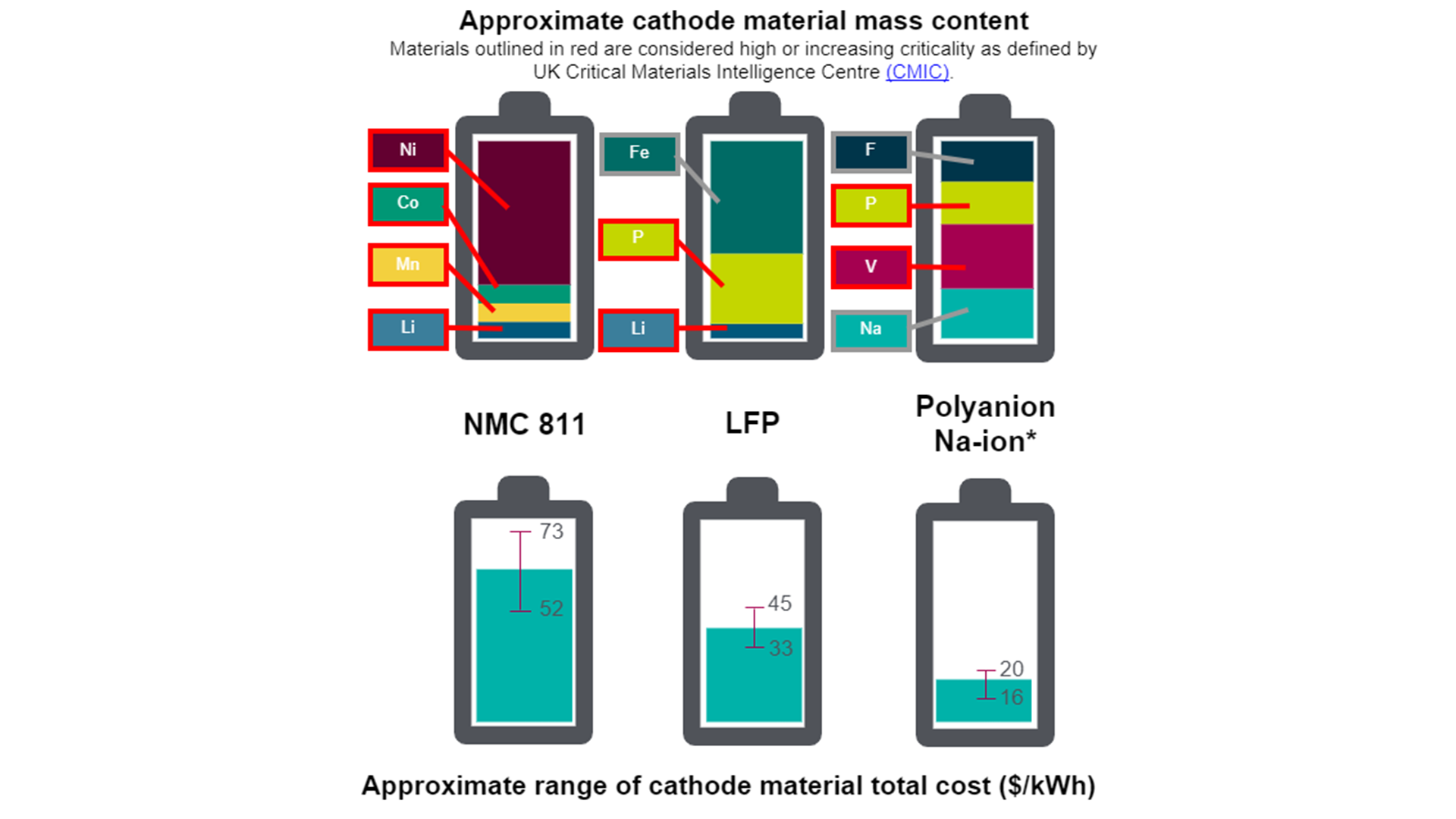

Given the quantities of critical minerals contained within popular lithium-based technologies – which can be as much as 30% of the overall weight in an NMC battery – any alternative that could eliminate, or at the very least significantly reduce, is going to be met with interest by industry. That is because it would, in part, help to reduce the cost of raw materials used, therefore helping to either increase profit margins for manufacturers, and/or lower the cost of vehicles to the end consumer (perhaps both), enabling a more competitive price point in comparison to traditional internal combustion engine (ICE) vehicles.

EVs are already grappling with higher upfront costs compared to ICE vehicles, so any reduction in costs would be a welcome boon towards wider adoption.

Adding to the argument for UK industry is the reduction in supply chain risk and export miles. Reports indicate that China could control up to one-third of the world’s lithium supply and processing by 2025, as well as having a leading share in many other critical minerals and rare earth elements (REEs).

As the COVID-19 pandemic made starkly apparent, this has the potential to cause significant supply chain issues. Sodium on the other hand, is a much more abundant element with a less costly processing for battery grade material, so there would be potential for the UK to either produce and process its own, or source it from closer partners (both physically and economically), therefore further reducing costs, for example via transport savings, and de-risking the supply chain.

Furthermore, while sodium-ion batteries vary in cathode chemistries, each having a different baseline cost, in general, the total material cost is lower per kWh than lithium-based chemistries. Material costs for sodium-ion batteries are expected to be more stable in cost in comparison to lithium-ion batteries.

However, as an APC report shows, it may not be as straightforward as it appears on the surface.

Concerns with sodium-ion batteries

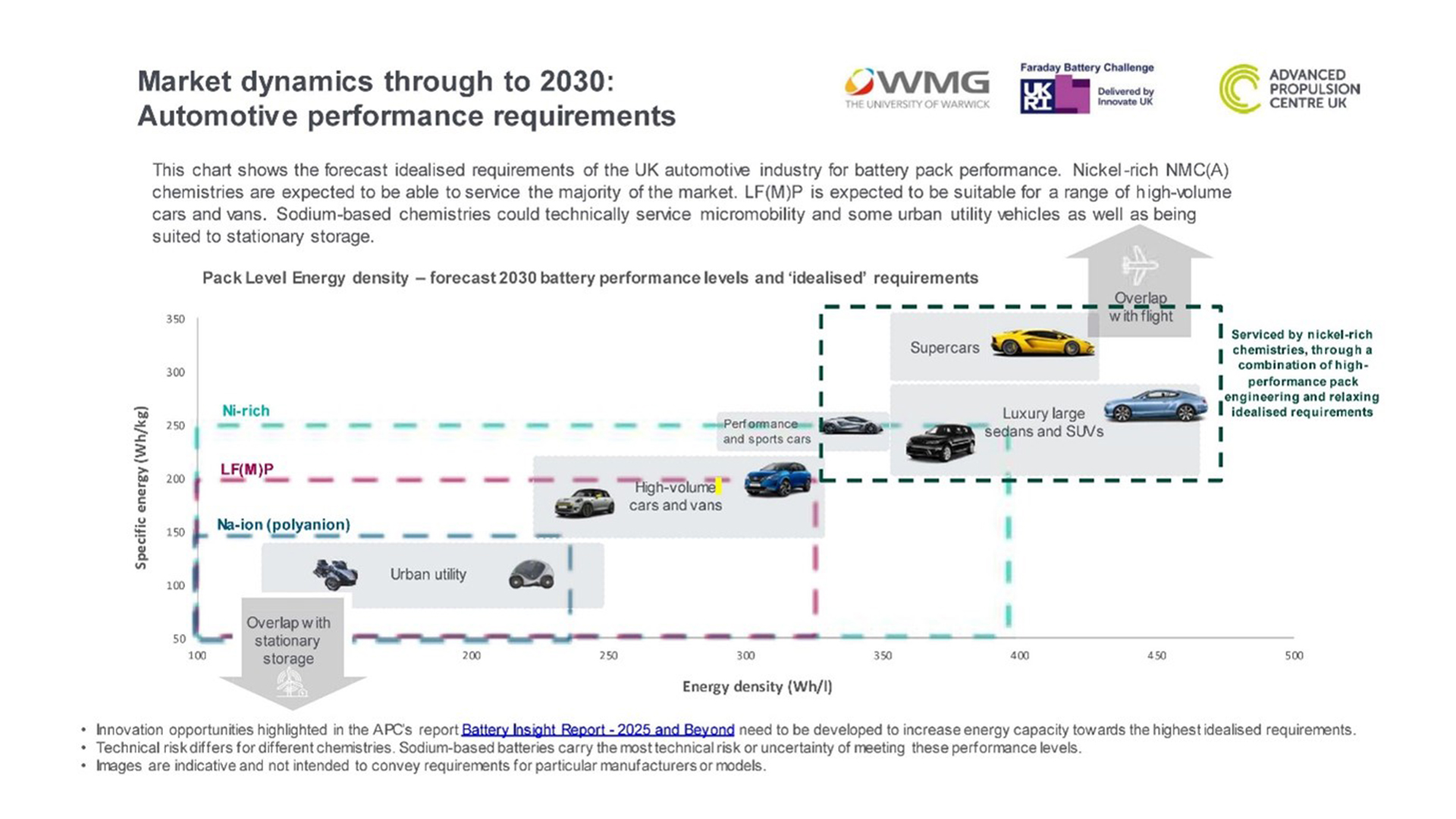

One of the primary concerns surrounding sodium-ion batteries is their energy density, a critical parameter in determining the driving range of electric vehicles. In comparison to their well-established lithium-ion counterparts, sodium-ion batteries tend to exhibit lower energy density.

The lower energy density translates to a reduced driving range for EVs using sodium-ion batteries, making them less practical for long-distance travel without frequent recharging. This limits the applications for which sodium can currently be used across the automotive industry.

As the chart below shows, as it stands, demand for low-cost chemistries such as sodium-based ones could come from two/three-wheeler vehicle markets and urban utility vehicles such as delivery vehicles. Lithium-based technologies, such as LF(M)P, meets the needs for the bulk of applications, especially high-volume cars, and vans.

Overall, therefore, the cost difference between sodium-ion chemistries and LF(M)P chemistries is potentially very small. Given the potential performance advantage of LF(M)P, cost difference does not make sodium-ion a clear winner.

While research and development efforts are underway to enhance the energy density of sodium-ion batteries, achieving a level that matches or exceeds lithium-ion batteries remains a formidable task. Until this hurdle is overcome, the widespread adoption of sodium-ion batteries in EVs may be limited, especially in applications where extended driving range is a top priority.

This is not to say that it will be that way forever though, which will create an interesting and complex decision for manufacturers as the technology develops and improves, especially when it comes to making choices that will future proof their operations for many years to come.

The importance of cycling and charging

Efficient charging and discharging rates are essential for the practicality of EVs where quick refuelling (or recharging) is a key factor for consumer acceptance. Sodium-ion batteries, while promising, may not yet meet the rapid charging and discharging expectations set by lithium-ion batteries. The inherent limitations in the kinetics of sodium-ion electrodes can result in slower charge and discharge rates.

For sodium-ion batteries to become a competitive option for EVs, significant advancements are required to optimise the charging and discharging kinetics. Improvements in this area would not only enhance the overall performance of sodium-ion batteries but make them more appealing to consumers who prioritise quick and convenient recharging.

Are sodium-ion batteries really better for the environment?

While one of the main draws for sodium-ion batteries is the reduction or elimination of critical minerals, including cobalt and lithium, that are often cited as environmentally challenging to mine and produce, that does not mean that sodium does not face challenges of its own in this arena.

Sodium is abundant and widely available, though the specific materials used in sodium-ion batteries, such as high-performance cathodes and anodes, may face scalability and resource availability difficulties. As demand for EVs continues to rise, the scalability of sodium-ion battery production becomes a crucial factor in determining their feasibility as a widespread energy storage solution.

Additionally, the extraction and processing of certain materials used in sodium-ion batteries may still pose environmental challenges like those faced by lithium-ion batteries. It is true that sodium-ion batteries present a more environmentally friendly alternative to lithium-ion batteries in terms of raw material availability, but the overall environmental impact needs careful consideration.

With this in mind, last year, the APC looked at the life cycle of many of the critical materials used in today’s battery technologies in their ‘Battery End of Life Recycling value chain report.’

Lithium has a first mover advantage

One of the greater hurdles to overcome for any future adoption of sodium-ion would be simply in ‘name recognition.’ Companies are often keen to use new advancements when the advantages are clearly shown, but there is something to be said for technologies that are tried, tested, and trusted, as lithium currently is.

Sodium-ion is still in the early stages of development compared to lithium-ion. The maturity of a technology is crucial for its successful integration into consumer products, particularly in sectors like electric vehicles, where reliability and performance are non-negotiable.

The market adoption of sodium-ion batteries in EVs will depend on factors such as the successful resolution of technical challenges, improvements in energy density, and the development of a robust supply chain. As of now, lithium-ion batteries have a significant head start in terms of technological maturity and market acceptance, posing a substantial barrier for sodium-ion batteries to overcome.

What does the future hold for sodium-ion batteries?

Clearly sodium-ion batteries show promise as an alternative energy storage solution for electric vehicles, yet they are not without their challenges and limitations. The issues related to energy density, charging, and discharging rates, material availability, technology maturity, cost considerations, and environmental impact collectively present hurdles that must be addressed for them to become a mainstream choice in the electric vehicle sector.

Ongoing research and development efforts are critical to overcoming these challenges and unlocking the full potential of sodium-ion battery technology. As the automotive industry continues its journey toward sustainability, it may play a role in the evolving landscape of energy storage, but careful consideration and further advancements are necessary for it to become a competitive and widely adopted option for powering the electric vehicles of the future.

For the meantime, as shown in the APC’s ‘Automotive battery Value Chains’ report (listen to the accompanying podcast), UK manufacturers would be well-served to continue to invest in lithium-ion technologies, particularly NMC(A) and lithium iron phosphate (LFP), at least in the short to medium term.

Please note, this article will also appear in the seventeenth edition of our quarterly publication.