David Trotter of the Minerals Research Institute of Western Australia addresses the challenges facing rare earth mining in Western Australia.

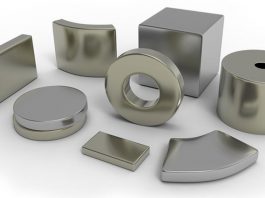

Rare earth elements (REE) are an incredibly important part of industry worldwide. They are

used in magnetics, electronics, glass, and numerous other industrial processes. Globally, China is the top exporter of these elements, but many countries are looking to develop stable domestic supply chains for rare earth mining to reduce their dependence on China.

One major player working to do so is Australia, which has seen significant efforts to up its REE exploration and production to support its own industry and become a key supplier to other countries.

The Minerals Research Institute of Western Australia (MRIWA) is a statutory body that supports research projects in Australia and beyond to develop mining technology and promote economic, social, and environmental benefits in Western Australia. The Innovation Platform reached out to David Trotter, Research Portfolio Manager at MRIWA, to learn more about the challenges faced in the region.

What is the current state of rare earth mining in Western Australia?

Western Australia produces over 28,000 tonnes of rare earth oxides (REO) annually with a value of A$569m (€335m) per year.1 This makes the State the fourth-largest producer of REO globally.

Major investments by Lynas Rare Earths and Iluka Resources are now set to establish Western Australia as one of only a few jurisdictions in the world producing processed REE. Lynas commenced construction on Australia’s first REE processing facility in Kalgoorlie in 2022, and Iluka Resources is set to build Australia’s first fully-integrated REE refinery in Eneabba, with initial production earmarked for 2025.

Several large-scale developments in exploration and processing are planned in association with these events, the net impact of which will be to increase rare earth mining in Western Australia.

The Lynas Rare Earth project at Mount Weld was first mined in May 2011 and produces 26,500 tonnes of REO annually. Mt Weld Mining Pty Ltd has proposed to expand the Mt Weld Mine, its life of mine, and enhance the processing recoveries of rare earths. A A$20m (€11.5m) Australian government grant was announced in June 2023 to support the addition of an apatite leach circuit at Weld, which will increase the recovery of high-value magnet rare earths.2

The Mount Weld project will provide a base supply to Lynas’ A$575m (€338.5m) Kalgoorlie rare earth processing facility. Commissioning of this recently completed facility is now underway, with lanthanide concentrate being fed to a kiln for roasting to produce mixed rare earth carbonate (MREC). The MREC will be further treated at Lynas’ existing processing facility in Malaysia and its new plant in the US (funded by the $258m, or €237.5m, grant from the U.S. Department of Defense).

Lynas is also reportedly considering a second phase of development for the Kalgoorlie processing facility.3

Iluka Midwest Limited has invested A$1.2bn (€706.2m) in the construction and operation of a rare earth refinery at Iluka’s Eneabba Mine, 5km south of Eneabba townsite and 300km north of Perth. This project, funded by a loan from Export Finance Australia, will produce approximately 17,500 tonnes per year of individual REO and MREC. Once operational, the refinery will utilise the existing Eneabba mine output of monazite concentrate, future Iluka feedstocks and third-party feedstocks.4

Northern Minerals Limited has commenced a rare earth mining project at Browns Range. Located 160km southeast of Halls Creek in northern Western Australia, the Browns Range Project is the first significant dysprosium producer outside of China.

This A$329m (€193.6m) project is separated into three development stages, under which Northern Minerals will initially produce and market a MREC product, develop the project to a bankable feasibility study level, and finally scale up to full operating capacity. Northern Minerals has an offtake agreement with Iluka for all the concentrate production from this project.5

Hastings Technology has completed a detailed feasibility study encompassing the development of a mine, processing plant (incorporating beneficiation and hydrometallurgy), and supporting infrastructure for its A$650m (€328.5m) Yangibana project. This project is designed to mine one million tonnes per year of ore, with the associated processing plant producing up to 15,000 tonnes of MREC per annum. The Probable Reserves Production Target from the initial Yangibana project is calculated as supporting an initial six years of mine life, with Hastings further evaluating the economic benefit of extending mine life to eight years by the inclusion of additional production from the Auer, Auer North and Yangibana West deposits. These resources contain substantial quantities of neodymium and praseodymium used in rare earth magnets.6

Other projects under evaluation also have the potential to increase rare earth mining in Western Australia, supporting a range of new technologies requiring REO. MRIWA is supporting a portfolio of research projects addressing technical challenges in the exploration and processing of Western Australia’s rare earth endowment and its application to support low-emission energy technologies.

What potential does Western Australia have for future rare earth exploration and production?

With the State’s good infrastructure and recognised resource potential, rare earth mining represents a significant economic opportunity for Western Australia. Current and prospective projects in the Yilgarn and Pilbara regions are located close to existing mining and processing infrastructure. The Geraldton and Esperance Ports can accommodate the export of rare earth concentrates in the short term for use in metal processing plants overseas, while future demand for renewable energy and storage technologies could ultimately support the development of more advanced rare earth processing locally. Opportunities in exploration, research and collaboration will lead to further investment in the rare earth value chain, potentially broadening the nature of the future rare earth industry in Australia.

Firstly, regarding the extraction and processing of material from REE-hosted clay deposits. Several projects are assessing the potential to extract and process valuable magnet rare earths and strategic heavy rare earths from ionic clay deposits in Western Australia. These resources have practical advantages for development, being located close to the surface and existing infrastructure, and containing low concentrations of radioactive elements. However, the low grades of total rare earths they typically contain will require the development of new low-cost mining methods to make their exploitation practical. Companies investigating these opportunities include Heavy Rare Earths Limited, Dreadnought Resources, West Cobar, Auric Mining, Terrain Mining and Golden Mile Resources.

Research potential is another key factor. MRIWA looks to collaborate with interested parties and support research proposals addressing these challenges and closing relevant knowledge gaps across geoscience, extractive metallurgy, and mine planning. Research projects to develop and validate extraction methods, overseen by researchers in Western Australia’s world-class universities, are some of the collaborative projects supported by MRIWA currently working to make the rare earth mineral sector profitable in the State. Western Australia’s university and research infrastructure provide the capacity for innovative companies to address the technological challenges of actualising rare earth mining in Western Australia.

Finally, there is decarbonisation. There is opportunity for Western Australia to develop capabilities in new technology that would enable the downstream processing of mineral resources powered by renewable energy. High local renewable energy availability factors for both solar and wind energy, combined with the ready availability of natural gas in a transitional support role make the Pilbara, south-west and eastern areas of Western Australia particularly attractive from this perspective.

Why is building a stable rare earth supply chain in Western Australia so important?

A stable supply chain would increase the economic value of the sizable known rare earth resource base in the state. Developing processing from simple concentrates to carbonates will increase local capability and know-how, supporting greater economic return from Western Australian resources, which would in turn be expected to drive further exploration and investment.

Western Australia has opportunities to improve the strength and stability of the rare earth supply chain through increased access to reliable energy and transport infrastructure. Industry collaboration with research organisations in addressing these supply chain opportunities will also increase transparency in the extraction and processing workflows for rare earths and encourage innovation in the sector.

Downstream reliance on overseas offtake for final processing also acts as a destabilising influence in the Western Australian rare earth supply chain. Further growth in Western Australia’s onshore rare earth mining capacity could help improve supply chain stability, with benefits both for the local rare earth production sector and end users in terms of enhanced market transparency, environmental certification, and product standards.

The enhancement and strengthening of rare earth supply chains is also well-supported by Federal and Western Australian State Government programmes and grants.

What are the challenges facing the acceleration of rare earth mining in Western Australia and what needs to be done to overcome these?

Western Australian minerals industry participants have identified several challenges to the development of further value-added development in rare earth mining.7

Firstly, there is a perceived project risk and accompanying difficulty in securing project financing. In addition to their technical complexity, rare earths (along with other niche critical mineral projects) are commonly seen to be riskier development prospects due to the pressures on supply chains in the race to develop new projects quickly.

Secondly, bottlenecks in access to project-ready industrial land and associated infrastructure (e.g., ports, rails, roads, renewable energy supplies) can cause delays and can increase project costs. This issue especially applies to foundation projects where costs to connect services (power, water, gas, etc.) can amount to hundreds of millions of dollars.

Furthermore, it has been forecast that Western Australia is increasingly competing with jurisdictions across the globe that have invested in serviced industrial land to attract investment.

Government can assist in understanding project requirements. Mineral processing operations are often complex projects requiring a range of rigorous regulatory assessments. The challenges of these processes can be particularly daunting when proponents seeking to develop projects are smaller companies with fewer resources.

The development of projects requires additional investment in research and development. Rare earth minerals require unique chemistry configurations in refining and processing that are not yet well understood, and further pilot work, which is often expensive and time consuming, is required to build and test extraction circuits prior to production.

In the recent economic climate, high capital costs and labour shortages have added further challenges. The unemployment rate is at a historic low, with this tight labour market producing acute skills shortages across many occupations and industries. These challenges are compounded by other factors, including high inflation, rising interest rates, changing geopolitical conditions and global economic uncertainty.

During the 2023 Diggers and Dealers mining conference, the CEO of Lynas Rare Earths, Amanda Lacaze, indicated upgrades required to local energy and water infrastructure and a dearth of qualified personnel (due to low enrolments in mining-specific fields of study) stand as potential barriers to the planned Phase 2 development of Lynas’ Kalgoorlie processing plant.8

How is the MRIWA working to accelerate Western Australia’s rare earth supply chain?

MRIWA is actively working to accelerate the development of rare earth mining in Western Australia through investment in targeted grants for research projects, education support, and collaboration with other institutions.

MRIWA’s active portfolio of research in this sector includes:

Microwave reactor for critical minerals

MRIWA is supporting Northern Minerals in testing the roasting of REEs in a microwave reactor which replaces the standard roasting kiln used in current processing. A joint commercialisation strategy is being implemented to allow further promotion of the method when proven at industrial scales.

Understanding the Mt Weld Carbonatite mineral system: A critical minerals super-resource in Western Australia

MRIWA is supporting rare earth explorers by developing a geological understanding of the large Mt Weld system, which is the source of most of the current rare earth mining in Australia.

Giant rare-metal pegmatites of the East Pilbara Terrane, Western Australia: Mineral systems analysis and terrane-scale exploration (MRIWA Odwyn Jones PhD Scholarship)

The support of PhD projects is part of MRIWA’s strategy to increase the knowledge and upcoming research expertise in rare earths.

The effect of water quality on rare earth minerals flotation

This project is supporting the optimisation and resource recovery in processing monzonite REE.

Organic acid leach system for rare earth extraction technology development

The alternative to the use of acid leaching may improve the environmental outcomes and increase effciency in the preparation of concentrates ready for processing.

MRIWA is also active in delivering training and workforce development for the minerals research sector in Western Australia. The Institute currently funds the studies of over 70 PhD students through either our scholarship programme or the diverse projects supported under our research portfolio, as well as directly managing industrial research internships investigating a range of MRIWA priority areas, including rare earth mining.

This cohort includes PhD students working to better understand the rare earth endowment and exploration potential of Western Australia, develop improved methods for processing and beneficiation of REE ores, and support government policy through improving guidelines for the strategic prioritisation of critical minerals projects in Western Australia.

Opportunities for the development of the State’s rare earth resources were a key driver of MRIWA’s execution this year of a Memorandum of Understanding with the Korean Institute of Geoscience and Mineral Resources (KIGAM). Collaboration and knowledge exchange with Korean scientists has already started, with a symposium on the processing of rare earths and a KIGAM delegation visiting Western Australia to develop research opportunities supporting the exploration and discovery of rare earths and other critical minerals.

MRIWA also meets regularly with the Australian Critical Minerals Office and Geoscience Australia to develop common strategies for research investment in rare earths and other critical minerals in Western Australia.

MRIWA has a further role in informing State Government activities relating to critical minerals and rare earth mining, helping to identify and define the potential benefit to the State in becoming a reliable global supplier of minerals and processed REO for new critical technologies. The Institute co-ordinates collaborative research initiatives with universities, industry and other government agencies to support amplification of research investment. Research activities in the rare earths sector are priorities for MRIWA under the focus area of critical minerals. MRIWA expects its rare earths portfolio to grow in the coming year.

About MRIWA

The Minerals Research Institute of Western Australia is a statutory body established by the Western Australian Government for the purpose of fostering and promoting minerals research for impact and benefit to Western Australia.

Key focus areas target the Institute’s work towards high value opportunities for the State, including critical minerals, exploration amplification, green steel, net zero emission mining, mineral carbonation, METS innovation, precision and low-impact mining, and alternative uses of tailings and waste.

To access research outputs and engage with the MRIWA team on new research opportunities, visit www.mriwa.wa.gov.au.

References

- https://www.wa.gov.au/system/files/2022-07/220630_Battery%20and%20Critical%20Minerals_Prospectus-Web.pdf

- https://lynasrareearths.com/projects-2/

- https://lynasrareearths.com/wp-content/uploads/2021/12/Lynas-Kalgoorlie-Processing-Facility-FAQs-Dec-2021.pdf

- https://iluka.com/operations-resource-development/resourcedevelopment/eneabba/

- https://northernminerals.com.au/projects/

- https://hastingstechmetals.com/projects/yangibana/

- https://www.wa.gov.au/system/files/2022-07/220630_Battery%20and%20Critical%20Minerals_Prospectus-Web.pdf

- https://www.afr.com/companies/mining/lynas-seeking-new-mines-leaving-nothing-to-waste-20230808- p5duwt

Please note, this article will also appear in the fifteenth edition of our quarterly publication.