With quantum computing representing a paradigm shift for a range of industries globally, we look at how this groundbreaking technology will revolutionise financial modelling.

Quantum computing, a concept once confined to theoretical physics and science fiction, is fast becoming a feasible tool for complex computations in various industries. Its potential impact on financial modelling is particularly pertinent where traditional computational methods often fail to adequately address the intricate dynamics within financial markets.

Quantum computing promises to revolutionise financial modelling by providing a robust framework for simulating market behaviours and optimising investment strategies.

However, as with any nascent technology, numerous challenges must be surmounted before quantum computing can be seamlessly integrated into the financial sector.

This article aims to delve into the nuances of quantum mechanics underlying this novel form of computation, elucidate the limitations of conventional computing techniques in finance, and highlight the advantages of quantum models.

Additionally, it will explore real-world applications of quantum computing in finance thus far, discuss potential future impacts on financial markets and consider ethical implications stemming from this technological advancement.

Understanding quantum mechanics

Delving into quantum mechanics reveals a fascinating universe where particles exist simultaneously in multiple states, promising significant financial modelling breakthroughs.

The concept of wave-particle duality is central to this unique world, which portrays particles as waves and individual entities. This fundamental characteristic allows quantum particles to behave differently than macroscopic objects.

They can interfere with themselves like waves or behave like localised particles. The implications of this principle are profound and pave the way for more sophisticated computational models.

Quantum superposition further illustrates the paradoxical nature of quantum mechanics. It posits that any two (or more) quantum states can be added together or ‘superposed’, resulting in another valid quantum state.

It indicates that a particle exists in all possible states at once until observed or measured. This concept has potential applications in financial modelling by providing an avenue for concurrently processing vast amounts of data.

The Heisenberg uncertainty principle is another critical facet of quantum mechanics, which asserts that it is impossible to measure a particle’s position and momentum simultaneously accurately; knowing one decreases certainty about the other.

Additionally, quantum entanglement—a phenomenon where pairs or groups of particles interact in ways such that their physical properties become intertwined—offers opportunities for instantaneous information transfer regardless of the distance between entangled parties.

Despite its inherent complexities, understanding Schrödinger’s cat experiment provides insight into these concepts’ practical implications. This thought experiment presents a scenario where a cat inside a box could be both alive and dead due to its interaction with a quantum particle — until observed directly.

The implication here suggests how future financial models using quantum computing may operate: accommodating multiple possibilities at once while awaiting resolution upon observation or decision-making moment.

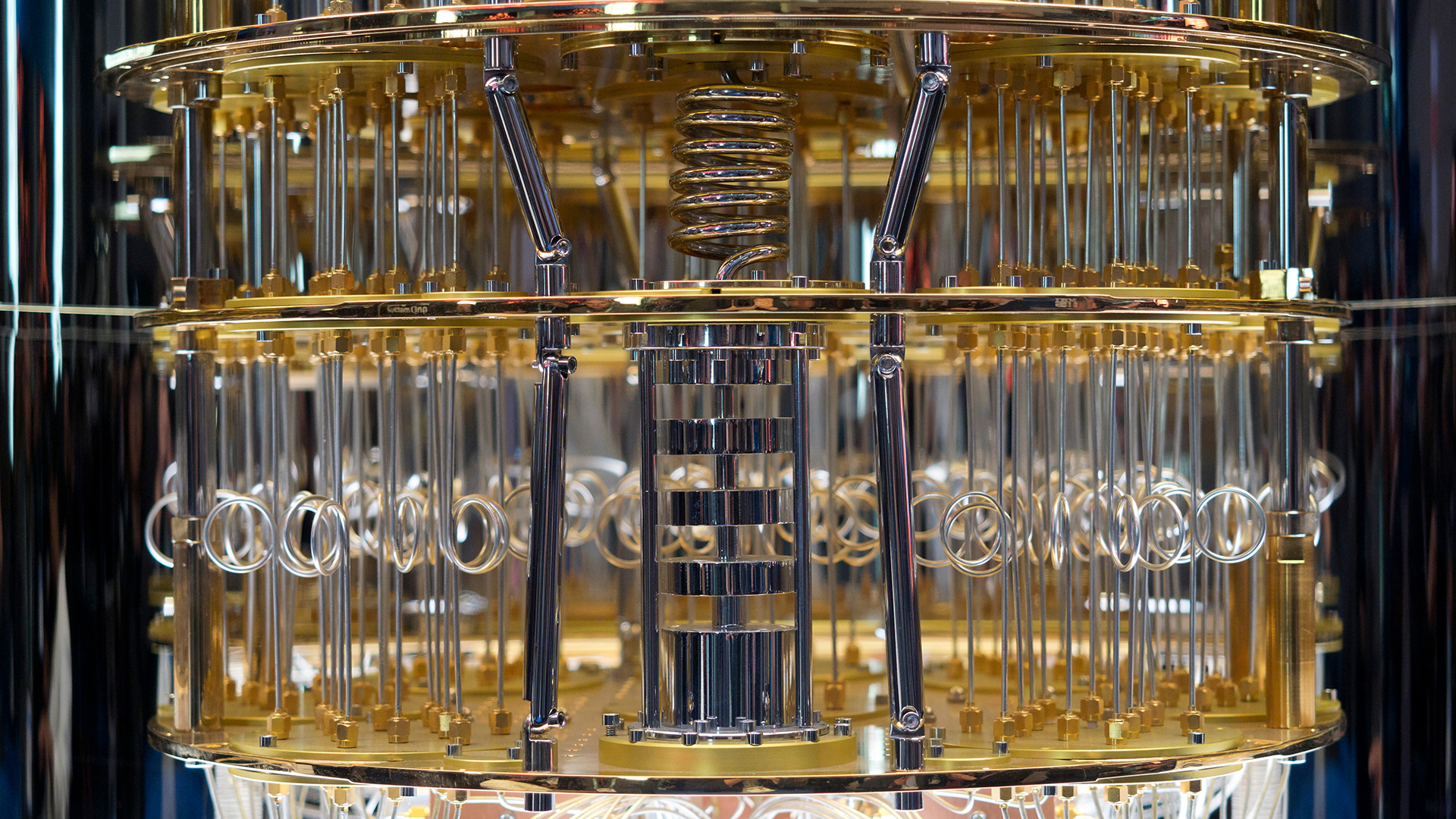

© shutterstock/Boykov

These principles lay exciting foundations for re-envisioning established models within finance underpinned by classical mechanics towards more robust frameworks supported by quantum mechanics’ intriguing characteristics.

The limitations of traditional computing methods

While traditional computational methods have undeniably served us well in the past, these systems are increasingly encountering bottlenecks and limitations when faced with complex problems and large-scale data processing.

This is largely due to inherent restrictions in sequential data processing, where operations are performed one after the other. Consequently, they struggle to keep up with the ever-increasing demands for high-speed computations needed in sophisticated financial modelling.

The term ‘Computational bottlenecks’ captures this phenomenon succinctly, referring to points of congestion that slow down or limit the overall performance of a computing system.

Delving deeper into specific issues, legacy systems’ inefficiency contributes significantly towards these computational challenges. Legacy systems refer to outdated hardware or software still in use within an organisation despite more efficient solutions being available.

These technologies often lack scalability and flexibility due to their rigid design architectures. As such, they are not suited for evolving computational needs such as those demanded by modern financial models, which require agile and malleable frameworks.

Another contributing factor is the processing power limitations inherent in classical computers. For instance, according to Moore’s Law – a rule of thumb in the history of computing hardware- the number of transistors on integrated circuits doubles approximately every two years; however, this trend has been slowing down lately due to its physical limits.

This implies that there comes a point where it becomes physically impossible to cram any more transistors onto silicon chips without causing overheating or energy inefficiency issues, hence limiting improvements in processing power based solely on transistor count increment.

Data storage issues also pose significant barriers to traditional computing methods used in financial modelling. Large-scale simulations generate massive amounts of data that must be stored efficiently for future reference or analysis, putting pressure on existing storage capacities.

Furthermore, algorithmic complexity also plays a role here: complex algorithms require larger memory spaces as well as longer times for execution, straining resources further and increasing latency times during simulation runs or model calculations.

Advantages of quantum computing in financial modelling

In the realm of advanced computational methods, one approach stands out for its potential to revolutionise traditional financial simulation models: harnessing the power of quantum mechanics.

For instance, consider a hypothetical scenario where risk analysts need to evaluate thousands of possible market scenarios; using quantum algorithms could significantly reduce computation time and enhance accuracy in predicting market trends. This phenomenon, known as quantum speedup, can enable financial institutions to process vast amounts of data rapidly and accurately, thus optimising investment decisions.

The application of quantum computing in risk analysis is another significant advantage. Risk assessment requires evaluating multiple variables simultaneously – a task that traditional computers handle with difficulty due to their linear processing capabilities.

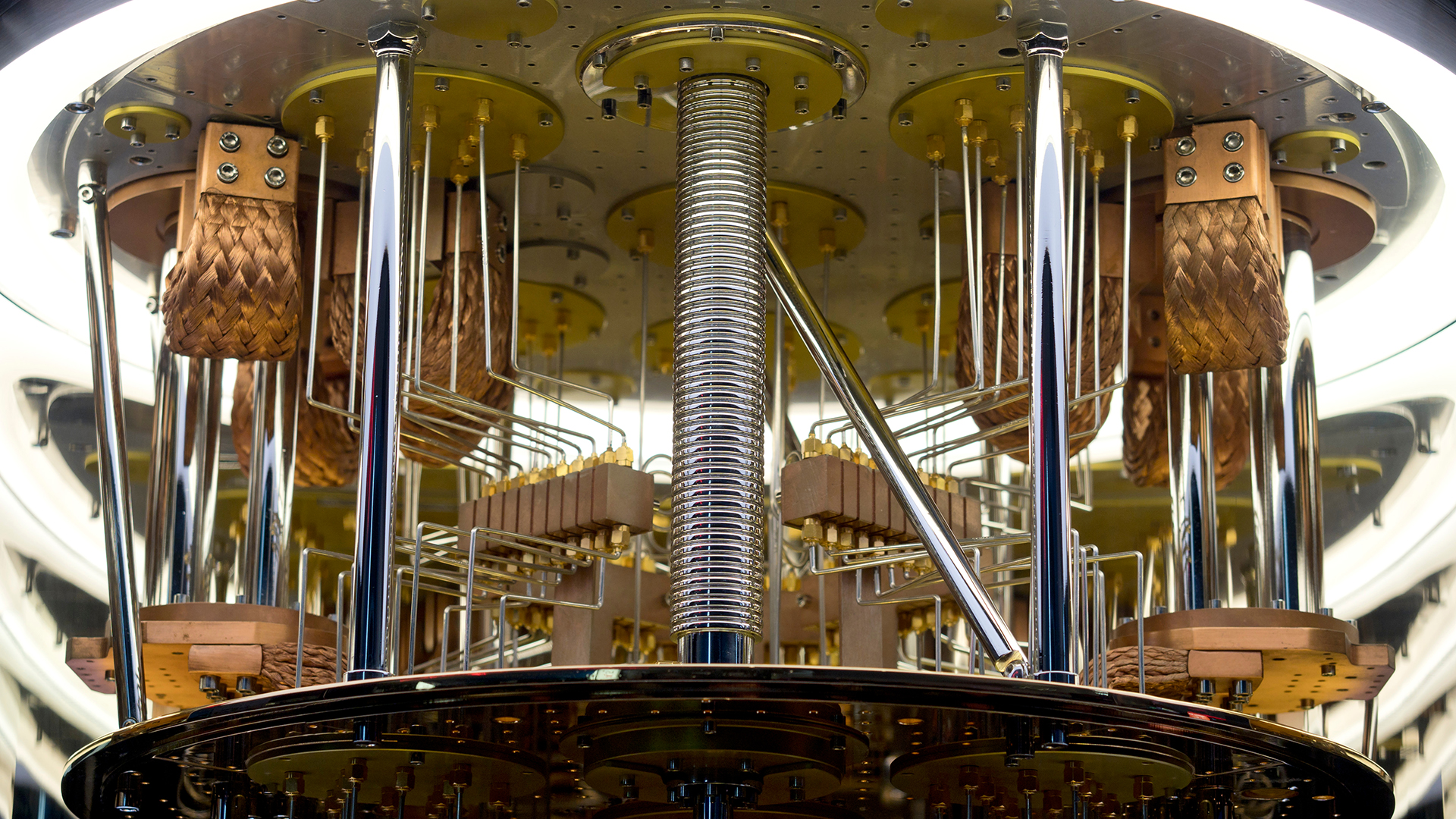

However, quantum computers operate on quantum bits (qubits) that allow them to process multiple variables simultaneously. Consequently, they are capable of completing complex calculations at speeds unattainable by classical computers.

Security benefits are another notable perk offered by quantum computing in financial modelling. The inherent properties of quantum information make it impossible for unauthorised parties to access data without detection. This enhances security measures beyond those provided by traditional encryption methods.

These advantages present an exciting prospect for future developments in finance. With enhanced accuracy in risk analysis and investment optimisation coupled with unprecedented security benefits, it is clear that embracing quantum computing could lead to significant advancements in financial modelling techniques and practices.

Challenges and obstacles in implementing quantum computing

Despite the appealing prospects, several hurdles need to be overcome for the effective implementation of this advanced technological paradigm.

One prominent challenge is quantum encryption, a technique necessary for securing quantum computing systems and protecting data from potential threats.

However, due to its complex nature, implementing quantum encryption poses significant difficulties. It requires specialised knowledge and expertise in both quantum physics and cryptography – areas that are still relatively nascent in many organisations.

Another considerable obstacle lies in the realm of cost barriers. Establishing a fully functional quantum computer is an expensive endeavour involving high capital investment for hardware acquisition, system maintenance, and continuous upgrades to match the rapid pace of technological advancements.

This financial burden becomes even heavier when considering the costs related to adapting existing technological infrastructure to accommodate quantum computing capabilities.

Speaking of infrastructure, achieving ‘quantum readiness’ within an organisation’s current technological framework presents another set of challenges. Existing digital infrastructures have been built around classical computing models.

Therefore, integrating them with novel quantum technologies will likely involve substantial modifications at multiple levels. This could disrupt operational flows temporarily or even lead to system-wide instabilities if not managed properly.

Talent scarcity also serves as a formidable barrier to the successful adoption and implementation of quantum computing in financial modelling. As this field requires highly specialised skills in both finance and advanced technology domains, such as coding languages specific for qubits, there is a dearth of qualified professionals who can effectively bridge these two disciplines together.

Therefore, despite the promising potentials offered by this emerging technology paradigm, these challenges underscore the necessity for careful planning and strategic approaches towards its adoption within any financial institution or industry sector.

Real-world applications of quantum computing in finance

Harnessing the power of advanced technologies, such as those based on principles of quantum physics, has allowed various industries to explore innovative solutions for complex problems; among these, the financial sector presents a compelling case with an array of potential applications.

Quantum computing holds immense promise for this sector, promising unparalleled computational speed and capacity that could revolutionise how financial institutions operate and interact with their clients. The theoretical advantage lies in quantum computer’s ability to process vast amounts of information simultaneously and solve complex mathematical problems more efficiently than classical systems.

One remarkable application is in risk assessment. Traditional methods struggle to adequately assess risk due to the inherent complexity and uncertainty involved in predicting market trends. However, quantum computing promises a more accurate evaluation by processing multiple scenarios simultaneously.

This ability would enable organisations to make better-informed strategic decisions and manage risk more effectively. Furthermore, securities valuation could also benefit from quantum computation’s superior processing capabilities. By quickly analysing vast amounts of data related to market trends, economic indicators, or business performance metrics, quantum computers could provide more precise valuations.

Quantum cryptography is another significant area where finance could be transformed through quantum technology’s unique properties. Securing digital transactions has become increasingly crucial, given the high frequency of cyberattacks targeting financial institutions nowadays.

Quantum cryptographic algorithms can offer a higher level of security than current encryption standards because they use unpredictable qubits instead of traditional binary codes.

Portfolio optimisation and algorithmic trading are other sectors where quantum computing can bring revolutionary advancements. Portfolio managers often face difficulties optimising investment portfolios due to the sheer volume of variables involved.

Integrating a large number of assets whilst accounting for each asset’s volatility poses a significant challenge that requires substantial computational power that only a machine like a quantum computer possesses.

Similarly, algorithmic trading involves making decisions based on patterns in data that are often too subtle or complicated for regular machines or humans but may be discernible by powerful quantum machines capable of simultaneous multi-variable analysis.

The potential impact of quantum computing on financial markets

The advent of advanced technologies stands to greatly influence the dynamics of global markets, with potential impacts ranging from risk management enhancements to revolutionised trading strategies.

Quantum computing, in particular, is poised to bring about radical changes in the financial industry. The quantum speedup characteristic of these powerful machines could potentially process complex calculations and simulations at unprecedented rates. This accelerated computational capacity may significantly reduce the time needed for financial modelling and forecasting, thus potentially leading to more accurate and timely investment decisions.

Market volatility presents one area where quantum computing’s impact will be crucial. Traditional computers struggle with predicting market trends due to their inherent complexity and dynamic nature.

However, quantum algorithms can handle multiple variables simultaneously and manage intricate computations efficiently. By leveraging this superior processing power, institutions may be able to predict market movements more accurately and quickly than ever before.

Investment strategies are another field that could benefit immensely from quantum computing’s capabilities. Financial firms spend substantial resources developing models that forecast stock performance based on a myriad of factors, such as historical data, economic indicators, and company fundamentals, among others.

With the power of quantum computers’ parallel processing abilities, these models could become even more sophisticated by including additional predictive variables while shortening computation times considerably.

Risk management also stands as a major beneficiary of advancements in quantum technology within finance markets. The ability of these machines to solve complex equations swiftly means quicker identification and measurement of risks associated with various investments or transactions – an invaluable asset for any firm operating in volatile financial environments.

It should also be noted that there are potential downsides, such as increased susceptibility to cyber threats; nevertheless, the benefits offered by this technology seem promising enough for it to have a transformative impact on global financial markets.

Ethical considerations and future developments in quantum computing

Quantum computing, with its promise of quantum supremacy, brings forth a new dimension of ethical considerations – often termed ‘Quantum Morality.’ This encapsulates the moral dilemmas that are exclusive to the realm of quantum technologies.

As these advanced systems hold the potential to process information at an unprecedented rate and solve complex problems beyond conventional computers’ reach, concerns about their misuse can’t be disregarded.

Privacy concerns are among the most pressing issues regarding quantum computing’s rise. The advent of such powerful computational capabilities could pose significant threats to data security.

It has been postulated that quantum computers could theoretically break many current encryption methods, leaving vast amounts of sensitive information vulnerable to unauthorised access and breaches. This raises essential questions about how privacy can be assured in a world where traditional cybersecurity measures might no longer suffice.

The regulatory framework for quantum computing is another area requiring robust discussions and strategic planning. Due to its nascent stage, regulatory bodies worldwide have yet to fully understand or establish comprehensive regulations governing this innovative technology’s use.

Lack of clear guidelines can lead to unethical practices, unregulated experiments, and unfair market advantages, particularly in high-stakes sectors like finance, where accurate prediction models can yield substantial profits.

Addressing these ethical challenges necessitates collective efforts from policymakers, researchers, technologists and other stakeholders involved in quantum computing development. Strategies must be developed to mitigate risks associated with data security and ensure fair competition in markets influenced by this revolutionary technology.

As society ventures deeper into this new era powered by quantum computing, it bears an immense responsibility to uphold principles of fairness and integrity while harnessing its benefits effectively.