The Natural Resources Canada discusses the potential of Canada’s rare earths and the importance of responsible sourcing to meet increasing demand for clean energy technologies.

The demand for minerals and metals associated with the clean energy transition and the transition to zero-emission vehicles is expected to increase significantly over the next ten years. Fortunately, Canada possesses significant potential to increase the mining and processing of many of these critical minerals, which will drive economic growth in Canada, create jobs for Canadian workers, and reduce Canada and our allies’ vulnerability to supply risks.

In this context, Canada is utilising its potential to step up to develop secure and stable supply chains for the minerals and metals essential to reaching net zero and support likeminded partners in critical minerals security to insulate Canada and its allies from geopolitics and reliance on an anti-market economy or anti-democratic nations.

The importance of rare earths to Canada

In recognition of this potential, the Canadian Critical Minerals Strategy aims to increase the supply of responsibly sourced critical minerals and support the development of secure, reliable domestic and global value chains, in collaboration with our like-minded international partners, for clean technologies, information and communication technologies, and advanced manufacturing inputs, such as military and defence applications.

Due in part to their important role in these value chains, rare earth elements (REE) are among the minerals identified for initial prioritisation under the Strategy.

Permanent magnets represent over 90% of the market value for REE. They are an essential component of modern electronics such as cell phones, televisions, computers, automobiles (including electric vehicle motors), wind turbines, and jet aircraft, among other products. Neodymium magnets (or NdFeB magnets) are the most common type of permanent magnet used globally, having the highest magnetic field per unit of volume and being relatively low cost to produce. Neodymium (Nd), praseodymium (Pr), dysprosium (Dy), and terbium (Tb) are four of the key REE used to create NdFeB magnets.

Demand for and prices of all permanent magnets are forecast to increase significantly, in the range of over 25% to 40% by 2040, according to the International Energy Agency, largely due to both global and domestic growth in the electric vehicle (EV) and wind power sectors. As an example, demand for neodymium is anticipated to more than double from about 50,000 tonnes in 2022 to 125,000 tonnes by 2050.¹

The permanent magnet value chain consists of several stages, including extracting rare earths from ore, separating rare earths into individual oxides, and turning rare earths into alloys and magnets.

Currently, the NdFeB magnet value chain (covering mining, processing, and manufacturing) is heavily concentrated in China. Canada, its allies, and industry stakeholders worldwide are seeking to diversify the sourcing of rare earths to ensure a reliable, responsible, and sustainable supply as demand grows internationally and domestically in Canada.

This is an opportunity Canada is well positioned to seize due to our abundant mineral resources, advanced projects and innovative processes being developed across the value chain.

Opportunities for Canada’s rare earths

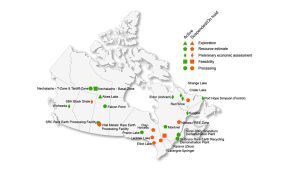

Canada has some of the world’s largest known reserves and resources (measured and indicated) of rare earths, estimated at over 15.2 million tonnes of rare earth oxide in 2023 and is host to several advanced exploration projects across the country. Some of these projects contain high concentrations of highly valued ‘heavy’ rare earths such as dysprosium and terbium that are in limited global supply.

Canada is also developing capacity in processing and separation, producing metal and alloy, and recycling rare earth magnets. Both the federal and provincial governments have announced funding support for initiatives along the value chain, including: Processing and separation operations in Saskatchewan; scaling up separation technology in Ontario; and Quebec and Ontario-based projects to scale up technology that recovers rare earths from magnetic waste. Several Canadian rare earth projects have also drawn funding and/or interest from the private sector, as well as Canada’s allies.

Canada also has the potential to develop magnet-making capacity, given it is already an established supplier of steel, aluminium, and alloys to automotive suppliers; has strong relationships with auto manufacturers; has a low-cost, clean power grid; and Canadian workers with established skilled manufacturing capabilities. As demand for EVs increases, permanent magnet manufacturing facilities could supply EV drivetrain production in North America.

Canada benefits from its attractiveness as a destination for foreign investment due to factors like its high environmental, social, and governance (ESG) standards, wide availability of clean and relatively cheap electricity, highly regarded innovation ecosystem, and reliability and security as a supply-chain participant.

Canadian companies are also innovating around the world on projects across the value chain. Examples include rare earth separation and magnet manufacturing in Estonia (Neo Performance Materials), processing and separation in the U.S. (Ucore), and mine development in Namibia (Namibia Critical Metals, E-Tech Resources).

While we look to maximise domestic opportunities, Canada understands that improved global coordination is required to create resilient and diversified permanent magnet value chains. The concentration of critical mineral production in a few countries overseas that use non-market-based practices raises the risk of supply chain disruptions and inflated prices of key minerals and materials for Canada and its allies.

The risk inherent to this concentration of production is being accentuated by geopolitical events, which further fuels supply uncertainties. In addition, some jurisdictions have not prioritised (ESG) standards, including in the resource development activities they undertake in other countries.

In important recognition of this reality, the Critical Minerals Strategy includes a Global Leadership and Security pillar, recognising that Canada can and must be a leader in the responsible, inclusive, and sustainable production of critical minerals and resilient value chains. This aligns with an accelerating interest among Canada’s allies to pursue collective action on critical minerals in support of the global transition to net zero.

As part of the green transition, advanced manufacturers are seeking to ensure their supply chains are carbon-competitive, environmentally sustainable, and respectful of human rights. As a trusted and reliable supplier of responsibly sourced mineral and metal products, Canada is well-positioned to be a leader in the responsible, inclusive, and sustainable production of critical minerals and resilient value chains.

Work under the Global Leadership and Security pillar of the Canada Critical Minerals Strategy is well underway. Since January 2020, Canada has formalised bilateral cooperation agreements on critical minerals with the United States, the European Union, and Japan. It is actively engaging with additional allies, such as the United Kingdom and the Republic of Korea.

Canada is also actively engaging key multilateral organisations on the topic of critical minerals and the transition to net-zero by 2050, including the Organisation for Economic Cooperation and Development (OECD); the G7/G20, including the G7’s Critical Minerals Five-Point Plan; the International Energy Agency and the Agency’s Critical minerals Working Party; the World Bank Climate Smart Mining Initiative; the Intergovernmental Forum on Mining, Minerals, Metals and Sustainable Development (IGF); the International Organization for Standardization; the Extractive Industries Transparency Initiative (EITI); the Conference on Critical Minerals and Materials – which Canada will chair in 2024; and the Minerals Security Partnership.

The federal government is supporting these efforts with investments and policy. This includes $70m for global partnerships to promote Canadian mining leadership, such as promoting ESG standards and supporting bilateral and multilateral critical mineral commitments, launching a Responsible Business Conduct (RBC) Strategy to continue enhancing Canada’s regulation abroad and strengthening the global RBC ecosystem, and policy commitments – including the leveraging of our existing ‘Towards Sustainable Mining’ framework – to drive the global uptake of ‘nature-forward’ mining practices that minimise and mitigate environmental impacts and work to return the land to its natural state.

Canada is uniquely positioned to take advantage of this global context. As a mineral-rich country, we are lucky to be endowed with many of the critical minerals needed for the green and digital economy, including REEs. We have clean energy resources and are carbon-competitive. Canada has mining expertise, advanced technologies, and manufacturing capabilities, and we have strong ESG credentials. This presents an opportunity for Canada – as a trusted global partner and supplier – to play a leadership role with our key allies in creating a more diversified global supply of critical minerals, such as for REEs.

Challenges confronting the rare earth industry

The global REE market is relatively small in terms of volumes of production. In 2023, there were approximately 350,000 tonnes of all total rare earth oxides produced globally (compared to 22 million tonnes of copper, for example).

The market is also relatively opaque, with limited pricing data, high price volatility, and the majority of market share held by only a few players, which increases the risk of pricing manipulation. As the dominant producer and consumer of rare earth products, developments in the Chinese domestic market have historically been critical to the global rare earths industry.

Demand and supply dynamics are complicated by the fact that rare earths are found and extracted together despite differences in the end market for each of them, which causes oversupply for some REEs.

Beyond market factors, there is a range of technical challenges confronting the industry. For example, the mineralogy of Canadian deposits is often complex and difficult to concentrate and process. Each ore is unique and requires specialised processing to produce a mixed rare earth salt for midstream separation and refining.

These processes are capital and operating-intensive, involving multiple units of operation. Long flowsheets are required to get to a purified, separated REE product. Further technology development is required to optimise recovery and manage radioactivity where applicable. Expertise in Canada and North America is beginning to build, and further investments in highly qualified personnel will help grow this emerging industry.

Role of innovation

Natural Resources Canada’s CanmetMINING research laboratory undertook a six-year REE Research and Development program, under which several advances were made to improve recoveries and reduce capital and operating expenses of REE mining. Work under the new Critical Minerals Research, Development and Demonstration program (CMRDD) will engage directly with the industry to build on this progress and address remaining gaps.

The following are specific examples of where federal researchers and other Canadian entities are making important research advancements.

Improving grades

Low ore grade is the primary weakness for Canadian projects trying to compete with others economically. To improve this challenge, a great deal of ongoing R&D is focused on pre-concentration and mineral processing. Many Canadian REE projects are now testing pre-concentration technologies such as sensor-based ore sorting and dense media separation. Federal researchers and academia alike are testing out novel and selective chemical reagents for flotation or other mineral processing methods to overcome this hurdle.

Reducing energy intensity

Most REE processing facilities rely on high temperatures (200°C to 600°C in the Chemical Decomposition step to extract REE from the minerals. Researchers from Canadian Federal laboratories are challenging this conventional approach, and they have successfully developed early-stage processes that operate at < 100°C and are applicable and effective for processing Canadian REE minerals. Some of these patent-pending processes are in the process of scale-up.

Improving separation

The separation of REE into individual elements is conventionally undertaken through a process known as solvent extraction, which requires hundreds of separation steps. Multiple groups in Canada are evaluating options/alternatives to make this process easier. For example, the Saskatchewan Research Council is manufacturing their own proprietary solvent extraction equipment in their Rare Earth processing facility under construction in Saskatoon, supported by an investment of almost $5m from the federal government.

Additionally, Ucore has developed RapidSX technology, accelerating the separation process at reduced costs, and is currently being demonstrated at a pilot plant in Kingston, Ontario. Federal and post-secondary researchers are investigating further novel technologies that can either complement or replace solvent extraction.

Strengthening International Standards

Canadian experts in REE represent Canada in the ISO efforts to draft standards for REE. Working with international partners, Canada is helping to ensure that pertinent and comprehensive standards are developed for the mining and processing of REE ores and the production of compounds and materials to supply manufacturers of REE-containing end-products.

In addition to the potential for REE production from primary sources, Natural Resources Canada’s Mining Value from Waste Program is looking to identify sources of critical minerals, including REE, from existing mine tailings. Reprocessing these tailings and repurposing the remaining residues would result in a pathway to creating a fully Canadian value chain while reducing the liability from long-term tailings storage.

Made-in-Canada processes are required to reduce processing steps, costs, and chemical and energy intensity while providing improved environmental performance. An important step is the piloting and demonstrating these novel processes to ensure successful scale-up and provide investor and regulator confidence.

Mining innovation is being driven by the needs of the net zero economy, and Canada is a global leader in this space. The Government of Canada is uniquely positioned to leverage our world-leading labs. We are working to catalyse the private sector to accelerate technological innovation in Canada’s critical minerals sector and associated industries, enhancing Canadian competitiveness and environmental performance.

Canada’s potential in the rare earths market

The net-zero energy transition, building a digital economy, and ensuring national security require a reliable and sustainable supply of neodymium magnets. The current status quo, with one non-market economy dominating production across the value chain, is untenable.

While no single country is going to address global capacity shortfalls at every stage, Canada is well-positioned to play an important role in diversifying supply. Canadian companies are already key global players in this market, and even more are stepping up with promising projects.

Through strengthened partnerships with provinces and territories, Indigenous communities, industry and international allies and partners, Canada can build on current positive momentum and see some of these projects through from pilots and demonstrations into commercial production. Canada continues to work closely with and support our like-minded international partners in critical mineral security through collaborative efforts to ensure secure, reliable, and sustainable global supply chains for the minerals and metals needed to meet our net-zero ambitions.

Canada is well positioned to be a global leader in critical minerals given our innovative industries, strong ESG credentials, clean energy, and regulatory regime. We know the race to net zero provides a tremendous and historic opportunity, and Canada is leading the way.