As Argentina’s leading vanadium explorer, NewEra’s strategic vanadium portfolio, including former mine sites, offers investors excellent growth and blue-sky potential in a virgin vanadium district.

NewEra Metal Resources Limited, a private UK-registered natural resources company (No: 10262618), is Argentina’s leading vanadium exploration company with 30 strategically-located exploration licences covering ten project areas, including concessions at, adjacent, or proximal to former mine sites in the Neuquén Basin of central Argentina. Vanadium is an important ‘credit metal’ at NewEra’s uranium projects which are also located in this 120,000km2 basin. Through its expanding project portfolio, the company’s business strategy in Argentina provides investors with direct exposure to clean energy and energy storage markets, including critical metals, such as vanadium, which are key commodities in the global energy transition now underway.

Located in the pro-mining department of Malargüe, southern Mendoza Province, NewEra’s vanadium projects are fully compliant with Mendoza’s mining code. This, together with its local experienced team and the support afforded by the provincial government, places NewEra in a very strong position to become Argentina’s first vanadium producer. Importantly, this will also make a significant and sustainable contribution to the socio-economic development of the Malargüe Department.

Vanadium in South America

South America’s excellent and diverse geological prospective for battery metals, together with being the fourth largest continent, makes it a highly desirable region for battery metal exploration. Vanadium exploitation in the region is best known from Minas Ragra in central Peru (American Vanadium Corporation, 1906 – 1956), and the Maracás Menchen mine (Bahia state, Brazil), discovered in 1981 and today operated by Largo Inc. (TSX: LGO). Despite the ubiquitous presence of vanadium in the Neuquén Basin, there has been no exploration since the 1940s.

While the traditional use of vanadium to strengthen steel continues to lead market demand, it is the metal’s use in battery manufacture, namely vanadium redox flow batteries (VRFBs), which is expected to have the biggest impact on future demand. The World Bank projects that annual vanadium demand will increase by 189% of 2018 annual production by 2050.

Vanadium batteries

The two electrical terminals of batteries, namely anode and cathode, are separated by a chemical material called an electrolyte. Irrespective of battery function, such as energy generation or energy storage, these three components require metals – the choice of which can influence battery performance and safety. VRFBs, a type of rechargeable battery, use vanadium’s ability to exist in a solution in four different oxidation states to make a battery with a single electroactive element instead of two. A vanadium redox battery consists of an assembly of power cells (positive and negative half-cells) in which two vanadium-based electrolytes are separated by a proton exchange membrane. Vanadium constitutes approximately 80% of a VRFB. For several reasons, including their relative bulkiness, vanadium batteries are typically used for grid energy storage, i.e., attached to power plants/electrical grids.

The relatively recent emergence of VRFBs not only has a fascinating connection to South America but also to bitumen – the host rock for vanadium mineralisation at NewEra’s Argentine projects. Despite the efforts of various researchers, including NASA, since the 1930s, it was the pioneering work of an Australian chemical engineer (Professor Skyllas-Kazacos) on vanadium redox batteries which resulted in her design being patented by the University of New South Wales (UNSW), in Sydney in 1986.

In Japan, a Mitsubishi subsidiary was using orimulsion made from Venezuelan pitch in their power stations. Orimulsion is a trademark name for a bitumen-based fuel developed by Petróleos de Venezuela S.A.(PDVSA) in Venezuela. Orimulsion is very rich in vanadium, and so Mitsubishi was looking at ways to realise value from the large amounts of vanadium-rich waste product at its power stations. UNSW licenced its technology to Mitsubishi, and in 1995 it installed the first industrial-scale vanadium battery at its power stations in Japan. This first patent only expired in 2006, thus allowing others to operate in this market and seek funding for research on vanadium flow batteries. Today, numerous companies and organisations globally are involved in funding and developing vanadium redox batteries.

Vanadium in Argentina

In ‘heavy oils’, such as those of South America, asphaltenes contain approximately 40-90% of total vanadium and 25-75% of total nickel. The summed concentration of vanadium and nickel in heavy oil asphaltenes can reach 1 wt%. The oils and their source rocks from South American basins are characterised by having a high vanadium (and nickel) content. Bitumen is genetically linked to oil, thus explaining the high concentration of vanadium in bitumen of the Neuquén Basin.

The Minas Ragra vanadium mine in Junín Department, central Peru, was discovered by the United States Geological Survey (USGS) in 1905 and operated by the American Vanadium Corporation (AVC) from 1906-1956. By 1914, 75% of the world’s vanadium ore production was sourced from Minas Ragra, which remains the world’s highest-grade vanadium deposit ever known. It was the AVC’s highly successful exploitation of this bitumen-hosted vanadium mine which led them to the Neuquén Basin in search of similar vanadium deposits.

A joint survey with La Direccion General de Fabricaciones Militares, led by the AVC in 1946, resulted in the discovery of > 100 vanadium-rich bitumen occurrences along a 500km north-south belt through the provinces of Mendoza and Neuquén. They identified various sub-districts, including the Malargüe sub-district.

Bitumen mining in Malargüe, e.g., La Valenciana and Minacar mines, reached peak production during the 1940s when wartime embargo’s cut off the supply of British coal to Argentina. Bitumen became useful as fuel for railway locomotives, or for steelworks. Post-combustion geochemical analysis of the ash showed it to be rich in vanadium. During this time, and since, there has been no exploitation, or investigation of vanadium in Malargüe. In fact, two of the AVC report conclusions stated that “under favourable conditions of recovery, the vanadium can add commercial value” and “combustion characteristic analysis and gas production potential studies, could add further economic value, e.g., electricity generation and hydrogen production.”

NewEra in Argentina

NewEra Metal Resources’ exploration work since 2018 has included a review of the AVC data and an independent satellite and structural study over 8,000 km2 of the Malargüe sub-district. This has led to application for 30 exploration licences (cateos) for a total of approximately 37,000ha in ten priority project areas, including areas of historic production. Environmental reports have been completed at three projects. The company has identified an environmentally-friendly processing solution and a prominent international buyer for its vanadium.

Projects overview

Location

NewEra’s projects are located in the Department of Malargüe, southern Mendoza Province. The projects are well-served by national route 40 from the provincial capital Mendoza, some 420km to the north. The department capital of Malargüe is central to the projects, and its excellent infrastructure includes inter-provincial air links, two planned industrial parks immediately south of the town, and Pata Mora close to the southern department boundary with Neuquén Province. The Chilean port of Concepción is situated 550km from Malargüe town and is accessible via the paved cross-border national route 40 to Tacla (320km) in Chile. It is envisaged that a project processing plant would be located at either the Malargüe or Pata Mora site.

Geology

Bitumen veins are common in sedimentary basins worldwide, and the Neuquén Basin is thought to contain the most widespread bitumen veins globally. Geologically, NewEra’s licences are located within the Malargüe fold-and-thrust belt (FTB), which is situated on the eastern side of the Andes in the Neuquén Basin. The solid bitumen veins occur in a region exceeding 500km in length and 100km in width, parallel to the Andean trend.

During a period of thermal subsidence of the basin (around 150 million years ago), the deposition of dark, organic marine shales of the Vaca Muerta Formation (Mendoza Group) occurred in a number of depocenters. These shales (Fig. 1) are the most important hydrocarbon source rocks. Approximately 70 million years ago, compression led to the inversion of the basin, formation of the Malargüe fold-and-thrust belt (FTB), and Vaca Muerta source rocks and bitumen veins being thrust to, or close to the surface in the cores of fold structures, including the prominent Malargüe Anticline. This near-surface mode of occurrence has potentially important project economic benefits.

It is assumed that some of the bitumen veins propagated upwards through as much as 8,000m of overburden, as far as sediments at the surface.

This would make the veins as deep as they are long. Bitumen occurrences generally occur near Tertiary or Quaternary age volcanic provinces, and veins are clustered sub-symmetrically around intrusions, typically andesite. This is true for the Minacar (Fig. 2) and La Valenciana (cover photograph) mines, and also for the bitumen occurrences at the company’s Aida, El Toki, and Los Castanos projects. NewEra has a 4,300 ha. project over the La Valenciana mine, and a project along strike, and adjacent to the Minacar mine.

The Minacar and La Valenciana mines were exploited commercially during the 1940s. Reconnaissance work was completed during the remainder of the AVC discoveries, and small-scale exploitation is thought to have occurred at Aida and Los Castanos/Mallin Largo. Bitumen vein dimensions of lengths up to 8km, and thicknesses up to 4m, with localised thickening to 30m (Minacar), are reported from the limited, and near-surface exploration completed during the 1940s and earlier. The deposits are often comprised of one or more veins, laterally or vertically, at more than one stratigraphic horizon, e.g., Minacar.

Mineralisation

The bitumen veins of the Neuquén Basin are metal-rich, e.g., discrete inclusions of vanadium-bearing mineral phases. These phases include vanadium-bearing iron oxide (up to 0.8% V) in bitumen at NewEra’s Mallin Largo project, and a vanadium-bearing aluminosilicate (up to 1.0 wt.% V) in Buta Ranquil bitumen (Neuquén Province).

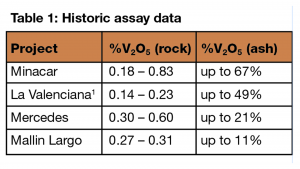

Limited historical vanadium assay data is available from the AVC (1947), and this is reported for bitumen rock and bitumen-derived ash in Table 1. Only a small number of samples were assayed (2-24 samples).

1An assay of 1.37% V2O5 and 0.3% Ni was reported in 2018.

Why invest in NewEra Metal Resources?

- A leading vanadium explorer in Argentina with ten vanadium projects (plus potential nickel

credits), and additional exposure through three uranium projects with associated vanadium (and

copper).

• ‘First mover’ status in the prospective and unexplored Neuquén Basin.

• Potential first Argentine vanadium producer and supply chain opportunity.

• Near-surface vanadium ore, gives a low-cost development scenario.

• Excellent infrastructure and project access.

• Self-sustainable, environmentally-friendly processing solution identified.

• Ore processing to produce energy – electricity and/or low-carbon hydrogen.

• Projects are fully compliant with the Mendoza mining code (ore is an industrial mineral).

This article contains forward-looking statements, including but not limited to comments regarding predictions and projections. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements.

Please note, this article will also appear in the thirteenth edition of our quarterly publication.