As demand for lithium soars, Lithium Energi Exploration Inc. (LEXI) is set to seize this global lithium market opportunity, thanks to its strategic location, innovative technology, geopolitical acumen, and commitment to responsible mining.

The global energy landscape is undergoing a seismic shift. As the world grapples with the urgent need to transition to cleaner and more sustainable energy sources, one element has emerged as a linchpin in this transformation: lithium.

The soft, silvery-white alkali metal, primarily used in rechargeable batteries, is a central focal point for the world’s efforts to electrify transport and store renewable energy. However, the burgeoning demand for lithium presents both opportunities and challenges for the industry.

A global lithium market opportunity

According to the International Energy Agency, there were 16.5 million electric cars on the road in 2021. That’s triple the amount from 2018, and this number is expected to reach 125 million by 2030.

This exponential growth in the EV market will drive robust demand for lithium, as lithium-ion batteries are the preferred choice for electric vehicles due to their high energy density and long lifespan.

Lithium-ion batteries are also used in energy storage systems to store the electricity generated by renewable energy. As countries worldwide strive to reduce their carbon emissions and transition to renewable energy, the demand for lithium for energy storage is also expected to rise significantly.

Meeting this growing demand for lithium will be a significant challenge. The lithium industry will need to invest heavily in new production capacity and improve the efficiency of lithium extraction and processing technologies. There will also be a need for more responsible methods of lithium production to minimise the environmental impact of lithium mining.

LEXI: Rising to meet the demand

Lithium Energi Exploration Inc. (LEXI) is a green energy company focused on acquiring and developing lithium brine assets in Argentina’s Lithium Triangle, one of the world’s most lithium-rich regions that currently accounts for 40% of the world’s lithium production.

This region, known for its vast salt flats and high-altitude landscapes, is a lithium treasure trove. LEXI has managed to consolidate one of the largest lithium brine claim portfolios in the region not owned by a producing company.

LEXI’s exploration projects are strategically divided into four separate campaigns, each with unique characteristics and potential. These include Antofalla Norte, Antofalla Sur, Trila JV, and Hombre Muerto Norte.

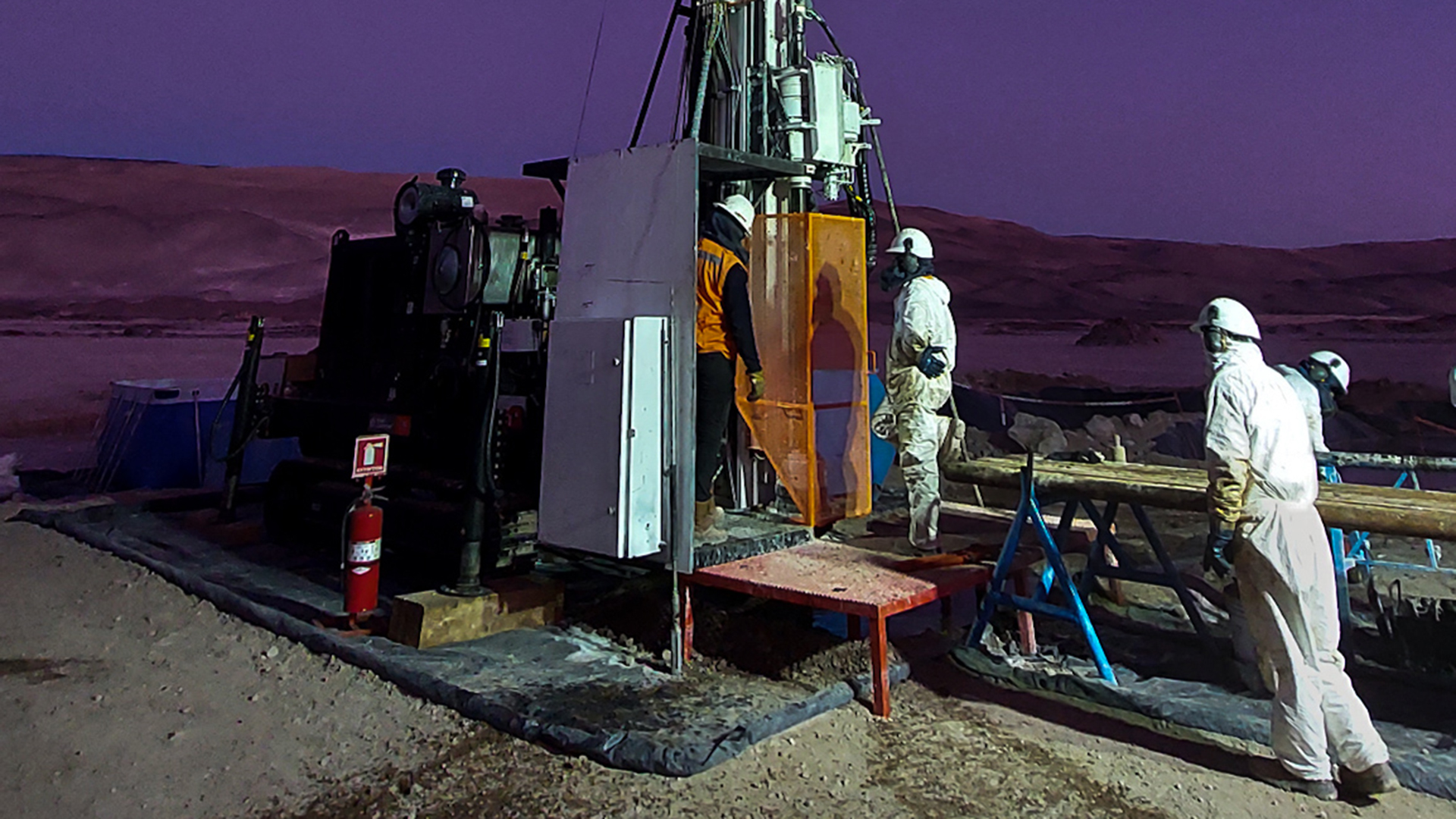

“By the time this article is published, we will have broken ground in Argentina and begun our first well of the Antofalla Norte campaign,” explained Ali Rahman, CEO of LEXI. “Simultaneously, we will conduct geophysics studies in our southern properties while drilling in the north.”

A competitive edge through technology and talent

But location and resources are just part of the equation. What makes LEXI stand out is its innovative approach to lithium extraction.

In a partnership with IBAT, LEXI has access to the world’s first and only modular direct lithium extraction (DLE) process. This cutting-edge technology offers a more efficient and economical method of lithium extraction that is not only cost-effective but also more environmentally responsible.

Rebecca Paisley, a board member of LEXI, brings the company her expertise and significant field experience as a respected geologist.

Highlighting the role of DLE in lithium extraction, she said: “DLE requires a much smaller footprint and significantly reduces water loss. If you’re evaporating water for 18 months and you double the concentration, that’s because you’ve lost 50% of your water.

“And it’s not water that has been removed and then can be reprocessed like it is in DLE. It’s lost to the environment, it’s lost to the atmosphere.”

She continued: “Each salar in the lithium extraction process has a unique geology, and even within a single salar, there can be considerable heterogeneity.

“Understanding these unconventional extraction methods and how successful they can be and how closely related that is to the chemistry of the waters is something I have a lot of experience in.”

Dr Paisley explains the difference between evaporation ponds and DLE

“The fundamental difference between evaporation ponds and DLE is how you isolate the lithium. In evaporation, you’re trying to remove everything else from the water so only the lithium is left. Through evaporation, you’re losing water molecules, and the lithium gets concentrated. This process results in a lot of loss in terms of water and salts deposited in the evaporation ponds. If you see satellite images from space, the different colours are due to the salts left behind.

“With DLE, regardless of the specific method you’re using, you’re just trying to extract the lithium and not touch everything else. This approach reduces your environmental impact. You isolate the lithium through adsorption technologies or ion exchange technologies and let the water pass straight through. Then you have a brine minus the lithium left over, which you can return to the subsurface. This brine can interact again with the deposits with the original lithium enrichment, potentially allowing for some recharge. You may well extend the life of that system because you’re keeping the net volume of water very similar. That’s the fundamental difference, and it’s why DLE is environmentally so much better. You’re doing far less removal of materials.”

Argentina is an ideal location to set up business. Over the past few years, Argentina has demonstrated a robust regulatory structure, committing to the private sector as the primary driver of investment in the lithium sector and the broader critical minerals and metals sector.

The company has a strong team in Catamarca, Argentina, led by Dr Gerardo Romero, a well-known attorney and businessman in Catamarca with decades of experience and a great relationship with the local government.

“One of the key lessons I’ve learned from my global business experience is the importance of having a strong local team to execute your strategy,” Rahman said. “It’s good for company culture and the community and significantly contributes to the company’s operational efficiency and success.”

A strategic investment and a commitment to ESG

This focus on responsible production isn’t just lip service. It’s a strategic move that aligns with the growing emphasis on responsible environmental and social practices, and good governance (ESG). As consumers and investors alike increasingly prioritise ESG practices, LEXI’s commitment to responsible lithium extraction enhances its appeal and competitive edge in the market.

LEXI holds a unique appeal for ESG-conscious investors. The company is committed to producing lithium through DLE from brine, the cleanest and greenest way to produce lithium.

Rahman explained: “If an investor is driven by supporting the cleanest, most environmentally and socially conscious method for producing lithium, they won’t find a better option than investing in lithium production from DLE, as LEXI offers.”

The compelling case for investing in LEXI lies in the significant gap between the company’s market capitalisation and its intrinsic value.

“LEXI’s intrinsic value, even at this stage, is considerably higher than its current market cap. This discrepancy is evident when you consider the company’s land package,” Rahman said. As LEXI continues to explore and understand its resources, this gap is expected to become even more apparent, making LEXI a compelling investment in the lithium space.

“LEXI has a great opportunity to grow tremendously and become a market leader by assembling a strong team, leveraging our unique skill set, and effectively communicating our message,” explained Thomas Lefebvre, an experienced and accomplished infrastructure investor, and entrepreneur who also serves on the LEXI boards of directors.

“We must differentiate ourselves from other players in the industry to maximise our potential for success. By focusing on innovation, sustainability, and quality, LEXI can capitalise on the ever-growing demand for lithium while preparing for any potential market shifts.”

The green energy future looks like the past

Investing in LEXI is not just about investing in a company; it’s about investing in the future of our planet.

As the world moves towards a decarbonised future, lithium is indispensable. The companies involved in the exploration and production of lithium will be critical to this future, and those with large and productive resources will be akin to the oil companies of the past.

Rahman highlighted: “If we draw an analogy between the building of the hydrocarbon world and the building of a decarbonised world, we can see a similar trajectory for the companies that participate in the supply chain of the energy transition.”

He further elaborated that “these companies, which control and produce the metals and minerals required for a decarbonised world, will be the investments of the future.”

Geopolitics is also a significant factor influencing policy and economics in the natural resources sector. LEXI Leadership has an extensive network of relationships, both commercial and political. This network distinguishes it from its peers, particularly when considering companies with a similar market cap.

“Without a grasp of geopolitics and an understanding of its current state and likely future direction, many natural resource companies can find themselves caught off guard by market shifts,” stated Rahman.

“I’ve briefed American and Argentinian officials, both elected and appointed, on critical minerals and how the industry will affect not only their economies but also geopolitics.

He concluded: “My diverse experience, understanding of geopolitics, and extensive network of relationships equip me uniquely to drive LEXI’s growth and success. I am prepared to leverage all these assets to help LEXI navigate the challenges and seize the opportunities in the dynamic lithium market.”

A vision for the future

Looking ahead, LEXI is focused on proving its lithium resources. “We aim to ensure that LEXI is seen as a competent player in the lithium market by demonstrating a smart, well-balanced drilling programme,” said Lefebvre.

“By showcasing determination and ability to produce lithium from its acreage, LEXI aims to prove to the market that they are among the few who can actually make it happen.”

Four main challenges and opportunities facing the lithium exploration industry

Environmental concerns: The lithium extraction process can lead to the depletion of local water sources or pollution of groundwater and surface water. At LEXI, we aim to operate with the utmost respect for the environment and implement responsible extraction practices to minimise our footprint. By imposing the best standards on our operators, we strive to emerge as the best-of-breed operator in the lithium space.

Political risks: Our management at LEXI has established strong relationships with local political leaders while maintaining a neutral stance. We are committed to maintaining operational continuity during governmental changes or political shifts.

Technical challenges: The lithium extraction process is complex, with challenges related to mapping acreage, ensuring successful drilling programs, and managing midstream operations. Our leadership at LEXI has a strong background in oil and gas, which provides valuable insights into addressing these technical challenges. We leverage top-notch technology and remain vigilant for competing technologies that could impact lithium prices or our operations.

Competitive environment: The lithium exploration industry is characterised by competition from other exploration companies. At LEXI, we know potential risks, such as resource depletion due to neighbouring operations. We are prepared to navigate local market imbalances and pricing pressures.

Lefebvre concluded: “What excites me about the lithium industry is the growing demand for lithium as a critical component in batteries and high-tech applications. As demand continues to rise, LEXI is well-positioned to capitalise on these opportunities while addressing the inherent challenges in the industry.”

Overall, the lithium industry is set to evolve significantly in the coming years due to the increasing demand for lithium-ion batteries in various applications, such as electric vehicles and renewable energy storage.

LEXI is well-positioned to capitalise on these opportunities while addressing the inherent challenges in the industry. Lithium Energi Exploration Inc is a pioneering company that is strategically positioned to play a critical role in the global energy transition.

With a strong commitment to ESG, a robust local presence, pioneering exploration projects, a competitive edge in technology, and a clear vision for the future, LEXI is not just a company; it’s an investment in the future of our planet.