Energy Transition Minerals Ltd’s Kvanefjeld project can potentially satisfy Europe’s need for rare earths for the foreseeable future.

Energy Transition Minerals Ltd (formerly Greenland Minerals Limited) is an ASX-listed company, (ASX:ETM). The company aims to develop mineral projects to meet the growing need for critical materials vital to global de-carbonisation and the accelerating transition to renewable energy systems.

In particular, the company’s two current projects, the Kvanefjeld rare earth project in southern Greenland and the Villasrubias lithium project in Spain, aim to meet this increasing demand.

Kvanefjeld rare earth project

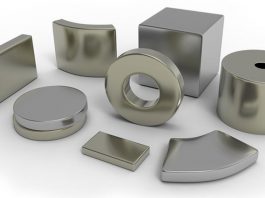

The company has focused on developing its 100%-owned Kvanefjeld project since 2007. Kvanefjeld is one of the world’s most significant and most critical undeveloped projects with the potential to be an essential world-class supplier of rare earths, in particular the group of ‘magnet metals’ (neodymium, praseodymium, terbium and dysprosium) which are the keys to an energy-efficient and environmentally-sustainable future.

The Kvanefjeld project has an established (JORC 2012 compliant) mineral resource of more than one billion tonnes, within which is an ore reserve of 108 million tonnes, sufficient to sustain a 37-year mine life. The size of the resource and the rate of conversion of resources into reserves suggest that the project could operate for significantly longer than the initially planned 37 years.

Kvanefjeld is a globally significant, shovel-ready project that can safely and environmentally sustainably meet Europe’s need for rare earths for the foreseeable future.

In addition, when in production, the project would provide the Greenland Government with an estimated US$22.8bn in tax revenue over the 37-year mine life. This revenue would be a significant contributor to Greenland’s economy in terms of GDP.

Recent challenges at the Kvanefjeld project

In April 2021, a snap election took place in Greenland. Once in power, the newly elected Government of Greenland introduced legislation to block the progress of the Kvanefjeld Project. This legislation was enacted in December 2021 as Greenland Parliament Act No. 20 of 1 December 2021 to ban uranium prospecting, exploration, and exploitation.

Under Act No. 20, no prospecting, exploration, or exploitation of a mineral resource is allowed if the average uranium content of the total resource is above 100 ppm. The Kvanefjeld deposit contains uranium at a low concentration of approximately 360 ppm, co-mingled with significant rare earth elements mineralisation.

From the commencing of operations in Greenland in 2007, the company worked cooperatively with all former governments with the joint aim of advancing the project to development. These governments promoted the Kvanefjeld project as one of the country’s leading mining projects at global forums, including at PDAC, arguably the world’s largest mining conference held annually in Toronto.

The company was, on numerous occasions, invited by the government of the day to present on the government’s behalf at these forums. Regulatory and legislative changes were implemented by both Greenland and Danish Parliaments that provided greater certainty to the company and its investors of the right to develop the Kvanefjeld project.

With the required legal framework in place and having completed its exploration and feasibility work in accordance with the exploration licence, the company notified the Greenland Government that it had delineated a commercially viable resource of rare earths, zinc, and uranium at Kvanefjeld which it intended to exploit, the requirement to be legally entitled to receive an exploitation licence.

In April 2020, the Greenland Government wrote to the company, confirming that it had satisfied the conditions under the Minerals Resources Act to be entitled to an exploitation licence for the Kvanefjeld project and set out the remaining steps to be completed for the licence to be issued (namely the approval of the Environmental Impact Assessment (EIA) and Social Impact Assessment (SIA) and completion of the community consultation process).

Exploration licences in Greenland are based on a set of ‘standard terms’ and the Danish Mineral Resources Act, both of which date back to the 1990s. They were drafted with the specific objective of attracting foreign mining investors to Greenland.

To achieve this investment promotion objective, the Standard Terms include a provision (Section 1401) which reads (in relevant part) as follows:

‘If the licensee has found and delineated commercially viable deposits which the licensee intends to exploit and provided the terms of this licence have been complied with, the licensee is entitled to be granted an exploitation licence.’

On 18 December 2020, the government formally approved the company’s EIA and SIA for public consultation. The company and the relevant Government authorities (Greenlandic and Danish) then commenced the joint process of community consultation on the EIA and SIA.

Initially, the consultation period was scheduled for 12 weeks. It was extended to 38 weeks, before unfortunately being derailed.

The company’s preferred course of action has been, and continues to be, working constructively with the Greenland Government to address any legitimate concerns. This was demonstrated when the company lodged an amended exploitation licence application in December 2022 where only rare earth, zinc and fluorspar would be exploited, and all uranium extracted as part of the mining process would be separated and stored safely in the tailings facility.

In June 2023, the government formerly rejected the company’s initial exploitation licence application. The rejection relied solely on the application of Act No. 20. In September, the government previously dismissed the company’s amended exploitation licence application.

Arbitration with the Government of Greenland

Following the passing of Act No. 20, the company met on several occasions to discuss potential options that would allow the project to proceed. The government refused to even consider any workable compromises, and the company was left with no other alternative than to initiate arbitration, a right under the standard terms of the company’s exploration licence.

In March 2022, the company commenced arbitration with the Government of Greenland, naming the Danish Government as a second respondent, primarily to obtain confirmation of its rights under the exploration licence – the board of arbitration comprising three arbitrators seated in Copenhagen. The company’s legal costs are being funded through a litigation funding agreement with Woolridge Investments LLC, a subsidiary of Burford Capital Limited. The litigation funding agreement is a non-recourse facility, repayable only on a successful outcome of the case.

A Statement of Claim was filed with the arbitral tribunal on 19 July, 2023. The Statement of Claim provides a detailed account of the company’s activities in Greenland over a 14-plus-year history. The Statement of Claim is supported by several independent expert reports, witness statements and approximately 1,900 pieces of evidence.

The independent expert reports include an independent valuation prepared by the Canadian firm Secretariat, which specialises in quantifying damages. Secretariat has valued the Kvanefjeld project at US$7.5bn (US$7.2bn excluding uranium), an interest component taking the provisional damages claim to US$11.5bn.

The main objective of the arbitration is to have the right to an exploitation licence re-instated. If these rights are not re-instated, it will be argued that the company has been expropriated of its acquired rights, and damages will be sought for the expropriation.

Spanish lithium projects

On 14 July 2022, the company announced that it has entered into a binding head of agreement with Technology Metals Europe SL (‘TME SL’) and its sole shareholder, Welsbach Holdings Pte Ltd, for the right to earn-in a 51% interest in TME SL. TME SL is the sole owner of an exploration permit in Spain prospective for lithium, known as the Villasrubias project.

The Villasrubias project is authorised by research permit No. 6914, granted to SIEMCALSA in 2019, which allows exploration for lithium, tin, tantalum, and niobium over an area of 11.4 km2. The Iberian Peninsula has a lithium and tin mining history, and Villasrubias itself has historical tin mines dating back to the 1940s.

The company can earn its interest in TME SL by spending AU$3m on a jointly agreed work programme concerning the Tenement within three years. The three-year period commenced on 28 October 2022, when the company obtained shareholder approval for the transaction.

Exploration activity at Villasrubias started in December 2022, including a drone aeromagnetic and electromagnetic survey, a very low-frequency electromagnetic tomography survey, and geological mapping, sampling, and trenching to identify the extension of pegmatite bodies. The results of the exploration will be shared as they become available.

A maiden drill programme comprising 1,133m across 12 holes commenced in March 2023. The results of this maiden were released in July. In terms of significant findings, the following points were highlighted:

• Nine holes intersected at least one pegmatite/aplite body, with thickness ranging between 0.28 and 2.90m;

• The intersected pegmatite bodies were mineralised with varying lithium, tin, and tantalum grades;

• Lithium occurs in the form of lepidolite; tin and tungsten are believed to be hosted within cassiterite and scheelite respectively; and

• High tantalum grades were identified in multiple drill holes, representing a novel discovery for Villasrubias. A follow-up second drill programme is scheduled for the second half of 2023.

Additional exploration licence applications

Energy Transition Minerals Ltd incorporated a wholly owned subsidiary in Spain, Energy Transition Minerals Spain (‘ETM Spain’). ETM Spain will become the legal owner of ETM’s Spanish projects and assets and spearhead the company’s expansion into the upstream lithium and energy transition minerals sector in Europe.

Furthermore, Energy Transition Minerals, through Technology Metals Europe (its partner in Spain), has applied for four new lithium-tin-tungsten exploration licences (‘permiso de investigación’) in the provinces of Salamanca and Cáceres, Western Spain, named ‘Aldeadávila’, ‘Hinojosa’, ‘El Payo’, and ‘Salvaleón’. ETM Spain will hold the permits, each providing priority and exclusivity for three years over 177.3 km2.

Once granted, Energy Transition Minerals will hold Europe’s largest lithium exploration licence area. The company is preparing initial exploration programmes to commence as soon as the licences are officially granted.

The company remains committed to developing the Kvanefjeld project and looks forward to working with the Government of Greenland on viable development paths. The company will continue to work with Greenland communities to address any concerns and develop the Kvanefjeld project in a manner that will minimise environmental impacts and provide benefits to Greenland for decades ahead.

Exploration and evaluation work on the Villasrubias lithium project will continue and will be complemented by exportation work on the new licence areas.

The company has been actively reviewing opportunities to acquire new technology metals projects to increase the company’s asset portfolio, provided it creates shareholder value.

Please note, this article will also appear in the sixteenth edition of our quarterly publication.