Ashley Burke, Senior Vice President of Communications at the National Mining Association, addresses whether US production of critical minerals is sufficient to meet the rapidly increasing demand and the domestic supply chain targets established by the government.

Vital components for use in batteries and modern technology, critical minerals are essential to national and economic security across the globe. Domestic supply chains for these minerals, however, are lacking, and many countries are heavily reliant on imports from countries such as China.

The United States is a key example here. Despite having large reserves of critical minerals, including lithium; graphite; rare earth elements; and cobalt, the US is largely import reliant.

With an ever-increasing demand for materials used in green technologies and electric vehicles to meet global energy transition targets, it is clear that countries must work hard to overcome challenges and secure strong and stable domestic critical minerals supply chains.

In a bid to do so, the Biden Administration has made strides towards securing a ‘Made in America Supply Chain for Critical Minerals’, with a range of investments in the domestic production of key critical minerals and materials.

This commitment stands alongside various policies designed to accelerate research and development in the field of critical minerals, including the Energy Act of 2020; the Bipartisan Infrastructure Law (BIL); and the Inflation Reduction Act (IRA).

Although the investment announcements and policies set out a direction to improve America’s domestic supply chains, the question remains as to whether they are enough to meet the rapidly rising demand.

In search of an answer to this question, The Innovation Platform spoke to Ashley Burke, Senior Vice President of Communications at the National Mining Association – the trade organisation serving as the voice of the US mining industry.

What does the US critical minerals supply chain currently look like?

Despite having robust mineral reserves, the US critical minerals supply continues to be unnecessarily import dependent.

This year’s United States Geological Survey (USGS) Mineral Commodity Summaries report found that the US is more import reliant than ever for the minerals needed by our manufacturing, technology, energy, transportation, infrastructure, and defence sectors.

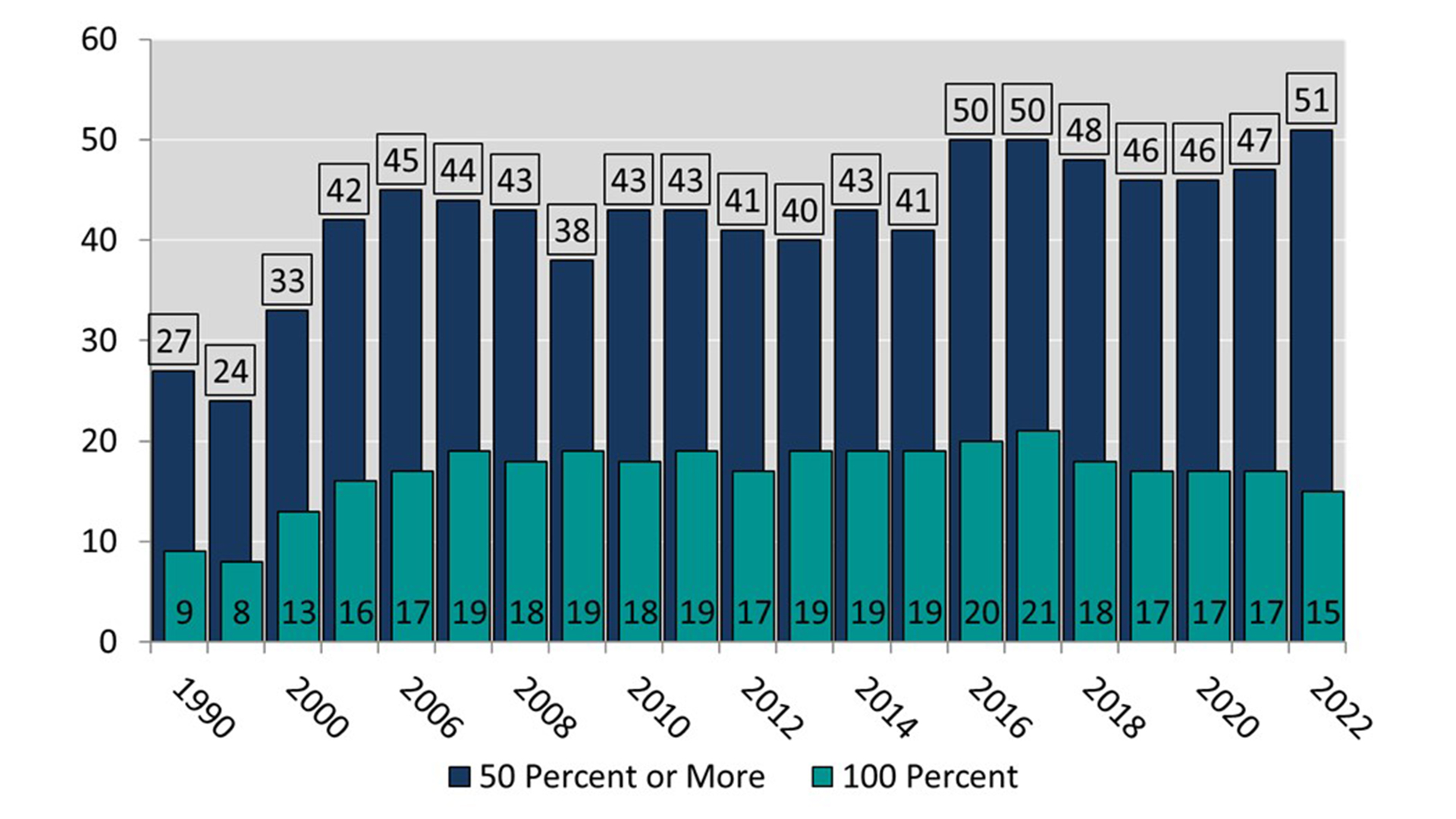

In 2022, imports made up more than one half of the US’ apparent consumption for 51 non-fuel mineral commodities. This has increased since 2021, when we were more than one half of the US’ apparent consumption for 47 non-fuel mineral commodities.

Digging into that deepening import dependence, China is the top supplier of the minerals our economy needs.

The following chart on import reliance shows the number of minerals for which we are 50% or more import reliant, and how this problem continues to grow year after year.

How has recent policy changed the direction of the US supply chain for critical minerals?

Unfortunately, it hasn’t. There is a massive gap between the Biden Administration’s stated energy priorities and the domestic availability of the minerals that are essential to its success.

Despite this clear reality and abundant domestic reserves, instead of increasing support for domestic mining, we are hearing more about US deals to source minerals overseas than we are about mining projects being approved here at home.

America’s growing domestic mineral needs have led us to the highest mineral reliance in our country’s history, yet the Administration seems to be doubling down on this glaring and growing vulnerability and placing obstacles in the way of a domestic supply chain instead of removing them.

Very few mines are getting approved here in the US. The Administration’s decisions continue to make it more and more difficult to mine in the US. Recent examples include the Department of the Interior’s withdrawal of hundreds of thousands of acres of mineral-rich lands in Minnesota from potential mining.

And the Environmental Protection Agency’s pre-emptive veto of a mining project in Alaska, which also more broadly blocks any future development across a broader area vastly exceeding the size of the proposed mine.

Instead, we are sending jobs overseas. The Administration has focused only on mineral agreements with Canada, the EU, the UK, and Japan. In one instance, pursuing an agreement with the Democratic Republic of the Congo, Zambia, and Indonesia to counter China’s control of EV battery mineral supply chains.

These decisions provide short-term solutions for an immediate material demand surge, but ignore long-term, systemic domestic supply chain problems that could be solved right here at home.

What would you outline as the major challenges that still need to be addressed to enable the supply chain to flourish? How can this be done?

Permitting mines here at home is the number one challenge. We believe policymakers should recognise that the success of the energy transition and pivot to electric vehicles will be defined by the strength, scale, and speed of US domestic mining operations.

To meet the massive anticipated increase in mineral demands, we need an all-of-the-above mineral strategy that starts with domestic mining.

What are your predictions and hopes for the future of US critical minerals supply?

Given the bipartisan support that exists for permitting reform, Congress should take targeted action to streamline the permitting process that includes: setting timelines on legal action and challenges; setting limits on Executive Land Withdrawals; setting timelines on steps in the federal permitting process; and implementing permitting process reforms contained in the Bipartisan Infrastructure Investment and Jobs Act.

Please note, this article will also appear in the fifteenth edition of our quarterly publication.