CJ Evans, Founder and Managing Director of American Diversified Enterprises (ADE), shares insights on funding programs to fuel the energy and climate revolution.

Governments with serious mandates and innovators with bold new solutions need to be able to connect. That is what American Diversified Enterprises (ADE) does every day. It assists top international innovators in connecting with forward-thinking public servants, commissioners, policymakers, and key stakeholders with the means, vision, and wherewithal to advance technological innovations that will save the planet – in renewable energy, renewable chemicals, bio-based and hydro-based products, clean fuels, agriculture, sustainable materials, and numerous other sectors.

As global sources of funding open up to meet the world’s urgent environmental challenges, ADE successfully enables businesses to secure major, meaningful project support for the earliest stages of development up through implementation, deployment, and operation at commercial scale. Its core mission is to aid innovation and accelerate solutions for stakeholders.

Growing consensus on the urgency of the planet’s collective challenge

Years of observed severe climate change, concerted global research, and increasing public awareness have led to a near-universal – albeit belated – consensus that the degradation of our environment must be addressed urgently, aggressively, and at scale for humanity and other species to survive and thrive. The threat is global, and interconnected, making it imperative that governments and innovators share best practices across borders and collaborate when feasible.

Interests have aligned in 2023, as detailed below.

Public sentiment is galvanised

Majorities in all 40 nations polled in 2016 by the Pew Research Center agree that climate change is a serious problem; moreover, 54% stated that urgent solutions are needed.1

Support and awareness has increased

Support and awareness has increased as the impacts of climate change have become more intense and affected more places and people. A 2021 study by Yale University2 shows that pluralities of people in the US – from 57-77%, from all areas of the US and all political persuasions – are worried about global warming: (65%), believe it will harm plants and animals (71%), will affect people worldwide (68%) and in the US (64%), and harm future generations (71%). A plurality also support research into renewable energy sources (77%), regulating CO2 as a pollutant (72%), setting strict limits on existing coal-fired plants (66%), requiring fossil fuel companies to pay a carbon tax (66%), teaching about climate change in schools (77%), and providing tax rebates for energy efficient vehicles and solar panels (77%).

Private initiative

Private initiative is mounting multiple initiatives to solve the myriad of problems posed by climate change by replacing or fortifying the outmoded global system of energy usage, storage, and distribution to ensure better long-term health and prosperity.

Public funding

Public funding is increasing to meet the most pressing needs. For example, the US recently rose to this challenge by increasing – by 4.5 times – the funds that previously had been allocated to encourage the robust US technology innovation marketplace to address climate change.

A recent bill passed by the US Congress, the Inflation Reduction Act,3 increases the existing funding of $80bn per year, to support and encourage US federal agencies to pursue renewable and sustainable solutions to the climate crisis, by another $350bn.

Moreover, the loan authorities of programs that facilitate the commercialisation of innovative, first-of-their-kind technologies were increased by another $70bn, on top of the $40bn of existing loan authority. In total, these commitments now amount to $540bn, available for promoting innovative technologies and addressing climate change.

Funding green solutions

Significant funding is being directed by US banks to finance sustainability, renewable energy, and innovative solutions to the climate crisis. For example, Citibank, the sixth largest bank in the world measured by total assets, has committed $1tr for these types of projects (announced by Citibank’s Managing Director of Sustainability at the Alternative Fuels & Chemicals Coalition’s 2022 Global Biobased Economy Conference in Washington, DC, in November 2022).

ADE is leading the way on these initiatives by working directly with federal and state governments and regulatory bodies to shape groundbreaking legislation. ADE’s decades of experience and global perspective provide energy agencies and their leaders and policymakers with the tools to ensure responsible law making and program operation that leads to the most effective solutions to the world’s climate problems.

Landscape for clean energy innovation

The U.S. Department of Energy (DOE) encourages innovators to utilise and develop new, significantly improved technologies that reduce climate impacts; help avoid, reduce, or sequester greenhouse gases; and are superior to existing technologies in use. The two examples listed below illustrate the growing commitment of US resources to address climate change through energy innovation.

Title 17 Loan Guarantee Program

The DOE’s Title 17 Loan Guarantee Program, to which ADE’s Managing Director submitted an application in response to the first Title 17 solicitation in 2008, is one example. ADE’s application was one of just 16 accepted for financing, out of the more than 350 applications submitted in total.

ADE lobbied in 2017-2020 to maintain the Title 17’s funding and loan authority when the program was under threat of elimination. ADE also drafted legislation to improve the Title 17 program’s operation, adopted at the end of 2020 and incorporated into the federal government’s 2021 consolidated appropriation act, which sets forth the annual funding for all federal government agencies and their programs. The result of these efforts has been to greatly streamline the Title 17 program’s ability to put innovative projects on the ground and into implementation.

The Title 17 program was designed to serve as a “bridge over the valley of death” for projects that, due to their newness and innovations, represent significant risk to investors and lenders, since many such projects have not been successfully scaled up and placed in commercial operation and, thus, have a high potential for failure.

This makes these projects exceedingly difficult to finance. The Title 17 program provides a critical ‘bridge to bankability’ so innovative, high-impact energy technologies can obtain the financing to build their first commercial facilities and prove their viability to attract private sector investment and financing for future expansion and deployment.

Advanced Research Projects Agency-Energy (ARPA-E)

The Department of Energy’s Advanced Research Projects Agency-Energy (ARPA-E) is a ‘moonshot’ agency. It provides funding to advance high-potential, high-impact, never-tried-before energy technologies that are still in the early stages of development and, therefore, are too risky and unproven for private sector investment. ARPA-E awardees are unique because they are developing entirely new ways to generate, store, and use energy that benefit environmental wellbeing, national security, and economic prosperity.

How American Diversified Enterprises’ expertise and capacity make a difference

American Diversified Enterprises has extensive expertise in project development and design, application preparation, project financing, and project execution. It provides a significant advantage to firms that seek to win contracts, secure grants and loans, qualify for bond financing, and attract investors to deliver large-scale solutions.

Over the past 20 years, ADE has enabled more than 250 client firms – from start-ups to Fortune 500 companies – to secure more than $5bn in project support to develop, mobilise, construct, implement, and operate projects that advance government objectives, create jobs, bring economic development to local communities, mitigate climate change, and place stewardship of natural resources foremost.

American Diversified Enterprises’ focus is on assisting companies to develop and deploy new, game-changing technologies and expand the market penetration of renewable energy, renewable chemical, biobased product, and alternative fuel technologies.

ADE’s subject matter experts and partner services with technology leaders offer the following services:

- Engineering and design;

- Preparation of independent feasibility, risk analysis, technical and environmental analysis, and engineering reports;

- Assistance with permitting and environmental compliance;

- Guidance in procurement and construction;

- Completion of greenhouse gas (GHG) emission and life cycle analyses;

- Feedstock characterisation and supply;

- Securing performance guarantees, insurance wraps, bond offerings, and accessing multiple financial vehicles; and

- Legal advice and assistance related to project finance, intellectual property, licensing, patents, infrastructure and construction projects, public-private-partnerships, feedstock, offtake, and power purchase agreements, and environmental and energy law.

ADE’s team member expertise spans all required specialisation areas

ADE’s track record of successfully overseeing the proposal process for its 250+ client engagements relies on its proven proprietary methods and its rigorous process management to strengthen each client’s story, substance, and presentation to make a compelling case for financing in compliance with requests for proposals (RFP), and investor and application requirements.

ADE’s staff and partner companies have a deep knowledge and understanding of the laws and regulations related to state and federal programs, their environmental and permitting requirements, and the requirements related to developing and constructing different types of projects in the US and its principalities.

Several of ADE’s team members and its partner companies have significant experience in the government programs, financing opportunities, laws, requirements, and project implementation stages in countries within the European Union, the Middle East, South Africa, South America, the South Pacific, the Far East, Indonesia, and India, which has been gained by direct involvement in multiple relevant projects and disciplines to deliver results. This includes:

- Finding funding opportunities to secure government grants and loan guarantees;

- Creating, improving on, and preparing each of the 16 elements of a successful financial presentation;

- Producing attention-grabbing business plans, annual reports, investor presentations, and responses to RFPs and bids;

- Conducting market analyses, feasibility studies, energy audits, due diligence, and technical, environmental, and risk assessments;

- Providing technical, financial, engineering, project planning, editorial, and graphic design assistance in pursuing innovative technology development and commercialisation; and

- Providing advice and guidance on pursuing and carrying out government relations and advocacy efforts.

ADE’s clients have a superb track record of accomplishment and growth, guided each step of the way by close teamwork with American Diversified Enterprises’ team members and proprietary processes for proposal development.

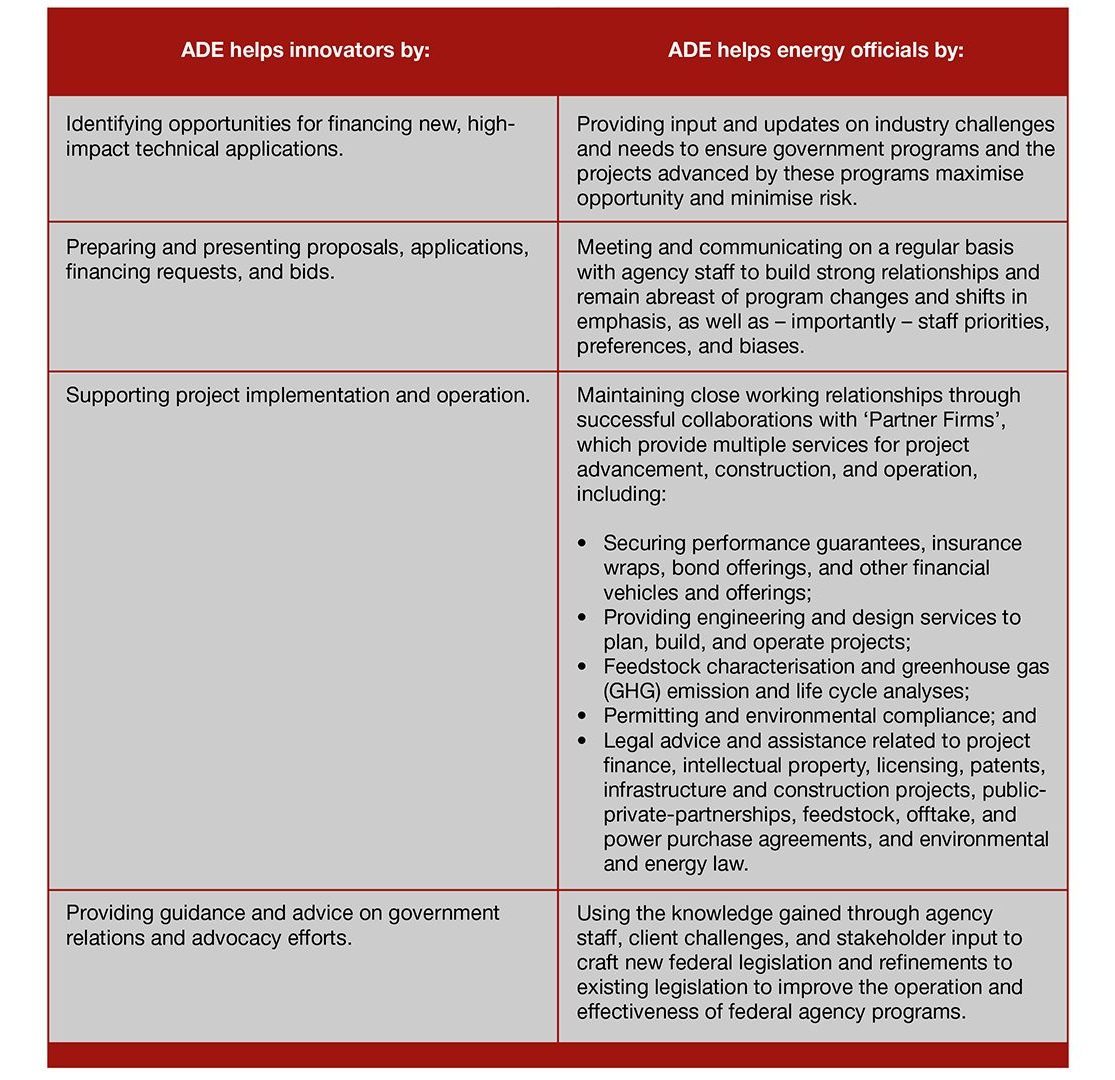

Services to technology innovators and energy commissioners

American Diversified Enterprises has been directly involved in the creation of federal program- financing legislation and the renewal of their annual appropriations. It therefore understands the objectives, needs, and preferences of the agencies and their program staff well. With this perspective, ADE has built a track record of advancing and overseeing successful proposal processes for over 250 client engagements.

ADE’s strategic aid includes the following services:

Consultancy4

ADE’s expertise and capacity enables its clients to identify and pursue opportunities to obtain US federal funding through grants, loan guarantees, and other forms of financing for new, first-of-their-kind technologies, materials, and production methods, beginning with their initial concepts at Technology Readiness Level 1 (TRL-1) up through each development step to enable successful commercialisation and deployment (TRL-9).

Project proposal preparation5

ADE has a rigorous and proprietary process of proven methods to lead innovators from initial proposal-framing through final bid, RFPs, and application submissions. Its team members are subject matter experts in multiple disciplines, including:

- Engineers, encompassing agricultural, biochemical, chemical, civil, electrical, environmental, mechanical, and process engineering;

- Construction managers;

- Operations managers;

- Permitting specialists;

- Environmental, project financing, and transaction attorneys;

- Business case and market analysts;

- Writers, editors, copy editors, and graphic designers;

- Project managers to lead company teams in preparing grant applications, project proposals and financing documentation, bids, and business publications;

- Financial specialists who can review, improve, create, and perform due diligence on financial models and financial presentations; and

- Government affairs managers.

Project Financing Assistance6

One of the companies operating under ADE’s umbrella, Project Financing Assistance, LLC, aids clients to:

- Prepare clear, compelling, easy-to-read, and easy-to-follow project financing documentation;

- Work with investors, lenders, and venture capital and equity firms; and

- Secure financing through a unique, low-interest source of financing for first-of-a-kind projects and technologies that includes financing for final development and pre-construction (including front-end engineering and design, permitting, deposits for equipment purchases, securing offtakes, etc.), which often is the most difficult money to find.

Independent third-party research7

ADE’s subsidiary, 3rd Party Studies, LLC, prepares:

• Independent, third-party reports;

• Feasibility studies;

• Energy audits;

• Environmental and technical evaluations; and

• Risk assessments.

Due diligence8

ADE’s Due Diligence & Analysis company provides:

• Financial verification and evaluation and calculation of the risk of lending to a particular borrower;

• Technical, financial, project planning, and construction due diligence (investigations, certifications, audits, and reviews that are performed to confirm that all material facts and details of a matter under consideration are accurate, complete, and clearly presented); and

• Project development analysis (reviews and audits to verify the data, conclusions, and successful completion of each Technology Readiness Level during the testing, validation, scale-up, and readiness for commercialisation of new technologies, processes, and materials).

Legal and regulatory review

Through its close affiliation with Mark Reidy, a global energy and project finance team founder and leader at Kilpatrick Townsend & Stockton – a world-leading construction and trademark law firm, and the number one patent law firm in the US for ten years running – ADE provides expert counsel to projects throughout North America, Europe, the Middle East, Africa, and Asia.

ADE and Reidy co-founded the advocacy organisation, the Alternative Fuels & Chemicals Coalition (AFCC)9, in 2019 to lobby on behalf of existing federal programs and their annual funding, as well as to advocate for federal policies and legislation that support the projects and initiatives contributing to sustainability and advancing the bioeconomy.

AFCC is now the second largest bioeconomy advocacy group in Washington, DC, with over 150 member companies that employ more than 600,000 people and generate in excess of $350bn per year in revenues.

Case study: The U.S. Department of Energy (DOE) Title 17 Innovative Technologies Loan Guarantee Program

One of the most significant legislative accomplishments, initiated by legislative language drafted by CJ Evans and moved through the U.S. Congress through AFCC’s advocacy, was the enactment of amendments to the Department of Energy’s Title 17 Innovative Technologies Loan Guarantee program, which was established in the Energy Policy Act of 2005 to provide the financing – “a bridge over the valley of death” – for first-of-their-kind projects which could not obtain private sector financing due to the high risks and potential failures involved in scaling up and building the first commercial-scale projects using new technologies.

The Title 17 program provided the financing for the manufacturing facilities and roll out of the first Tesla and Nissan Leaf models; allowed Ford to develop its EcoBoost motors, which are now in all of its new vehicles; and enabled the first utility-scale wind and solar projects in the US.

The legislation promoted by AFCC, which was incorporated in the Energy Policy Act of 2020 as well as in the Consolidated Appropriations Act of 2021, has been called ‘A Game Changer for Financing Clean Energy Projects’, which was the title of an article in the 27 April 2021 issue of Biomass Magazine, describing the significance of the amendment.

The significance of the amendment was extolled by other industry magazines with articles entitled ‘A Cost Breakthrough in Department of Energy Loan Guarantees’, published in Advanced Biofuels USA on 5 January 2021; and ‘The DOE Loan Guarantee Program re-invented, re-programmed, re-vived’, published in Biofuels Digest, on 5 January 2021.

These accolades were repeated in several other renewable energy, renewable chemical, and biobased product publications.

Mark Reidy, who has been involved with federal grant and loan guarantee programs for a large part of his 40-year career, was quoted in several of these articles as saying: “This program amendment is likely the largest win in the history of revising U.S. federal government loan guarantee programs.”

By the end of 2022, the Title 17 program had almost 100 projects under consideration, with six projects going to closing; had generated $500m for the U.S Treasury from its 2021 loan interest payments; and received a significant boost in its loan authority through the Inflation Reduction Act, which tripled the Title 17’s initial loan authority of $40bn to more than $120bn. This compared to the program’s ability to only bring one project to closing in the previous seven-year period from 2014 to 2021.

American Diversified Enterprises, LLC understands the risks of delay and not acting, and stands ready to aid technology innovators and forward-minded energy officials to seize – and maximise the benefits of – opportunities to facilitate the deployment of projects to address the planet’s collective challenges. Together, we survive and thrive!

References

- https://www.pewresearch.org/fact-tank/2016/04/18/what-the-world-thinks-about-climate-change-in-7-charts/

- https://climatecommunication.yale.edu/visualizations-data/ycom-us/

- https://www.congress.gov/bill/117th-congress/house-bill/5376/text

- www.ade.llc

- www.americandiversified.energy

- www.pfa.llc

- www.3rd.llc

- www.duediligence.llc

- www.altfuelchem.org

Please note, this article will also appear in the thirteenth edition of our quarterly publication.