Proteum Energy’s innovative SnMR™ hydrogen production technology leverages renewable ethanol to help decarbonise the heavy-duty truck industry.

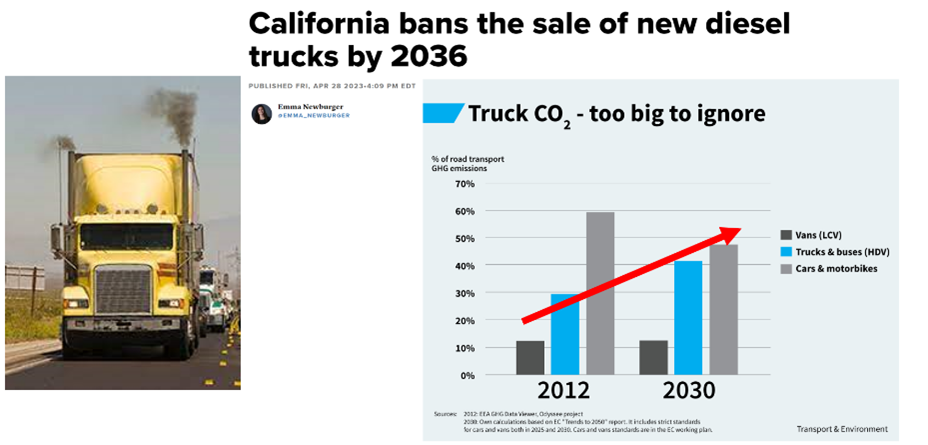

The fossil diesel heavy-duty truck industry in the US and Europe is one of the largest greenhouse gas polluters and is facing extraordinary legislative challenges to transition toward zero emissions solutions.

Both regions have implemented regulations that reduce CO2 and NOx emissions by minimising the use of diesel and internal combustion engines in heavy-duty trucking.

The approach and specific measures vary among different countries, regions, and states.

These are just a few examples of the specific legislation and regulations around the heavy-duty truck industry in the United States and Europe:

- Advanced Clean Trucks regulation: In June 2020, the California Air Resources Board (CARB) adopted the Advanced Clean Trucks (ACT) regulation. This regulation requires manufacturers of medium- and heavy-duty vehicles to sell an increasing percentage of zero-emission trucks in California. The goal is to transition to a fully zero-emission truck market by 2045 for all classes of trucks.

- Innovative Clean Transit (ICT) regulation: The ICT regulation, established by CARB, aims to transition California’s transit buses to zero emission technologies. It requires transit agencies to gradually transition their fleets to electric or hydrogen fuel cell buses. By 2040, all transit buses in California should be zero emission.

- Renewable Diesel regulations: California also has regulations in place to promote the use of renewable diesel fuel in heavy-duty trucks. By using renewable diesel, which is derived from waste oils, agricultural byproducts, and other renewable sources, emissions from diesel trucks can be reduced.

- Regulation on CO2 emission standards for heavy-duty vehicles: The European Commission’s regulation ensures that manufacturers will meet the targets set for the fleet-wide average CO2 emissions of new lorries. From 2030 onwards, stricter targets will start applying.

Engine manufacturers rise to the decarbonisation challenge

Cummins

Cummins, a global leader in the manufacturing of engines and power generation equipment, has been actively involved in the development of hydrogen fuel cell technology.

The company has been researching and developing hydrogen internal combustion engines as a potential pathway toward decarbonisation. They have demonstrated successful integration of hydrogen-fuelled engines into commercial vehicles and are exploring the use of hydrogen as an alternative fuel for internal combustion engines.1

They are also collaborating with other companies to develop fuel cell systems for various applications, including both automotive and stationary power applications.2

Caterpillar

Caterpillar, a global manufacturer of construction and mining equipment, diesel and natural gas engines, and industrial gas turbines, is also focusing on the development of hydrogen internal combustion engines and fuel cells.

The company has been exploring fuel cell applications for various industries. They have developed a fuel cell system for use in telecom backup power systems, which helps reduce emissions and improve efficiency compared to traditional backup power solutions.3

Caterpillar has also partnered with different organisations to further the development of fuel cell technology. For instance, they have collaborated with Ballard Power Systems, a leading provider of fuel cell solutions, to develop heavy-duty fuel cell power systems for off-road applications.4

These examples demonstrate how both Cummins and Caterpillar, large engine manufacturers, are actively involved in the development of hydrogen fuel cell technology, including both hydrogen internal combustion engines and fuel cell applications.

“Now, ethanol producers can participate in the diesel fuel business by producing clean, renewable hydrogen to replace fossil-based diesel in heavy-duty transportation.”

Heavy-duty truck manufacturers move toward the hydrogen industry

Nikola Corporation

Nikola is a leading manufacturer of heavy-duty trucks and hydrogen-electric vehicles. They have developed the Nikola One and Nikola Two hydrogen-electric trucks that aim to revolutionise the industry.5

Toyota

Toyota is one of the world’s largest automobile manufacturers and has been actively involved in hydrogen fuel cell technology. They have introduced the Toyota Mirai, a hydrogen fuel cell vehicle, and are working on developing fuel cell electric heavy-duty trucks.6

Daimler AG

Daimler AG, the parent company of Mercedes-Benz, has been actively exploring hydrogen fuel cell technology for heavy-duty trucks. They have developed the Mercedes-Benz GenH2 Truck, a long-haul fuel cell truck concept, and plan to start customer trials in the next few years.7

Volvo Group

Volvo Group is a leading manufacturer of heavy-duty trucks, and they are also focusing on hydrogen fuel cell technology. They have developed the Volvo FH Fuel Cell Concept, which aims to combine hydrogen fuel cell technology with electric drivetrains for heavy-duty applications.8

Hyundai Motor Group

Hyundai Motor Group is investing heavily in hydrogen fuel cell technology for various applications, including heavy-duty trucks. They have introduced the Hyundai XCIENT Fuel Cell, the world’s first mass-produced hydrogen-powered heavy-duty truck, and have plans to expand their fuel cell commercial vehicle lineup.9

Hino Motors

Hino Motors, a subsidiary of Toyota, is a major manufacturer of commercial vehicles, including heavy-duty trucks. They have shown interest in hydrogen fuel cell technology and are collaborating with Toyota to develop a hydrogen fuel cell truck for the Japanese market.10

These are just a few examples of truck manufacturers that are taking steps towards hydrogen fuel as the fuel of choice in the heavy-duty truck and engine industry.

Many other manufacturers, including, Iveco, and MAN, are also actively researching and developing hydrogen fuel cell technologies for heavy-duty applications.

Ethanol used for renewable hydrogen production

Included in the following are talking points and excerpts from Luke Geiver, author of the article Turning Ethanol into Hydrogen, in the June 2023 edition of Ethanol Producer magazine.

Proteum Energy wants to work with ethanol producers to produce renewable hydrogen for transportation. The approach by Proteum is to partner with ethanol producers or buy ethanol gallons directly from them.

There are two main business models. The Partner-Customer Tolling model locates a modular system at a partner’s facility. Proteum works with partners to resource feedstock and CO2 sequestration. Proteum will receive a tolling fee and may use excess hydrogen production capacity to produce hydrogen or other designer fuels for third-party customers.

Alternatively, in the Build-Own-Operate model, the company would install its system at a location of favourably priced feedstock and CO2 sequestration/utilisation. Proteum would source and purchase feedstock, and process H2 fuel, along with renewable natural gas (RNG).

Biogenic CO2 produced during hydrogen production would be sold or sent to permanent storage, potentially generating tax incentives. Lastly, hydrogen fuel and RNG will be sold to customers.

Proteum’s innovative SnMR™ technology

The proprietary and patented SnMR™ hydrogen production technology modules are built off a system that relies on thermals that create steam before converting that steam to hydrogen.

Steam-methane reforming, the main method used today for producing hydrogen, is high in temperature while the SnMR™ technology is lower in temperature and requires less water and energy.

SMR typically relies on natural gas, i.e., methane as a feedstock. Methane in the presence of steam at 3 to 25 bar pressure (1 bar equals 14.5 psi), along with a catalyst, produces hydrogen, carbon monoxide, and a small amount of CO2. According to the U.S. Department of Energy, this is called the water-gas-shift reaction.

In the final step of the reformation process, carbon dioxide and other impurities are removed from the stream, leaving pure hydrogen. Feedstock gas for Proteum (in this case an ethanol beer cut) and low amounts of water are fed into the core SnMR™ hydrogen production technology platform where it first runs through the proprietary steam non-methane reformer technology.

From there, standard auxiliary equipment is utilised to treat the reformate and the result is clean hydrogen fuel. Additional standard equipment units are added for CO2 separation, H2 separation, and renewable natural gas (RNG) production.

The ethanol feedstock is oxygenated and injected at 375 to 500 psig. The Proteum Energy standard base system produces 30,000 kg/day of renewable hydrogen.

Proteum’s business model relies on five things: ethanol feedstock, a hydrogen off-taker, a CCS project, power, and land. With an ethanol partner providing the feedstock through a joint venture or through sale, Proteum already has off-takers ready for the hydrogen product.

Working with an ethanol producer that is sequestering carbon, Proteum can send over roughly 400 tons of biogenic CO2 per day. The system can also provide the ethanol producer partner with some waste heat and power to their facility.

Proteum’s important milestones

Proteum is currently working on the buildout of a hydrogen production facility in California, and the team is also working to expand across the Midwest ethanol belt.

Starting in 2014, the company had already racked up several important milestones. It all started as a technology proof of concept to better utilise flare gas produced during shale oil and gas production. A system was tested in the Bakken of North Dakota, along with shale plays in Texas.

A commercial system was deployed in 2017 and used by major exploration and production company Diamondback Energy in 2018 to help utilise flare gas. It received a statement of endorsement and technical qualification by global consulting and testing firm DNV in 2020; tested and proven for hydrogen production from NGLs in 2021; and turned fully commercial through term sheets in 2022.

Late last year, the company signed with Transitus Energy to produce hydrogen from hydrocarbons produced in the North Sea. The agreement included a letter of intent for opportunities in the UK, The Netherlands, the Republic of Ireland, and Norway to produce low-carbon hydrogen for European markets.

Now, ethanol producers can get into the diesel fuel business by producing clean renewable hydrogen that could, or will, replace fossil-based diesel in heavy-duty transportation.

Proteum Energy’s liquid H2 can achieve a negative CI liquified hydrogen score

In addition to hydrogen fuel for over-the-road transportation, the modular SnMR™ units created by Proteum can produce hydrogen for sustainable aviation fuel or for low-carbon ammonia fertiliser products, as well. And then there is the variable that the entire ethanol industry is following: carbon intensity score.

The best-case scenario for inputs used to create the hydrogen would net a negative CI score. With biogas combustion fuel or waste heat recovery in the mix, Proteum’s liquid H2 can achieve a negative CI liquified hydrogen score.

The Proteum team can serve several markets, utilise a variety of feedstocks, and produce various highly desirable, incentivised end-products.

But it’s the ethanol sector Proteum is trying to align with.

It is a new place to send ethanol gallons and it is a continuation of ethanol’s momentum leading carbon offset efforts for the decarbonisation of transportation fuel molecules.

It’s not an entire hydrogen revolution or a move away from one type of production method or use of feedstock. It is something different, a gain by doing more with existing assets (tech and ethanol).

Proteum Energy likes to call it an “energy addition.”

References

-

- Cummins – Hydrogen Solution

- Cummins – Fuel Cells

- Caterpillar – CAT Microgrid Solutions

- Ballard Power Systems – Ballard and Caterpillar Extend Collaboration

- Nikola Corporation

- Toyota Hydrogen

- Daimler AG

- Volvo Group – Sustainable Transportation

- Hyundai Motor Group – XCIENT Fuel Cell

- Hino Motors – Toyota and Hino collaboration