Liberty Lithium, a new lithium brine project in the US, is turning heads among end users due to the insatiable demand for raw material projects with size and scale in the battery supply chain race.

QX Resources Limited (ASX: QXR) has secured a deal with IG Lithium LLC, a private US company, to secure 75% of the Liberty Lithium project in Inyo County California. Just across the state border is Albemarle’s Silver Peak lithium operation in Nevada – the US’ longest lived lithium brine operation.

Large-scale target

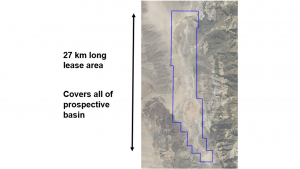

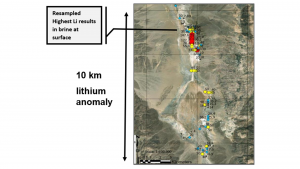

The Liberty Lithium Project leases cover more than 10,000 hectares, obtaining a large surface lithium brine anomaly across the key part of the long-lived enclosed basin. This single package makes it one of the largest project areas in the western US. For scale, that is equivalent to two times the area of Sydney Harbour or the size of Paris city.

Initial exploration has been encouraging. Surface brine results in auger holes have returned elevated lithium assays of 125mg/L up to 215mg/L in the centre of a 10km anomaly. Geophysics (TM and gravity) has indicated a basin more than 25km long and 1,000m deep with conductive horizons, which may indicate brine-bearing aquifers at depth.

Liberty Lithium is in a prime location

The western US has become a prime location for lithium brine exploration and development as it exhibits many of the characteristics of the famous lithium brine basins in Chile and Argentina. Improved infrastructure, such as sealed roads and access to power, facilitates US production in shorter timeframes at lower capital costs.

In addition, Liberty Lithium benefits from the access to the use of saline water (that is not for drinking), which many locations prohibit or severely restrict.

Potential government support

The Biden Administration’s support of the battery materials supply chain and battery production within the continental US has supercharged the entire sector supporting electric vehicles (EVs) – especially in battery production and increasingly in cathode, anode and battery raw materials production.

The Inflation Reduction Act (IRA) of August 2022 (Section 45X) has provided tax breaks on various aspects of the green energy (EV/battery) industry and any mining company that can produce critical minerals central to energy transition products like electric vehicles (batteries).

Further, in California, not known for supporting the resources sector, Governor Gavin Newsom seems keen to support the battery minerals supply chain. He personally attended the opening of CTR’s geothermal lithium project in March 2023 – a key ceremony held in Imperial Valley south of California, in conjunction with Japan’s Fuji Electric $1.4bn investment.

Geothermal power will be produced and lithium production is planned using a form of Direct Lithium Extraction (DLE), followed by conversion into battery-grade lithium hydroxide.

Pathway to production

Discussions with regulators and local administrators have reaffirmed the local interest in developing projects similar to Liberty Lithium in this part of California. Evaporative salt operations nearby (soda ash, trona) have been operating continuously for 150 years.

Further north of the project, U.S. Borax (part of Rio Tinto) has been producing borates using brines and evaporation for more than 50 years. Inyo County is the largest and least populated county in California and is clearly keen to assist in being part of the energy transition sweeping the US.

QX Resources and deal terms

QX Resources is focused on the exploration and development of battery minerals in Tier 1 jurisdictions. This includes hard rock lithium projects in a prime location of Western Australia, a lithium brine project in the US, high-grade nickel sulphide interests in Sweden and copper-gold-moly assets in Queensland.

The company’s aim is to connect end users (battery, cathode and car makers) with QXR, an experienced explorer and developer of battery minerals.

The company is headed up by Managing Director Steve Promnitz, who is often considered a leader in the lithium sector. Steve has a geology and chemistry background with majors (CRA/Rio Tinto), as well as financial experience with equities and investment banks (Citi).

His previous role in lithium brine exploration, developing a A$2bn listed company from scratch, demonstrated his skills in opportunity identification, project development and connecting end users in the battery sector with project developers.

QXR reviewed many projects before entering a non-binding letter of intent, in May 2023, for exclusivity to negotiate terms in acquiring a controlling interest of 75% in the Liberty Lithium Brine Project. In August 2023, the final terms were released.

QXR will be paying option payments over 30 months – a commitment to drill the project and the maintenance costs of the leases.

Next steps

Drilling of this target is scheduled for the last quarter of 2023, with lithium brines to be tested by a number of DLE methods together with preconcentration of lithium brines by evaporation. If encouraging, an accelerated drilling programme is envisaged in 2024, leading to a potential initial resource and later a pre-feasibility study (PFS).

Steve Promnitz, Managing Director of QX Resources, said: “QXR consider the Liberty Lithium Project to be truly large-scale with a pathway to development.

“It’s a sought-after project with many characteristics similar to Albemarle’s Silver Peak lithium brine deposit in Clayton Valley, US, and other Argentina brine projects.

“It is encouraging to note end-users’ growing interest in investing directly into projects, making Liberty Lithium an attractive opportunity.

“Liberty Lithium is well located nearby a long-life salt operation. We aim to drill soon and, if the results continue to be encouraging, accelerate development to resource and PFS stage.

“There are only a few small-cap companies so committed to the battery materials supply chain – with hard rock lithium projects in the Pilbara of Western Australia, the best location in the world for hard rock lithium, together with copper-gold and nickel interests. The so-called ‘big boys’ of the sector all have lithium brine and lithium hard rock assets – sometimes with nickel sulphides or copper.”

By this time next year, it will be clear if these aspirations can be realised.

Please note, this article will also appear in the fifteenth edition of our quarterly publication.