Queensland Pacific Metals new quarterly report demonstrates their commitment to developing a sustainable battery metals industry.

As the world’s energy landscape continues to evolve rapidly, the demand for sustainable energy solutions is at an all-time high. Queensland Pacific Metals are at the forefront of this, working to provide sustainable sources of Critical Battery Metals for the electric vehicle (EV) industry. In their latest quarterly (Q3) report for 2023, several important milestones are highlighted, including:

The Moranbah project

The Moranbah project, which collects and processes waste gases from metallurgical coal mining, has now been fully acquired by Queensland Pacific Metals Energy (QPME). This de-risks the gas supply for the TECH project and has the added benefit of making QPME a business generating significant standalone revenue. The company has already seen promising results with growth in gas capture and increased flow of gas to the nearby Townsville Power Station.

From this acquisition, QPME has also gained the rights to store and transport gas through the North Queensland Gas Pipeline (NQGP) and to generate electricity from the Townsville Power Station (TPS). From 25 August to 30 September 2023, electricity generation was 6,621MWh. Upon assumption of control, QPME optimised run times to coincide with peak market prices, and as gas supply and market conditions shift, plans to run the TPS for longer peaking-periods to increase revenues.

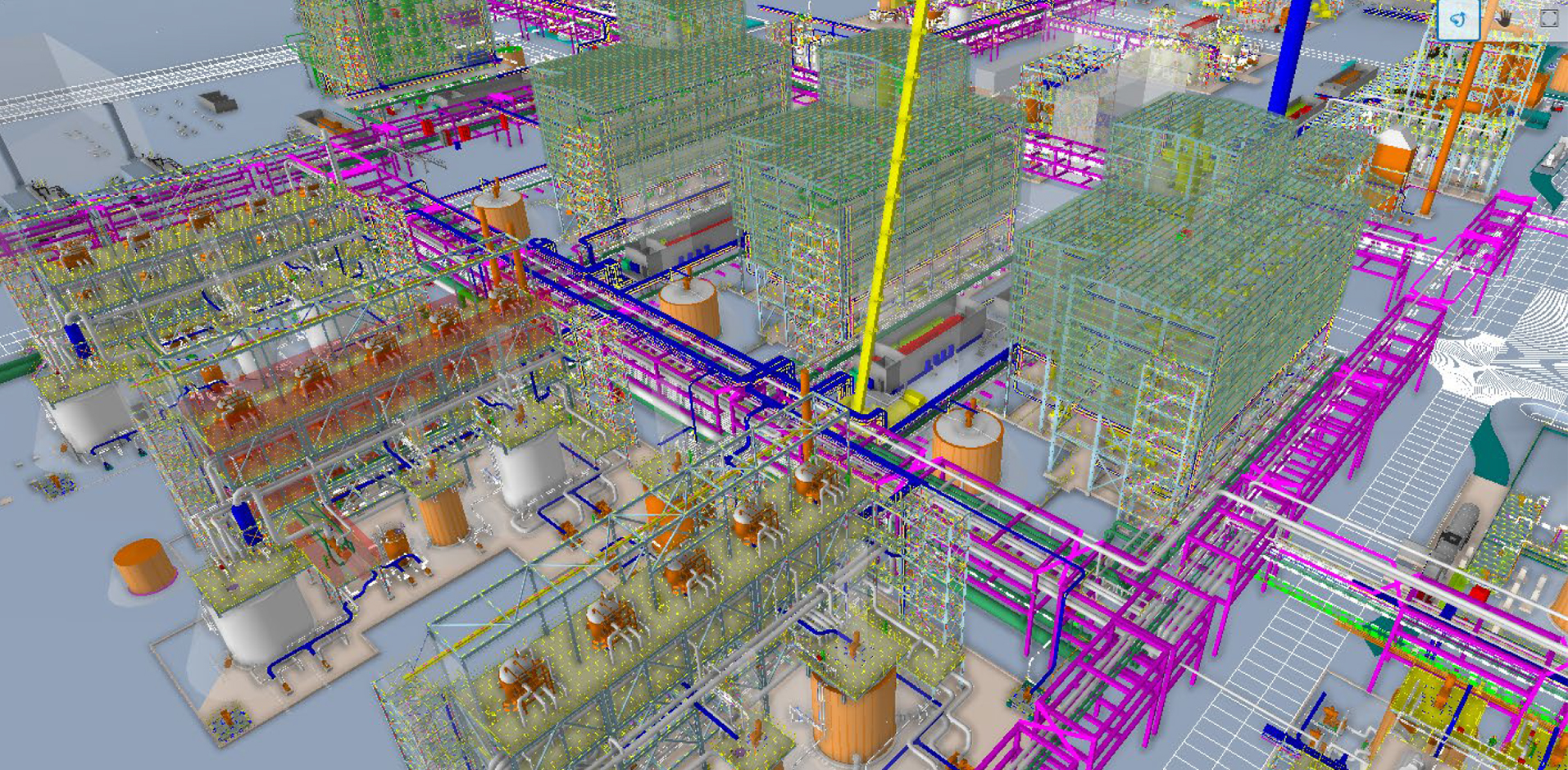

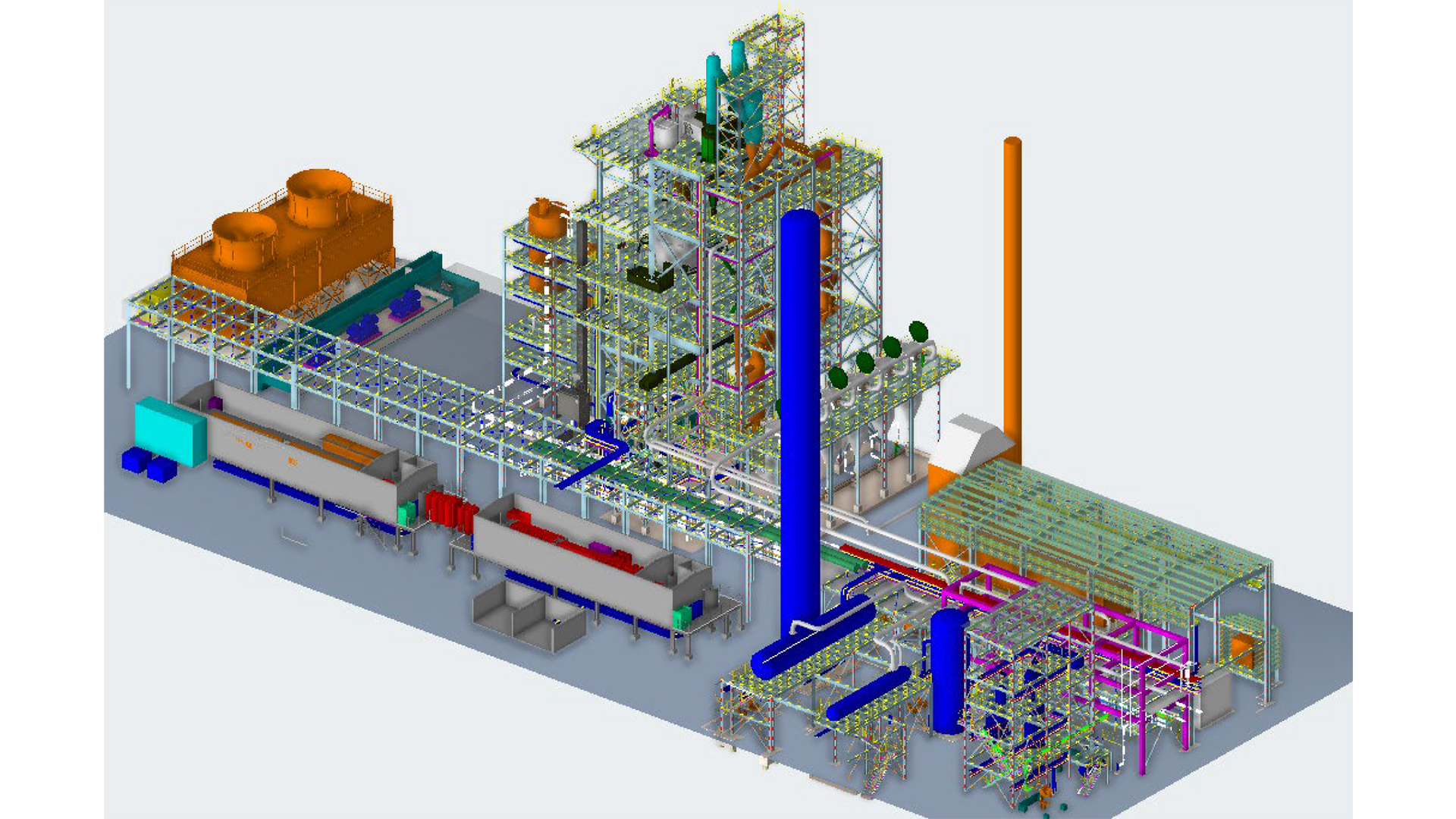

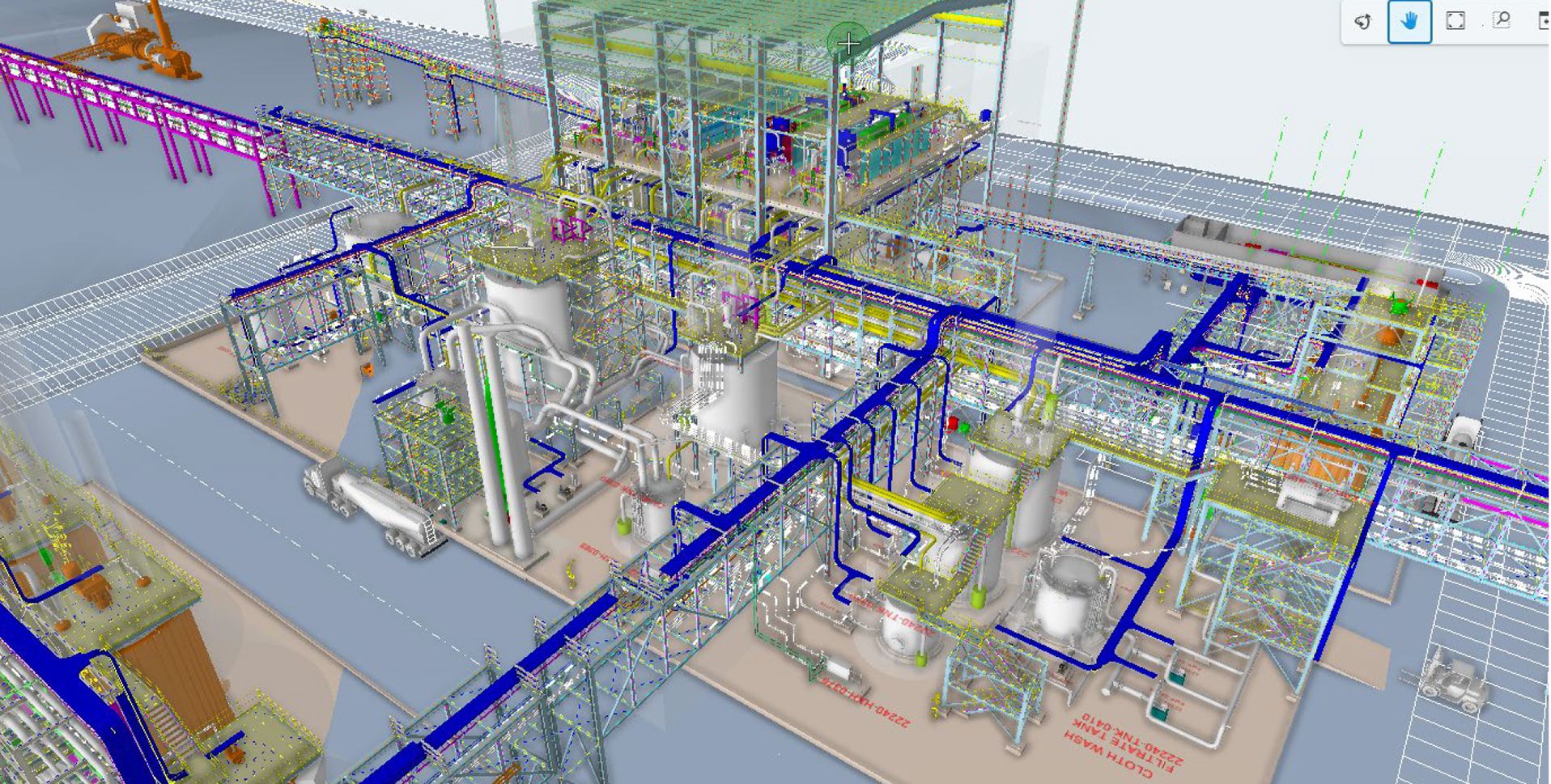

The TECH project

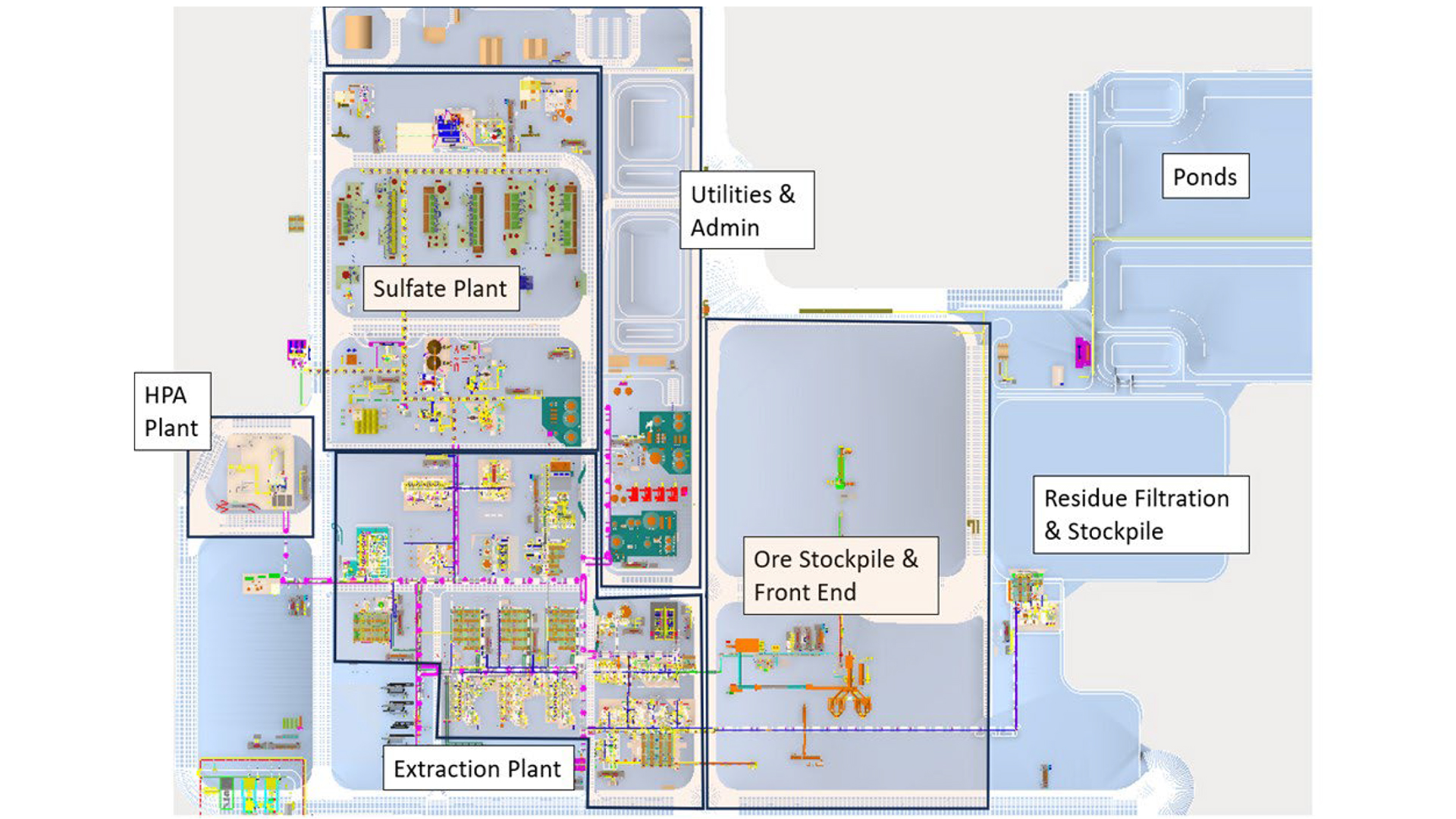

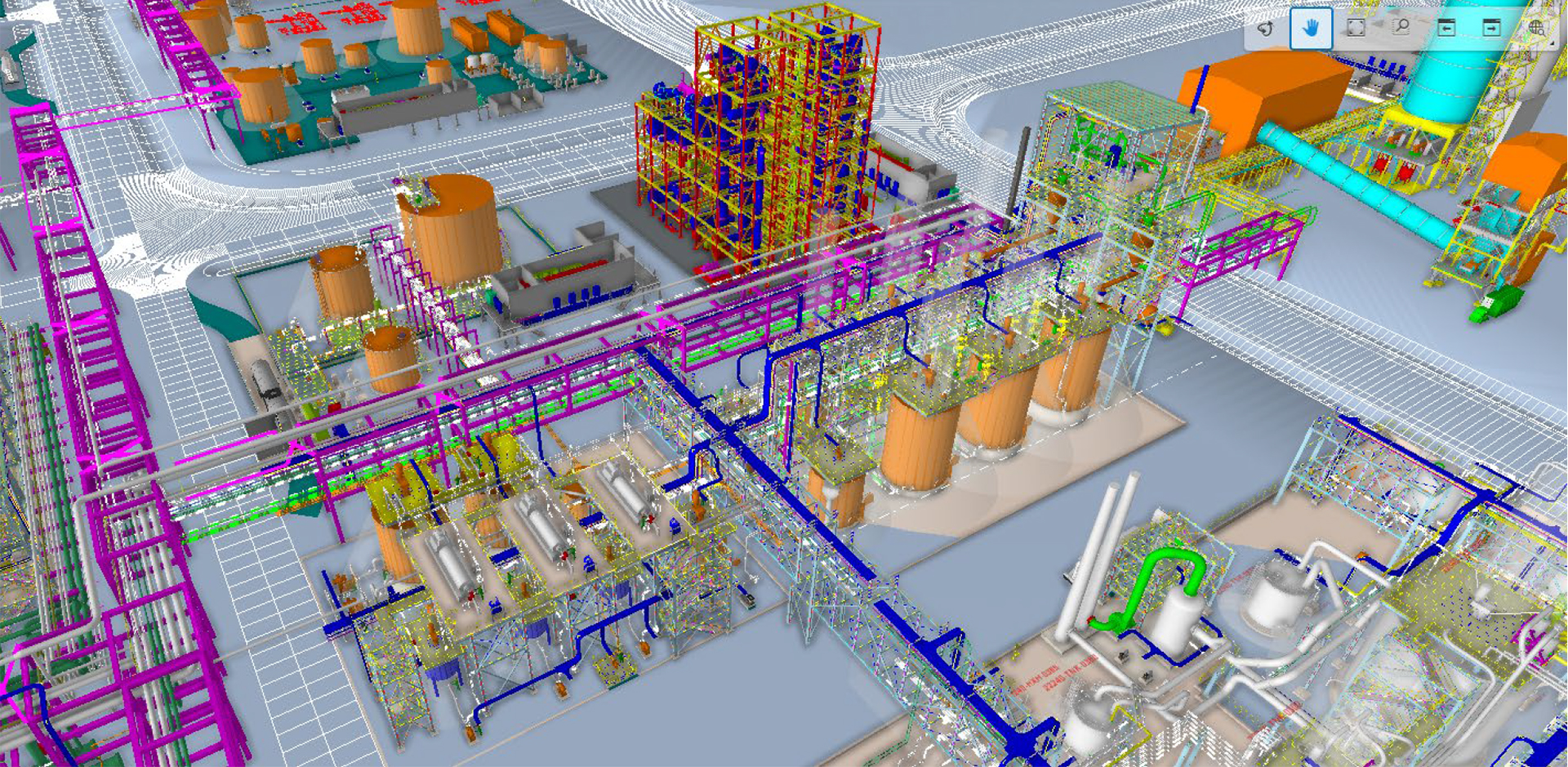

The Townsville Energy Chemical Hub (TECH) project is a developing metals-refinery plant, seeking to be sustainable and modern in its production of nickel sulphate and cobalt sulphate. Significant advancements were made in the feasibility of the TECH project, bringing it closer to a Final Investment Decision. These include:

- Nickel sulphate pilot testwork: A pilot plant at SGS in Canada confirmed that nickel sulphate that meets specific offtake agreements of General Motors, LG Energy Solutions, and POSCO, can be produced using the TECH projects commercial flowsheet.

- Pressure iron hydrolysis and aluminium hydrolysis test work: A large pilot plant has been constructed in Glenn Innes, New South Wales. This will contribute to the tests of the iron and aluminium hydrolysis in the DNi Process™ for QPM, in association with KBR Plinke, who is providing a major equipment package for this process. This process also recycles most of the nitric acid used in leaching. The balance of nitric acid recovery and recycling occurs in the next step.

- High Purity Alumina (HPA) Testwork: The HPA demonstration plant, operated by QPM partner Lava Blue, continues producing 99.99% HPA at about two kilograms daily. Samples are being transported to the US and will be provided to targeted potential customers.

- Stakeholder infrastructure support: In conjunction with stakeholders Townsville City Council; Powerlink; Port of Townsville; and Queensland State Government, QPM have entered discussions to help secure the financial support for the TECH project that will accelerate QPM reaching its funding goals and to accelerate increased gas capture.

SMT and General Motors investment

The quarterly report details that QPM and SMT have entered into a strategic partnership based on recognising the importance of secure and long-term ore supply for the first phases of the TECH project; the importance of SMT’s participation in the long-term value in the battery-metal supply chain; and collaboration in investment opportunities in QPM; and the importance of ESG in the electric vehicle sector.

A share placement also took place, raising $16m, in which SMT and General Motors both took part. SMT contributed $5m in initial investment, and QPM and SMT will work on continued investments as part of the strategic partnership.

Ultimately, this will contribute towards funding work streams for the TECH project, and both capital initiatives and operating cashflow requirement management for the Moranbah project.

For the future

As QPM continues its journey to a sustainable energy future, the company remains committed to responsible resource management and innovation. The success of the TECH Project, the strategic partnerships with key players, the acquisition of the Moranbah project, collectively paint a bright future. The energy sector’s transformation is underway,

and QPM is integral to this promising transition.

In conclusion, Queensland Pacific Metals (ASX: QPM) demonstrates its dedication to sustainability and progress as it moves forward in the dynamic energy industry. With a clear vision and a record of accomplishments, the company is well-positioned to play a pivotal role in the sustainable energy future.

Please note, this article will also appear in the sixteenth edition of our quarterly publication.