Galvanic Energy CEO Brent Wilson examines the history and progression of petrolithium exploration.

What is petrolithium?

With the rise of the electric vehicle (EV), lithium has been portrayed as ‘the new gasoline’ and ‘the new oil.’ However, these descriptors are merely illustrative and not intended to be taken literally.

Likewise, the term ‘petrolithium’ is not intended to describe some sort of fuel or petroleum and lithium mixture, which can lead to confusion about the role of lithium and ion batteries. Rather, the term describes the coexistence of lithium in certain oilfield reservoirs or the operation of extracting lithium from brine solutions present in oilfields, not the separation of lithium from oil or other hydrocarbons.

Petrolithium may have first been coined in 2016 by Jared Lazerson, CEO and founder of MGX Minerals, a lithium mining startup company that once promoted the chemical extraction of lithium in Alberta oilfield brines. The following year, Lazerson formed a company bearing the name (PetroLithium Corporation of America) to acquire mineral leases in US oilfields. The term has since been used to describe other companies, including E3 Lithium and Standard Lithium, which are similarly focused on extracting lithium from North American oilfield brines.

Discovery of petrolithium

Although the term and applications of petrolithium may have emerged more recently, the concept has been around for decades. The first and foremost publication on this topic was the iconic Geochemistry of Oilfield Waters (Gene Collins, 1975), which documented the presence of lithium in multiple oilfield reservoirs across nine US states.

Collins’ landmark research was the first to report lithium concentrations in oilfield brines using flame spectrophotometric and atomic absorption methods.

Given Collins’ reporting and the anticipated future demand for lithium by the United States Geological Survey (USGS), companies like Dow Chemical took note. According to International Battery Metals (IBAT) founder John Burba, concurrent to Collins’ work, Dow was also looking at lithium in oilfield brines for the purpose of developing a lithium-based battery, which others were also seeking to develop.

The impact of Dow chemical

Given Dow’s chemical plants and research facilities located near key oilfields, the company was uniquely positioned to conduct brine research during the 70s. In one case, Dow operated a chemical production plant in Magnolia, Arkansas (later acquired by Albemarle Corporation), sourcing bromine from the Smackover Formation.

Since lithium was also present in the Smackover, Dow scientists and engineers had a unique opportunity to pursue lithium battery research while having a source of lithium at their disposal. The only challenge they needed to solve was extracting the lithium dissolved within the oilfield brine.

According to Burba, this is where he, Bill Bauman, Ken Klaus, John Lee, and a handful of other Dow researchers made meaningful contributions to developing a novel lithium extraction process using an ion exchange resin. Once absorbed by the resin, lithium can be liberated with a hot water rinse, making the process quite elegant.

Given the breakthrough and commercial potential, Dow applied for an initial patent in 1978, followed by additional patents in 1982 after refining the process by creating a composite crystalline layered resin that dramatically improved the ion selectivity – increasing lithium absorption while rejecting contaminants.

With the earliest form of a Direct Lithium Extraction (DLE) process established and vetted in the laboratory, Burba and others set off to test it at the Dow bromine production facility in Arkansas.

After completing the construction of a pilot lithium extraction plant in 1983, Dow proved it was possible to commercially extract lithium from oilfield brines, though the economics weren’t ideal at the time due to low lithium prices and demand.

A lithium-powered EV revolution

Since the first successful pilot test in 1983, DLE has been in limited use. Although resurrected by Burba at FMC (now Livent) and made commercial in the late 1990s, DLE was primarily used to enhance solar evaporation processes at Salar Hombre Muerto in Argentina. Besides the efforts at one salar in the Andes, DLE was a nearly forgotten technology for decades.

However, things began to change in 2012, when the newly emerging EV startup Tesla Motors debuted its semi-affordable Model S luxury sedan; the vehicle was a hit among environmentalists and auto enthusiasts alike. The following year, Tesla announced plans for the first-of-its-kind Gigafactory, named for the gigawatt (one billion watts) annual battery production potential needed for the emerging EV industry in North America and abroad.

Once the EV market took off, it didn’t take long for mining companies and others to realise the demand for lithium was going to skyrocket.

Given it typically takes four to seven years to build a lithium mine (according to Simon Moores, CEO of Benchmark Mineral Intelligence), it was vitally important to commence launching as many new opportunities as possible, including unconventional mining approaches. Hence, the resurgence of petrolithium.

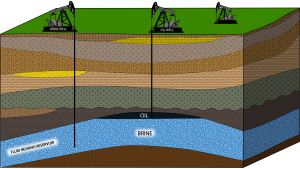

Illustration of an oilfield and the reservoir thousands of feet below ground containing enormous volumes of brine in comparison to hydrocarbons. In the case lithium is present, some reservoirs can contain significant lithium reserves. Given the minimal surface footprint and environmental impact, petrolithium offers favorable advantages over current lithium mining practices

A petrolithium breakthrough

Although DLE has yet to reach commercialisation in a petrolithium capacity, several companies have successfully tested DLE pilot plants utilising oilfield brines containing economic quantities of lithium, including the previously mentioned E3 Lithium (Alberta) and Standard Lithium (Arkansas). Startups such as Anson (Utah), and Prairie Lithium (Saskatchewan) are also testing the petrolithium potential of certain oilfields.

Even Burba’s IBAT made a petrolithium comeback after testing the same oilfield brine he had tested 40 years ago for the first DLE pilot plant. During a brief partnership with Galvanic Energy, IBAT tested the Smackover Formation in southern Arkansas and again proved DLE has the potential to extract lithium from oilfield brines, but this time with favourable economics due to the historic rise of lithium prices.

However, the next chapter in petrolithium may lead to the biggest breakthrough yet. With ExxonMobil’s acquisition of Galvanic Energy’s Smackover prospect, the oil supermajor has big plans to become a major lithium producer by 2030, producing enough lithium to manufacture over a million EVs a year.

With well drilling and plans for a processing facility already underway, as well as negotiations with EV and battery manufacturers, ExxonMobil is on its way to disrupting the mining world with its entry into the industry, as evidenced by sliding stock prices for Livent and Albemarle on the day of the company’s announcement.

The upside of petrolithium

Since its inception, petrolithium has been showcased as an alternative to conventional lithium mining, which has faced greater environmental scrutiny in recent years.

Touted for its minimal surface footprint, reduced carbon emissions and water recycling capabilities, petrolithium offers far-reaching benefits that are better aligned with the ultimate goals of electrification than historic mining approaches.

Additionally, petrolithium unlocks vast amounts of untapped lithium in the US and Canada, lessening national dependency on foreign resources and reducing national security risks. Unlike the salt-laced playas of the Lithium Triangle of South America or the lithium-concentrated mineral veins of the Australian Outback, North America has an abundance of deep oil and gas reservoirs containing lithium-enriched brines.

Although petrolithium resources have not been exploited in the past, they have long been considered. Given the rapid adoption and production of EVs and changing economics, as well as new major investments from an array of interested parties, it appears that the development of this critical resource has finally come. It will be exciting to see how it advances over the coming months and years, not only in North America but the rest of the world.